KO Elliott Wave Analysis for The Coca-Cola Company (KO)

In this Elliott Wave analysis, we will examine the trend structure of The Coca-Cola Company (KO), utilizing both daily and 1-hour charts to determine the current wave position and potential price movements.

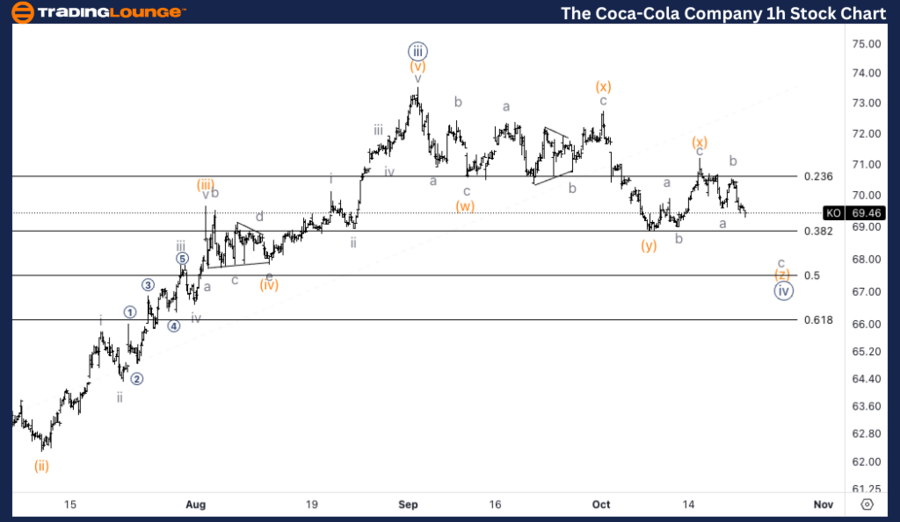

KO Elliott Wave Analysis – Trading Lounge Daily Chart

The Coca-Cola Company (KO) Daily Chart

KO Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Complex

Position: Wave {iv}

Direction: Bottom in wave {iv}

Details: We are currently observing a correction that has persisted for slightly over a month, which appears to be part of wave {iv} following a sharp impulsive wave {iii} move.

KO Elliott Wave Technical Analysis – Daily Chart

On the daily chart, The Coca-Cola Company (KO) is in the midst of a wave {iv} correction, which has lasted just over a month. This correction follows a strong impulsive move in wave {iii}. The complex structure typical of wave {iv} suggests that the correction is nearing its conclusion, setting up for the next upward movement in wave {v} once this correction is complete.

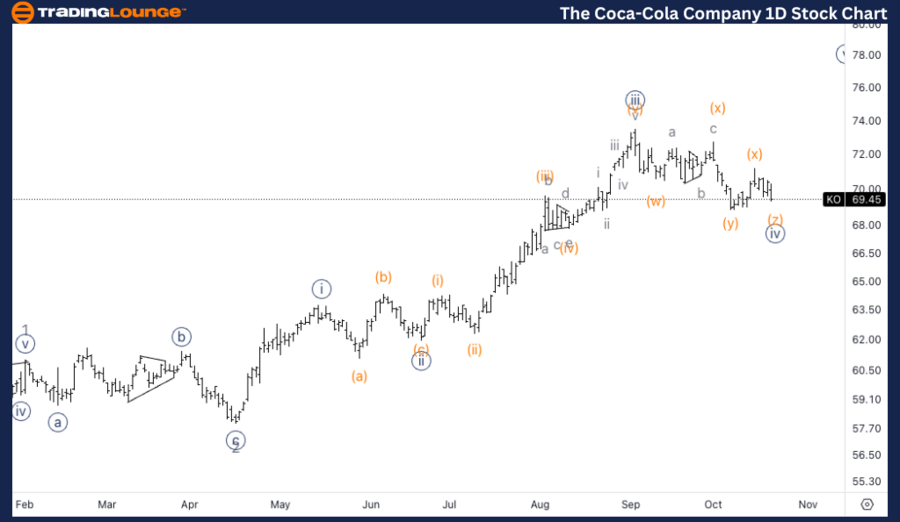

The Coca-Cola Company (KO) 1H Chart

KO Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Complex

Position: Wave (z) of {iv}

Direction: Downside in wave (z)

Details: A closer look at the corrective structure of wave {iv} shows that the most recent upward movement appears to consist of three waves, which suggests that the correction is still ongoing. Therefore, the current complex wave count seems to be the most accurate scenario at this stage.

KO Elliott Wave Technical Analysis – 1H Chart

On the 1-hour chart, the market is positioned in wave (z) of {iv}, indicating that the complex correction is still unfolding. The most recent move upward is corrective, made up of three waves, signaling that the correction is not yet complete. This complex corrective structure, likely a double or triple combination, suggests the possibility of further downside before the completion of wave {iv}. Once the correction concludes, we expect the market to resume its uptrend in wave {v}.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: GOOGL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support