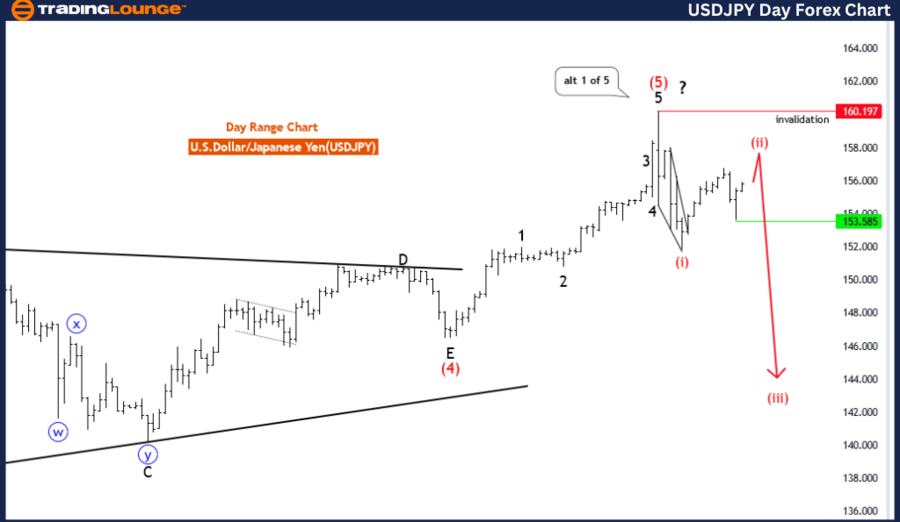

USDJPY Elliott Wave Analysis Trading Lounge Day Chart,

U.S.Dollar/Japanese Yen(USDJPY) Day Chart

USDJPY Elliott Wave Technical Analysis

Function: Trend

Mode: Corrective

Structure: Red Wave 2

Position: Blue Wave 1

Direction Next Lower Degrees: Red Wave 3

Details: Red wave 2 of blue wave 1 is still active and appears to be nearing completion. The wave cancel invalid level is set at 160.197.

Function

The USD/JPY market movement on the daily chart is categorized as a "Trend." This indicates that the analysis focuses on identifying the pattern and direction of the prevailing market trend.

Mode

The mode is described as "corrective." In Elliott Wave terminology, this means the market is currently undergoing a correction phase rather than a continuation of an impulsive move. Corrective waves typically move against the primary trend direction and are usually composed of three sub-waves: A, B, and C.

Structure

The structure being analyzed is "red wave 2." This suggests that the current movement is part of the second wave of correction in the larger trend cycle. Corrective waves like red wave 2 often retrace a portion of the initial impulsive wave.

Position

The market is currently in "blue wave 1," implying that the corrective red wave 2 is occurring within the initial phase of a new wave cycle. Blue wave 1 marks the start of a new degree of trend, which encompasses the corrective red wave 2.

Direction for Next Lower Degrees

The next anticipated movement is "red wave 3." This is expected to be an impulsive wave following the completion of the corrective red wave 2, signaling a potential resumption of the primary trend direction.

Details

Wave Progress: The analysis notes that "red wave 2 of blue wave 1" is still in progress but appears to be nearing its end. This suggests that the market is about to transition into red wave 3, which would indicate a continuation of the trend.

Invalidation Level: The wave cancellation or invalidation level is identified at 160.197. If the market moves beyond this level, the current wave count would be invalidated, necessitating a reevaluation of the wave structure and potentially indicating a shift in market dynamics.

Summary

The USD/JPY Elliott Wave analysis on the daily chart indicates that the market is currently in a corrective trend phase, specifically within red wave 2 of blue wave 1. As red wave 2 approaches its end, the market is expected to transition into red wave 3, marking a resumption of the primary trend direction. The analysis highlights an invalidation level at 160.197, which, if breached, would negate the current wave count and suggest a need to reassess the market's wave structure. This analysis provides traders with insights into the ongoing corrective phase and critical points for potential trend continuation.

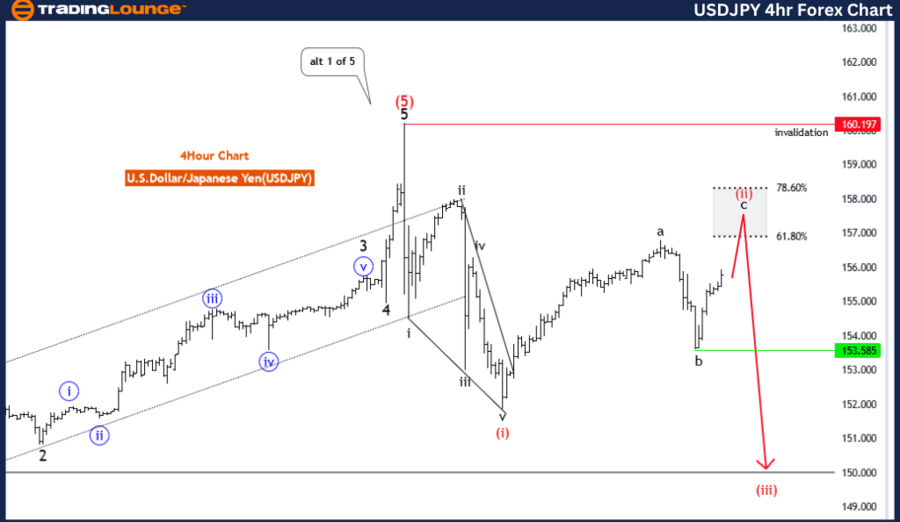

USD/JPY Elliott Wave Technical Analysis: 4-Hour Chart

Function: Trend

Mode: Corrective

Structure: Red Wave 2

Position: Blue Wave 1

Direction Next Lower Degrees: Red Wave 3

Details: Red wave 2 of blue wave 1 is still active and appears to be nearing completion. The wave cancel invalid level is set at 160.197.

Function

The current analysis identifies the USD/JPY market movement on the 4-hour chart as a "Trend." This suggests that the wave pattern being observed is moving in the same direction as the prevailing market trend.

Mode

The mode is "corrective," indicating that the market is undergoing a correction phase rather than an impulsive move. In Elliott Wave theory, corrective waves move against the primary trend and typically consist of three sub-waves (A, B, and C).

Structure

The structure under examination is "red wave 2." This wave is part of the corrective phase within the larger trend and is typically a retracement of the initial impulsive wave.

Position

The market is currently in "blue wave 1." This implies that the corrective red wave 2 is occurring within the first wave of a new degree, the blue wave 1.

Direction for Next Lower Degrees

The next anticipated movement is "red wave 3." This would be an impulsive wave following the completion of the corrective red wave 2, indicating a resumption of the primary trend direction.

Details

Wave Completion: The analysis notes that "red wave 2 of blue wave 1" is still in play but appears to be nearing its end. This signals an impending transition to red wave 3, where the market is expected to resume its trend direction.

Invalidation Level: The wave cancellation or invalidation level is set at 160.197. If the market exceeds this level, the current wave count will be invalidated, suggesting a need to reassess the wave structure and possibly indicating a shift in market dynamics.

Summary

The USD/JPY Elliott Wave analysis on the 4-hour chart indicates that the market is currently experiencing a corrective trend within red wave 2. This wave is part of a broader structure within blue wave 1. As red wave 2 approaches its completion, the market is expected to transition into red wave 3, signaling a resumption of the primary trend. The analysis highlights an invalidation level at 160.197, where exceeding this level would negate the current wave count and suggest a potential reevaluation of the market dynamics. This wave analysis provides traders with insights into the ongoing corrective phase and critical points for potential trend continuation.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: U.S.Dollar /Canadian Dollar (USD/CAD)

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support