Elliott Wave Analysis for UnitedHealth Group Inc. (UNH)

This detailed Elliott Wave analysis for UnitedHealth Group Inc. (UNH) explores the daily and 1-hour charts, utilizing the principles of Elliott Wave Theory to predict potential future price movements.

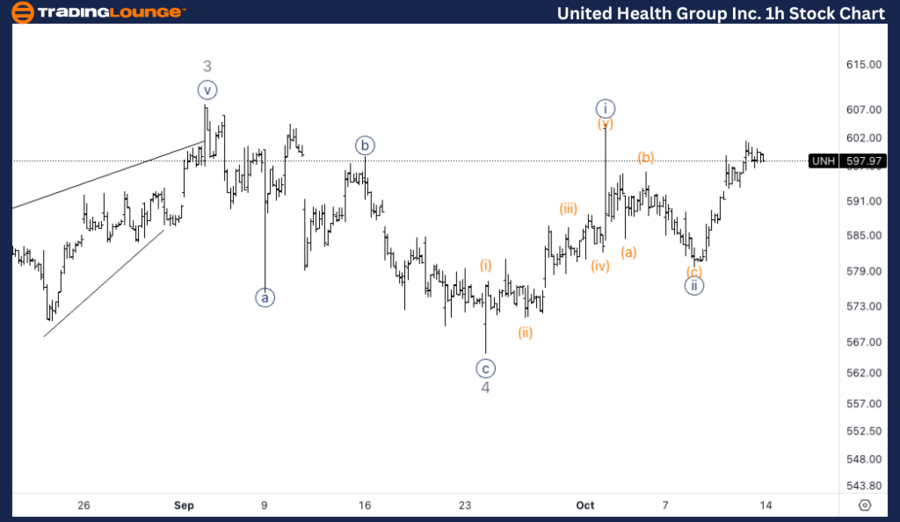

UNH Elliott Wave Analysis - TradingLounge Daily Chart

UnitedHealth Group Inc. (UNH) Daily Chart Overview

UNH Elliott Wave Technical Analysis:

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 5

Direction: Upside within wave 3

Key Details: We are closely monitoring wave 4 to see if it has already reached its bottom or is near completion. Once wave 4 confirms its conclusion, we expect further upside movement targeting the MediumLevel of $650.

META Shares Technical Analysis – Daily Chart

According to the daily chart, UNH is likely in the final stages of wave 4 or has already completed it. The next expected move will be Minor wave 5 with an upward push towards $650. The corrective phase (wave 4) is coming to an end, and once confirmed, the continuation of the uptrend should follow. This will solidify the bullish structure towards the anticipated target.

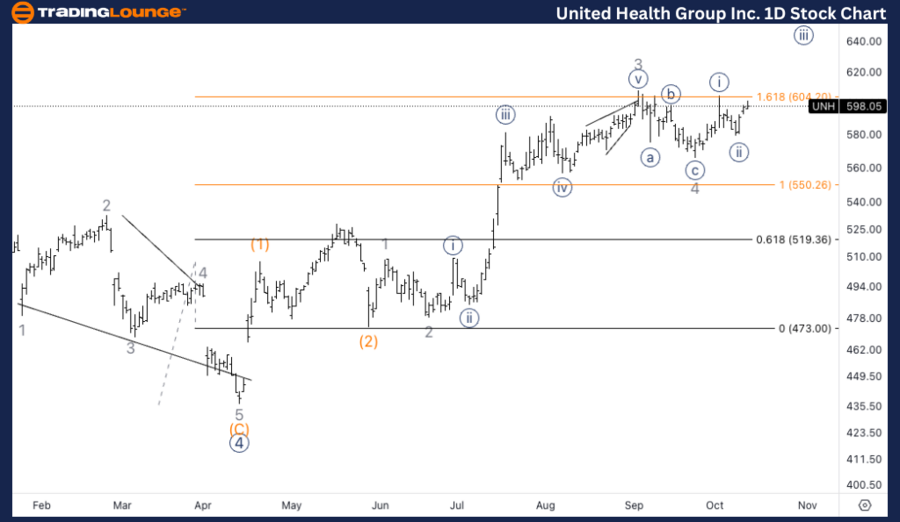

UnitedHealth Group Inc. (UNH) 1-Hour Chart Analysis

UNH Elliott Wave Technical Analysis:

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minute wave {iii}

Direction: Upside within wave {iii}

Key Details: The 1-hour chart suggests that the stock has completed a five-wave structure within wave {i} of Minor wave 5. The current movement could represent wave {ii}. A critical test will be the establishment of support above the $600 level. Once this support is confirmed, the uptrend should resume, propelling the stock higher into wave {iii}.

META Technical Analysis – 1-Hour Chart

UNH has likely finished the initial wave {i} of Minor wave 5, with wave {ii} currently unfolding. The key focus now is on testing support at $600. A successful test at this level would confirm the resumption of the bullish trend into wave {iii}, signaling more upside ahead.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Avery Dennison Corp. (AVY) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support