Costco Wholesale Corp. (COST) Elliott Wave Analysis

In this Elliott Wave analysis, we examine the trend structure of Costco Wholesale Corp. (COST) using both the daily and 1-hour charts. This assessment helps determine the current wave position and potential price movements based on Elliott Wave theory.

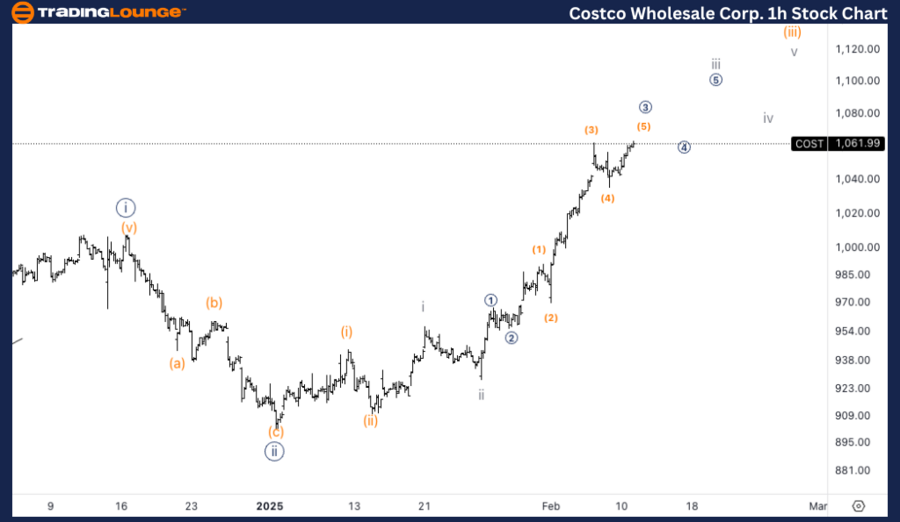

Costco Wholesale Corp. (COST) Elliott Wave Analysis – Trading Loung Daily Chart

COST Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {iii} of 5

Direction: Upside in wave 5

COST Elliott Wave Technical Analysis – Daily Chart

Costco Wholesale Corp. (COST) is currently extending within wave {iii} of 5, signaling further upside movement. The stock has broken above the key resistance at $1000, a critical level (TradingLevel1), confirming bullish momentum.

- The next key target is $1150, where an equality relationship between wave {iii} and wave {i} is expected.

- If the impulsive trend continues, higher price levels could be reached before a potential pullback in wave {iv}.

- As long as support holds, the broader uptrend remains intact, reinforcing the bullish Elliott Wave count.

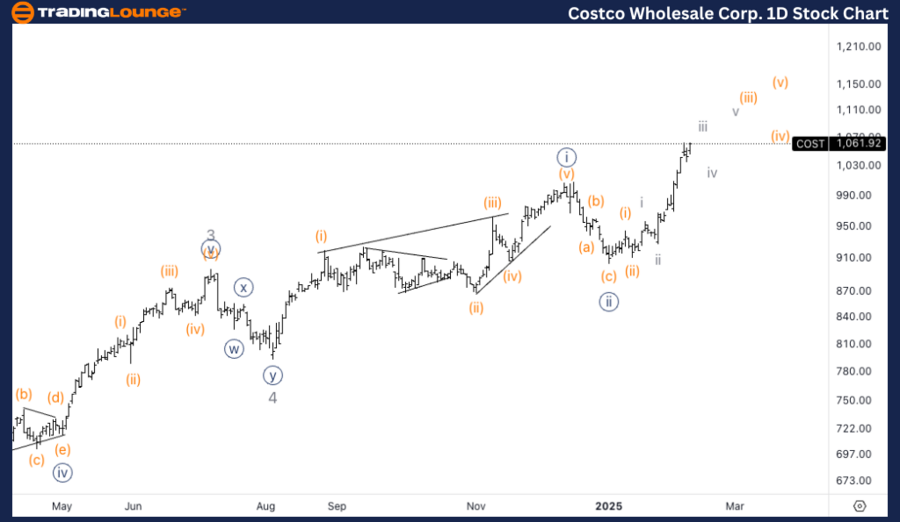

Costco Wholesale Corp. (COST) Elliott Wave Analysis – Trading Loung 1H Chart

COST Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave iii of (iii)

Direction: Upside in wave {iii}

COST Elliott Wave Technical Analysis – 1H Chart

On the 1-hour chart, COST is progressing in wave iii of (iii), a strong third-wave extension that suggests a sharp upside move. The steep ascent angle supports the current Elliott Wave count, reinforcing the ongoing bullish trend.

- The market is displaying a third-of-a-third wave extension, typically a powerful price acceleration phase.

- Expect a series of smaller corrective waves (threes and fours) as the trend unfolds, maintaining upward momentum.

- This structure indicates continuation to higher levels before a potential corrective move.

As long as momentum sustains, the bullish wave structure remains valid, with potential new highs forming within the Elliott Wave cycle.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Mastercard Inc. (MA) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support