Costco Wholesale Corp., Elliott Wave Technical Analysis

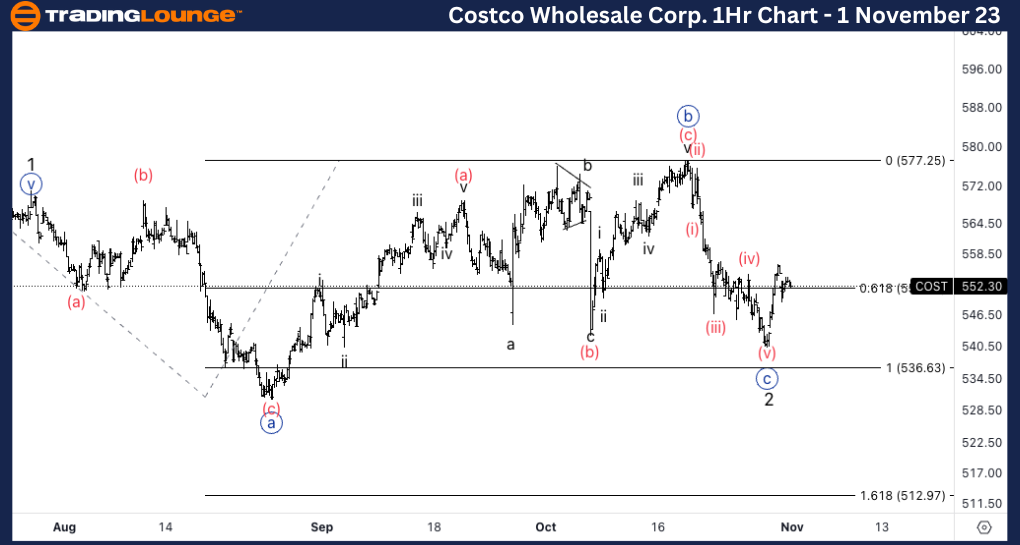

Costco Wholesale Corp., (COST:NASDAQ): 4h Chart 1 November 23

COST Stock Market Analysis: We have been looking for upside continuation after the completion of the triangle in wave (4). At this stage we have been forecasting a flat correction into wave 2, confirming the overall upside trend.

COST Elliott Wave Count: Wave {c} of 2.

COST Technical Indicators: 200EMA as support.

COST Trading Strategy: Looking for longs into wave 3 with invalidation at 477$.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get a trial here!

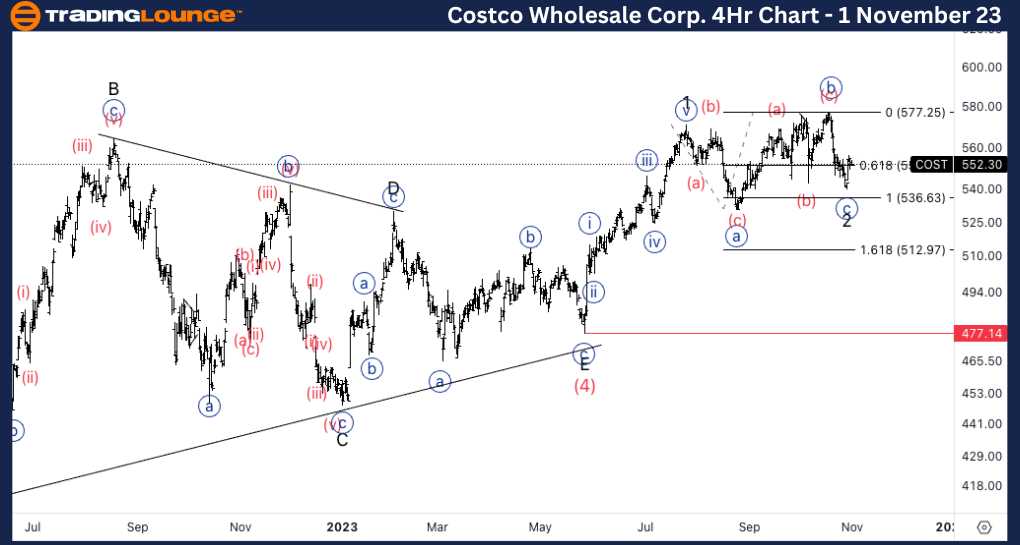

Costco Wholesale Corp., COST: 1-hour Chart 1 November 23

Costco Wholesale Corp., Elliott Wave Technical Analysis

COST Stock Market Analysis: It looks like we have had a five wave move into wave {c} as you can see on the chart. We reacted strongly and we are trying to find support on the 550$. Looking for upside confirmation into wave {i}.

COST Elliott Wave count: Wave (i) of {i}.

COST Technical Indicators: 20EMA as support.

COST Trading Strategy: Looking for longs into wave {i} after a clear five wave move.