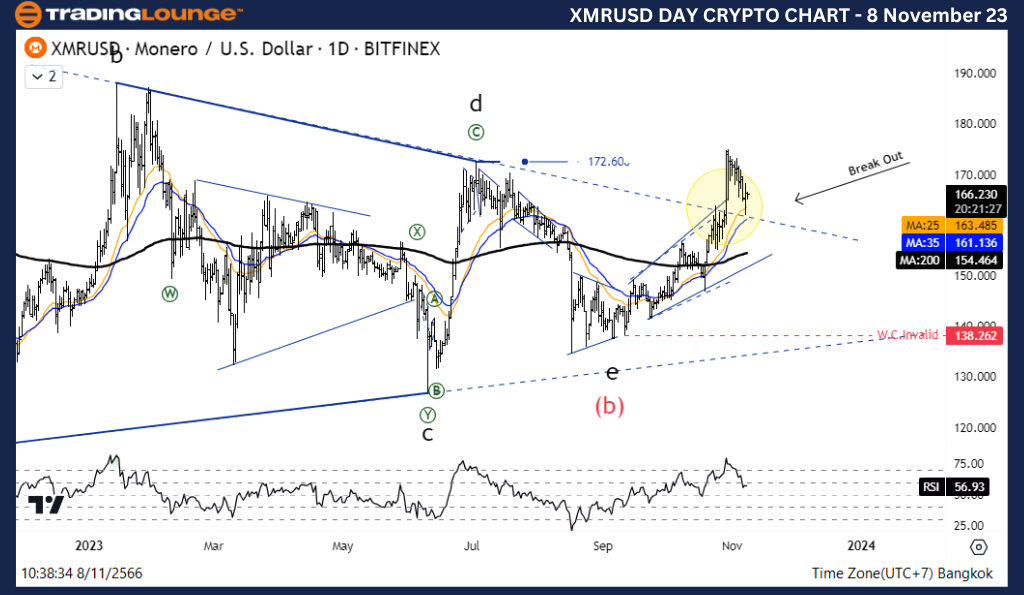

Elliott Wave Analysis TradingLounge Daily Chart, 8 November 23,

Monero/ U.S. dollar(XMRUSD)

XMRUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Correvtive

Structure: Triangle

Position: Wave E

Direction Next higher Degrees: Wave (B) of Zigzag

Wave Cancel invalid Level: 138.262

Details: Wave E may end and the price five-wave Increase in Wave (C) of Zigzag.

Monero/ U.S. dollar(XMRUSD) Trading Strategy: XRM recovered well from the 138.262 level, where the price structure can be divided into five waves in a diagonal pattern that points us to an uptrend forming. And currently the price is likely to enter a correction period. To give us another opportunity to join the trend. Waiting for the base adjustment to be completed.

Monero/ U.S. dollar(XMRUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, RSI is a Bullish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

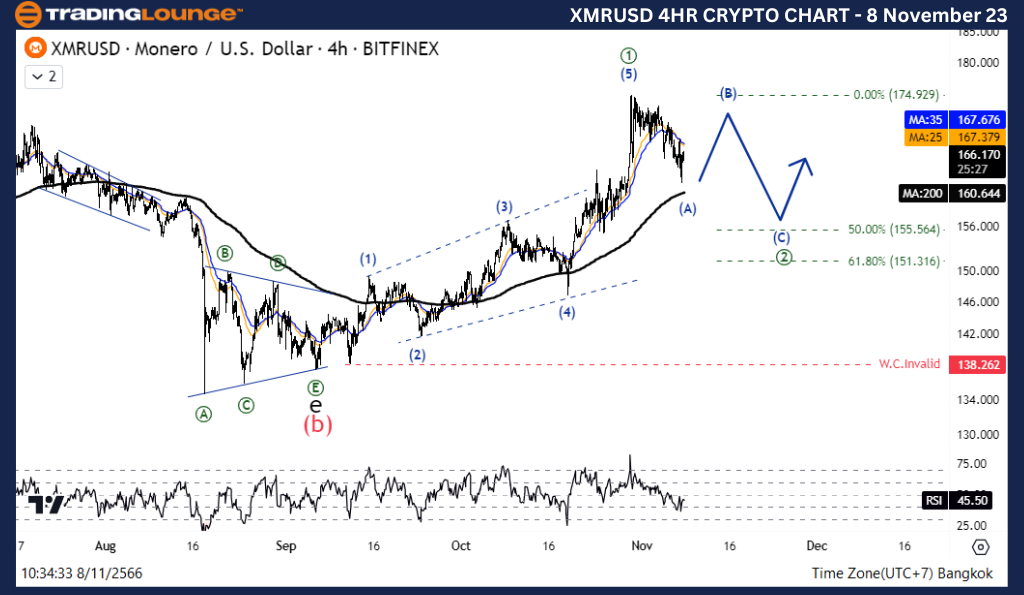

Elliott Wave Analysis TradingLounge 4H Chart, 8 November 23,

Monero/ U.S. dollar(XMRUSD)

XMRUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: ……

Position: Wave ((2))

Direction Next higher Degrees: Wave ((2)) of Impulse

Wave Cancel invalid Level: 138.262

Details: Retracement of wave ((2)) usually .50 or .618 x Length wave ((1))

Monero/ U.S. dollar(XMRUSD)Trading Strategy: XRM recovered well from the 138.262 level, where the price structure can be divided into five waves in a diagonal pattern that points us to an uptrend forming. And currently the price is likely to enter a correction period. To give us another opportunity to join the trend. Waiting for the base adjustment to be completed.

Monero/ U.S. dollar(XMRUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, RSI is a Bullish Momentum.