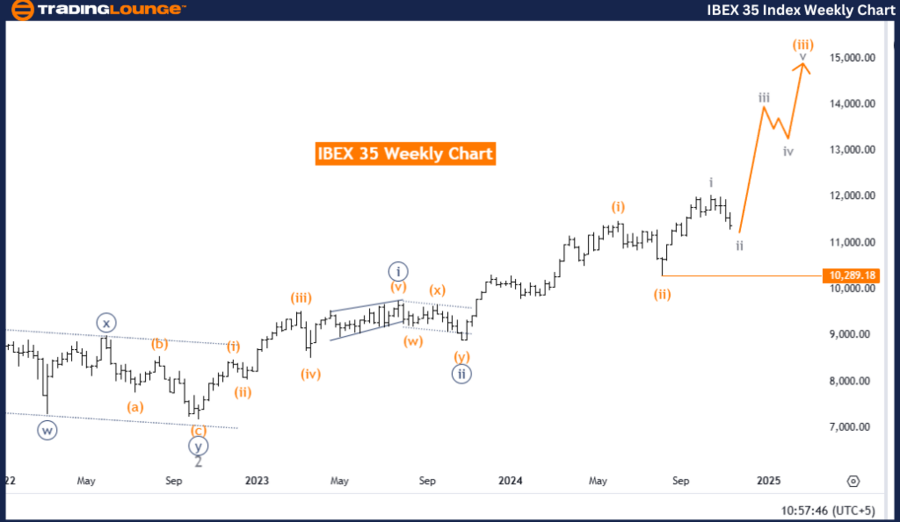

IBEX 35 (Spain) Elliott Wave Analysis - Trading Lounge Daily Chart Analysis

IBEX 35 Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Gray Wave 2

Position: Orange Wave 3

Direction (Next Higher Degrees): Gray Wave 3

Details: Gray wave 1 appears completed; gray wave 2 within orange wave 3 is active.

Wave Cancellation Invalidation Level: 10,289.18

Analysis Overview

The daily IBEX 35 Elliott Wave analysis by Trading Lounge identifies a corrective phase in the Spanish stock index. Currently, gray wave 2 is unfolding within the broader orange wave 3, indicating a counter-trend movement. This development suggests a temporary pullback in the upward trend, marking a period of consolidation or retracement before a potential continuation of the bullish trajectory.

Wave Details

- Gray wave 1 has concluded, allowing gray wave 2 to proceed within the larger orange wave 3 structure.

- Within the Elliott Wave framework, wave 2 typically represents a retracement phase, often characterized by consolidation or price corrections.

- The current corrective phase within orange wave 3 implies the potential for a short-term dip before the next rally, particularly as the higher-degree gray wave 3 gains momentum.

Key Level: Invalidation Threshold

- Invalidation Level: 10,289.18

If the IBEX 35 index falls below this critical level, the ongoing wave structure will be invalidated. Such a breach could indicate a halt or reversal in the trend, necessitating a reassessment of the wave dynamics and the broader trend outlook.

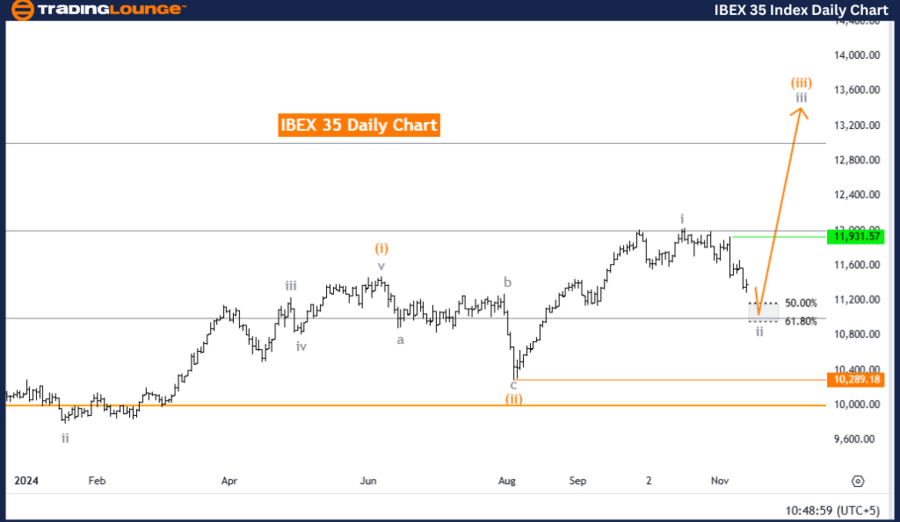

IBEX 35 (Spain) Elliott Wave Analysis - Trading Lounge Weekly Chart Analysis

IBEX 35 Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction (Next Higher Degrees): Continuation of Orange Wave 3

Details: Orange wave 2 appears complete; orange wave 3 within navy blue wave 3 is active.

Wave Cancellation Invalidation Level: 10,289.18

Analysis Overview

The weekly IBEX 35 Elliott Wave analysis presents a bullish trend supported by an impulsive wave structure. Currently, orange wave 3 is advancing as part of the broader navy blue wave 3, highlighting sustained upward momentum. This phase aligns with the characteristic strength of wave 3 within Elliott Wave theory, reflecting a robust continuation of the index's bullish movement.

Wave Details

- The conclusion of orange wave 2 has paved the way for orange wave 3 to progress.

- Wave 3 is typically a high-momentum phase, marked by significant price increases and strong trend alignment.

- Positioned within navy blue wave 3, the ongoing orange wave 3 reinforces the positive trajectory, suggesting further gains for the IBEX 35 index.

Key Level: Invalidation Threshold

- Invalidation Level: 10,289.18

If the index drops below this level, it would invalidate the current wave structure and potentially signal a pause or reversal in the bullish trend. Monitoring this level is crucial to confirm the wave's strength and the broader upward momentum.

Summary and Recommendations

The weekly analysis indicates a strong bullish outlook for the IBEX 35, with orange wave 3 actively advancing within navy blue wave 3. Traders are advised to monitor the invalidation level at 10,289.18 closely, as a drop below this point could disrupt the current wave structure and trend direction. This threshold serves as a vital checkpoint for confirming the continuation of the bullish trend and identifying potential shifts in market dynamics.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: TASI Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support