Exxon Mobil Corp., Elliott Wave Technical Analysis

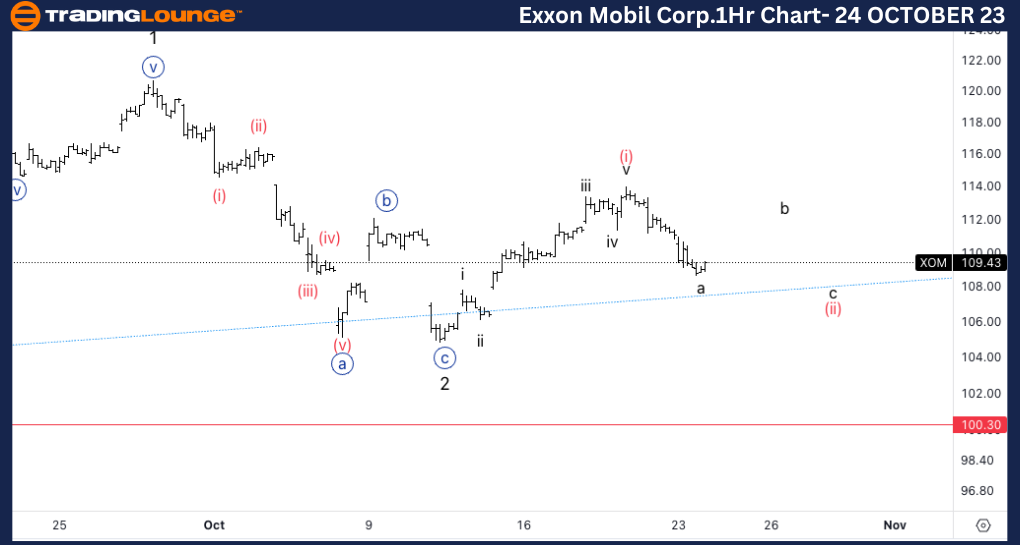

Exxon Mobil Corp., (XOM:NYSE): 4H Chart, 24 October 23

XOM Stock Market Analysis: We have been anticipating a three wave move into wave 2 which we seem to have got right. At this point as we have broken previous wave {b} top we can start looking at the move up as trend establishing.

XOM Elliott Wave Count: Wave (i) of {i}.

XOM Technical Indicators: Below all averages.

XOM Trading Strategy: Looking for longs into wave (iii).

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

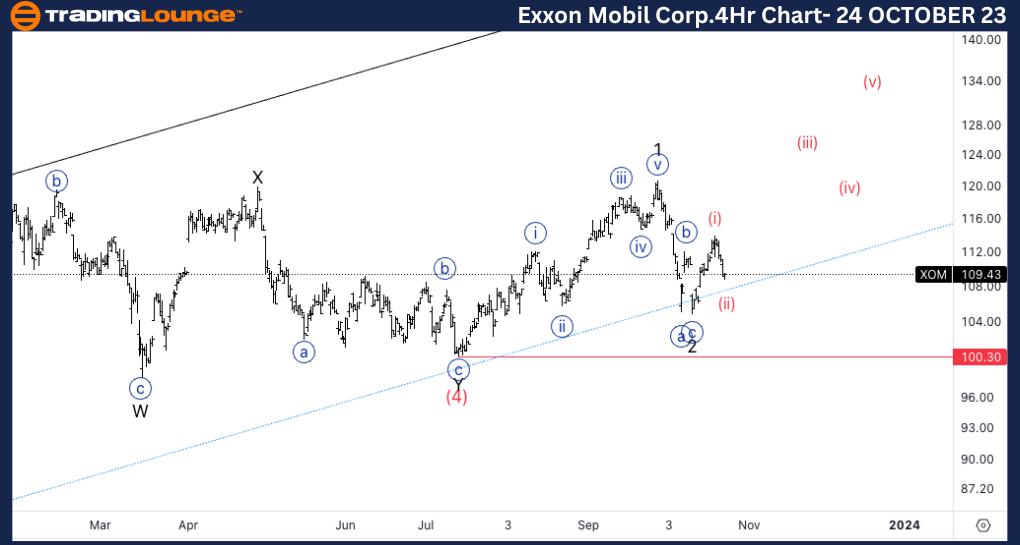

Exxon Mobil Corp., XOM: 1-hour Chart, 24 October 23

Exxon Mobil Corp., Elliott Wave Technical Analysis

XOM Stock Market Analysis: Looking for another leg up into wave b of (ii) as we seem to have had one direction wave only in wave (ii). Therefore looking for continuation lower with invalidation at 104.8$.

XOM Elliott Wave count: Wave b of (ii).

XOM Technical Indicators: Below all averages.

XOM Trading Strategy: Looking longs after wave c of (ii).