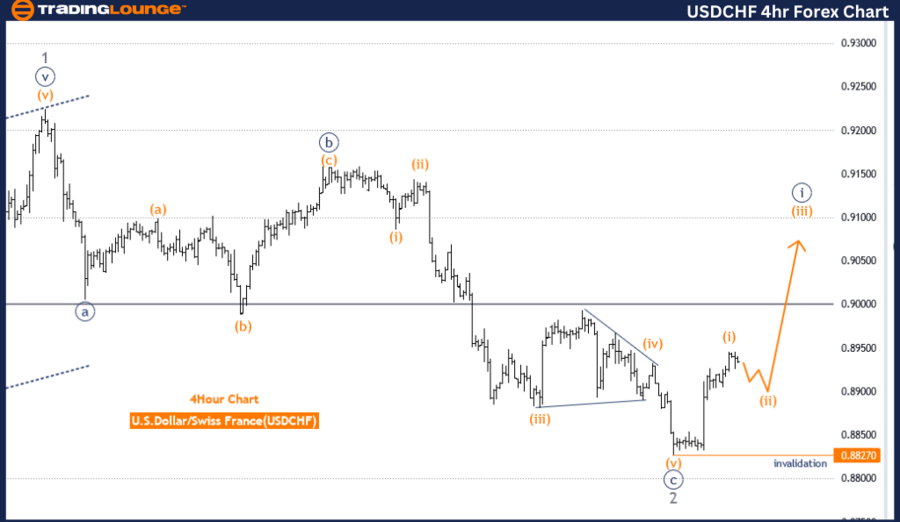

USDCHF Elliott Wave Analysis Trading Lounge Day Chart

U.S. Dollar/Swiss Franc (USDCHF) Day Chart Analysis

USDCHF Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Grey wave 3

DIRECTION NEXT HIGHER DEGREES: Navy blue wave 1 (started)

DETAILS: Grey wave 2 looking completed, now Navy Blue Wave 1 of Grey wave 3 is in play.

Wave Cancel invalid level: 0.88270

The USDCHF Elliott Wave analysis on the day chart focuses on the market trend using Elliott Wave theory. The function of this analysis is to identify and understand the trend, which is described as impulsive, indicating an upward movement driven by a series of impulse waves.

The structure currently under examination is Navy blue wave 1, marking the initial phase of this impulsive trend. The position within this trend is identified as Grey wave 3, suggesting that the market has progressed through Grey wave 2 and is now advancing into Grey wave 3.

The direction for the next higher degrees is indicated as Navy blue wave 1, which has already started. This means that the initial impulsive wave (Navy blue wave 1) is underway within the larger structure of Grey wave 3. This wave is expected to continue driving the market upward, following the completion of the previous corrective phase (Grey wave 2).

Detailed observations point out that Grey wave 2 appears to be completed, setting the stage for Navy blue wave 1 of Grey wave 3, indicating a new phase of market advancement. This transition marks a critical point in the Elliott Wave structure, suggesting a continuation of the upward trend.

An essential aspect of this analysis is the wave cancel invalid level, set at 0.88270. This level is crucial for validating the current wave count. If the market price falls below this threshold, it would invalidate the current wave structure, necessitating a reassessment of the wave count and potentially altering the market outlook.

In summary, the USDCHF day chart analysis identifies the market as being in an impulsive upward trend, with Navy blue wave 1 currently in play within the larger Grey wave 3 structure. Following the completion of Grey wave 2, the market is expected to continue its upward trajectory. The wave cancel invalid level at 0.88270 is a key indicator for confirming the current wave structure and guiding future market predictions.

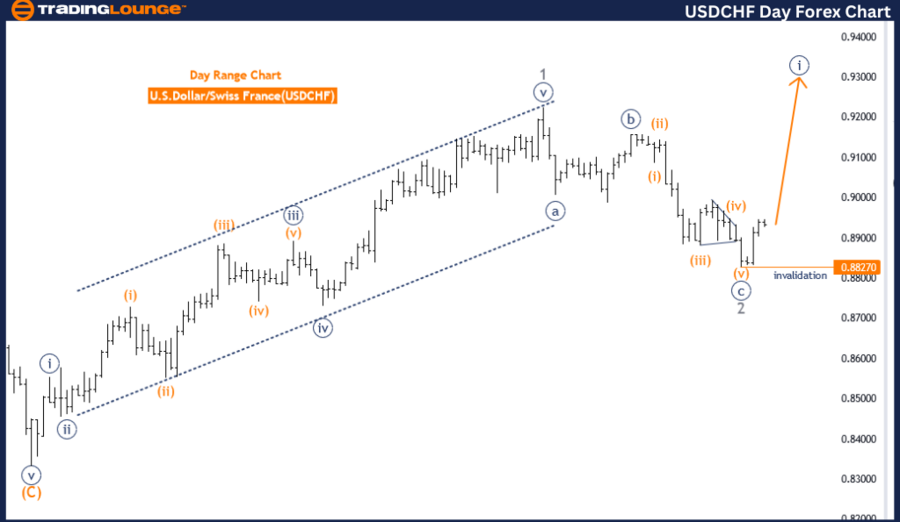

USDCHF Elliott Wave Analysis Trading Lounge 4-Hour Chart

U.S. Dollar/Swiss Franc (USDCHF) 4 Hour Chart Analysis

USDCHF Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Corrective

STRUCTURE: Orange wave 2

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange wave 3

DETAILS: Orange wave 1 looking completed, now Orange wave 2 is in play as correction.

Wave Cancel invalid level: 0.88270

The USDCHF Elliott Wave analysis on the 4-hour chart provides a technical assessment using Elliott Wave theory, focusing on the current market trend. The analysis identifies the function as a trend with a corrective mode, indicating that the market is undergoing a corrective phase within an overall upward trend.

In this context, the structure being examined is Orange wave 2, following the completion of Orange wave 1. The position within this corrective phase is designated as Navy blue wave 1, showing that the initial impulse wave has completed, and the market is now in a corrective wave.

The direction for the next higher degrees is projected to be Orange wave 3, suggesting that after the completion of the current correction, the market is expected to resume its upward movement. This implies that once Orange wave 2 concludes, Orange wave 3 will begin, continuing the overall bullish trend.

The details provided in the analysis highlight that Orange wave 1 appears to be completed. Now, Orange wave 2 is in play as a correction, indicating a temporary retracement before the market continues its upward trajectory. The corrective phase represented by Orange wave 2 is essential for the market to consolidate and prepare for the next impulsive wave.

A critical component of this analysis is the wave cancel invalid level, set at 0.88270. This level serves as a crucial threshold for validating the current wave count and ensuring the accuracy of the Elliott Wave structure. If the market price moves below this level, it would invalidate the current wave analysis, necessitating a reevaluation of the wave count and potentially altering the market outlook.

In summary, the USDCHF 4-hour chart analysis suggests that the market is currently in a corrective phase, represented by Orange wave 2, following the completion of Orange wave 1. This correction is expected to be temporary, with the market anticipated to resume its upward trend in Orange wave 3. The wave cancel invalid level at 0.88270 is a key indicator for confirming the validity of the current wave structure and guiding future market predictions.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: British Pound/U.S. Dollar (GBPUSD) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support