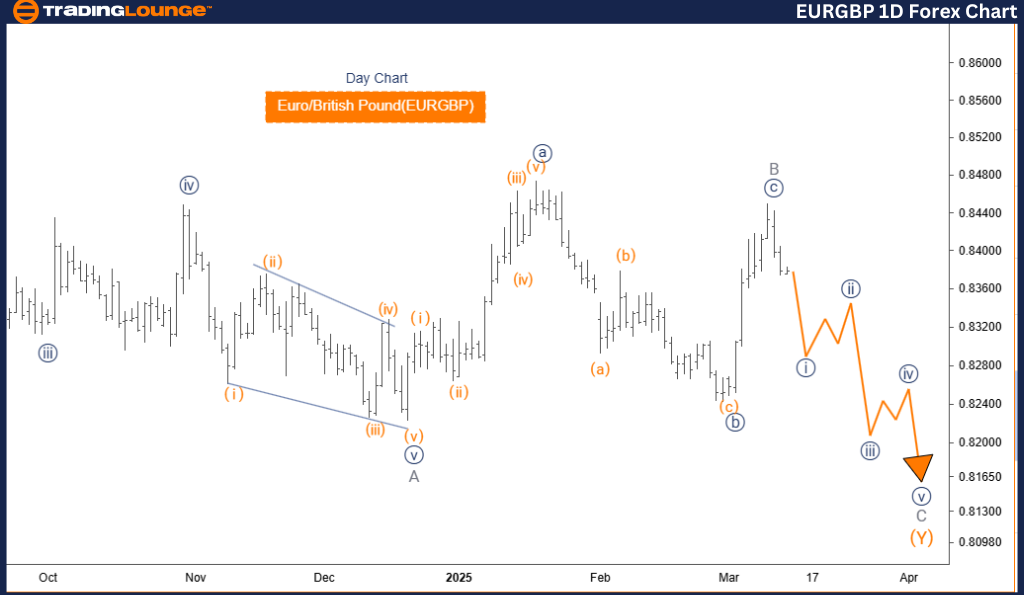

Euro/British Pound (EURGBP) Elliott Wave Analysis – Trading Lounge Daily Chart

EURGBP Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Gray Wave C

Position: Orange Wave Y

Next Lower Degree Direction: Gray Wave C

Details:

- Gray Wave B appears to be complete.

- Gray Wave C of Y is currently in play.

Analysis Overview

The EURGBP Elliott Wave Analysis for the daily chart provides insights into the Euro/British Pound currency pair, identifying crucial market trends and potential price movements.

- The market is in a counter-trend phase, dominated by impulsive rather than corrective movements.

- The primary structure under observation is Gray Wave C, forming a key part of Orange Wave Y in the overall wave pattern.

- Gray Wave B has likely reached completion, signaling a transition into Gray Wave C of Orange Wave Y.

- As Gray Wave C is impulsive, traders can anticipate strong directional movements before the next major trend shift occurs.

Key Considerations for Traders

- The next wave to monitor is Gray Wave C, following the completion of Gray Wave B.

- Traders should watch for potential market shifts as Gray Wave C progresses.

- Understanding the current wave structure enables traders to anticipate future price trends more accurately.

- The daily chart analysis provides a broader market perspective, helping traders align their strategies with long-term trends and possible reversals.

Trading Insights

This detailed EURGBP Elliott Wave Analysis offers a structured trading approach that enhances market understanding.

- Identifying wave transitions helps traders anticipate price movements and adjust their strategies accordingly.

- Recognizing wave patterns supports informed decision-making in trading.

- Detecting the end of one wave and the beginning of another ensures traders stay prepared for evolving market conditions.

- By applying the Elliott Wave framework, traders gain valuable insights into EURGBP market dynamics, optimizing their trading strategies.

Euro/British Pound (EURGBP) Elliott Wave Analysis – Trading Lounge 4-Hour Chart

EURGBP Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave C

Next Higher Degree Direction: Navy Blue Wave 2

Details:

- Gray Wave B appears to be complete.

- Navy Blue Wave 1 of C is currently in play.

Analysis Overview

The EURGBP Elliott Wave Analysis for the 4-hour chart focuses on shorter-term movements within the Euro/British Pound currency pair, identifying key trading opportunities.

- The market remains in a counter-trend phase, characterized by impulsive price action.

- The primary wave structure under analysis is Navy Blue Wave 1, which is part of the broader Gray Wave C pattern.

- Gray Wave B has likely completed, signaling a transition into Navy Blue Wave 1 of Gray Wave C.

- Since Navy Blue Wave 1 is impulsive, strong directional movements are expected before the next major trend shift.

Key Considerations for Traders

- The next wave to monitor is Navy Blue Wave 2, which follows the completion of Navy Blue Wave 1.

- Traders should closely watch the development of Navy Blue Wave 1 and prepare for the possible emergence of Navy Blue Wave 2.

- Understanding the wave structure aids in predicting future price movements.

- The 4-hour chart analysis offers a shorter-term perspective, enabling traders to align strategies with immediate market trends and potential reversals.

Trading Insights

This EURGBP Elliott Wave Analysis for the 4-hour chart provides a clear roadmap for traders navigating short-term market movements.

- Tracking wave transitions helps traders anticipate market shifts and adjust strategies accordingly.

- Recognizing wave formations supports traders in making informed trading decisions.

- Identifying wave cycle shifts ensures traders stay prepared for changing market dynamics.

- Applying the Elliott Wave structure provides a comprehensive view of the EURGBP market, enhancing trade execution.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support