Wheat Elliott Wave Analysis – TradingLounge

Function - Trend Mode

Trend Structure - Diagonal for Wave V

Position - Wave C of V

Direction - Wave C of V is Still in Play

Wheat futures have continued their upward trend since May 13, 2025, and prices may soon reach a critical resistance zone. This could potentially trigger a fresh wave of selling pressure. The longer-term downtrend that began in March 2022 appears incomplete, implying further bearish potential for wheat in the near future.

Wheat Daily Chart Analysis

Wheat is approaching the terminal stage of a long-running bearish impulse wave that originated in March 2022. The fifth wave of this structure has taken considerably more time to form than the earlier waves. Nonetheless, the wave count remains unfinished. Since October 2022, wave (V) has been developing as an ending diagonal — a typical pattern that precedes a major trend reversal. This implies a multi-month or possibly multi-year bullish correction could follow after one more downward movement.

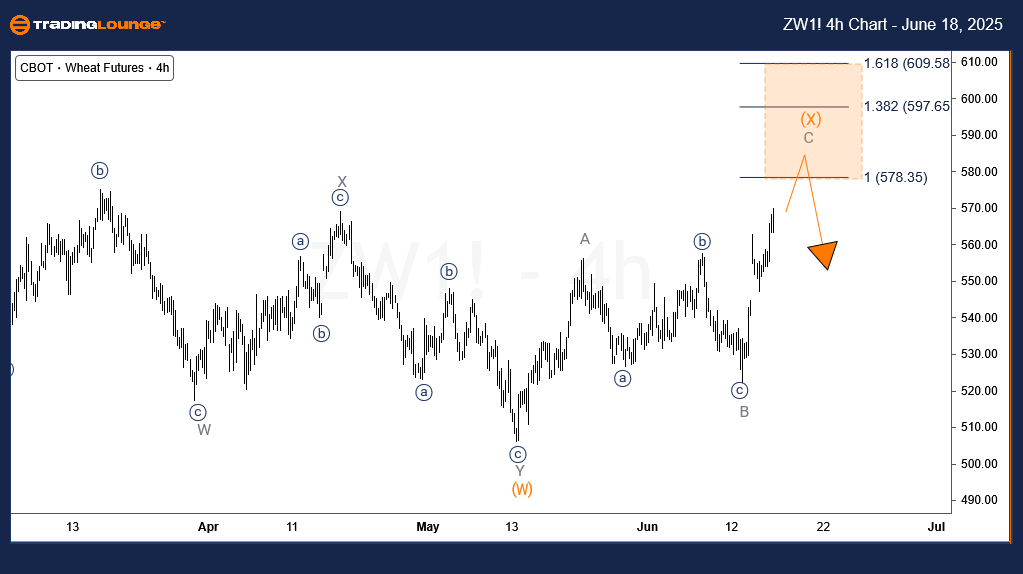

Wheat H4 Chart Analysis

The 4-hour timeframe shows that sub-wave ((B)) of wave V of (V) concluded at 621 in February 2025. This initiated wave ((C)), with sub-wave (W) of ((C)) finishing on May 13, 2025. The ongoing upward leg is wave (X) of ((C)), which is projected to stay below 621.75. Resistance is expected between 609.58 and 578.35. If this resistance zone holds, wave (Y) to the downside could begin, targeting the $500 level or lower — a price range likely to reintroduce strong bearish momentum.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Natural Gas Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support