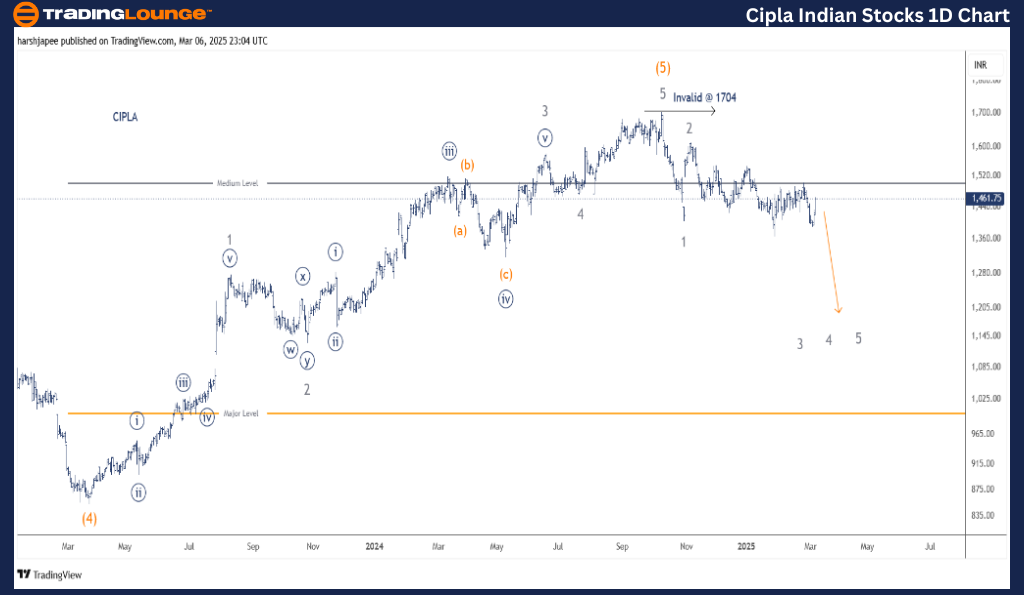

CIPLA – Elliott Wave Technical Analysis (1D Chart)

Function: Counter-Trend (Minor Degree - Grey)

Mode: Corrective

Structure: Impulse within a larger-degree corrective structure

Position: Minor Wave 3 (Grey)

Analysis & Market Positioning

CIPLA's price action suggests a larger-degree correction in progress. Minor Wave 1 concluded near the 1400 level, while Minor Wave 2 appears completed in the 1620-1630 range. Currently, Wave 3 is likely developing downward, targeting a move below the 1600 resistance level, with a key invalidation point at 1705.

CIPLA Daily Chart – Elliott Wave Forecast & Key Levels

The daily chart signals a major peak at 1705, recorded in October 2024, before the stock reversed downward, breaking a key support level at 1470. This decline hints at a potential shift in trend, forming an impulsive structure at Minor Degree.

Historically, the stock dipped to 850 in March 2023, marking Intermediate Wave (4) (Orange) before rallying impulsively to 1750. The subsequent downward momentum indicates that CIPLA may continue lower as Minor Wave 3 progresses.

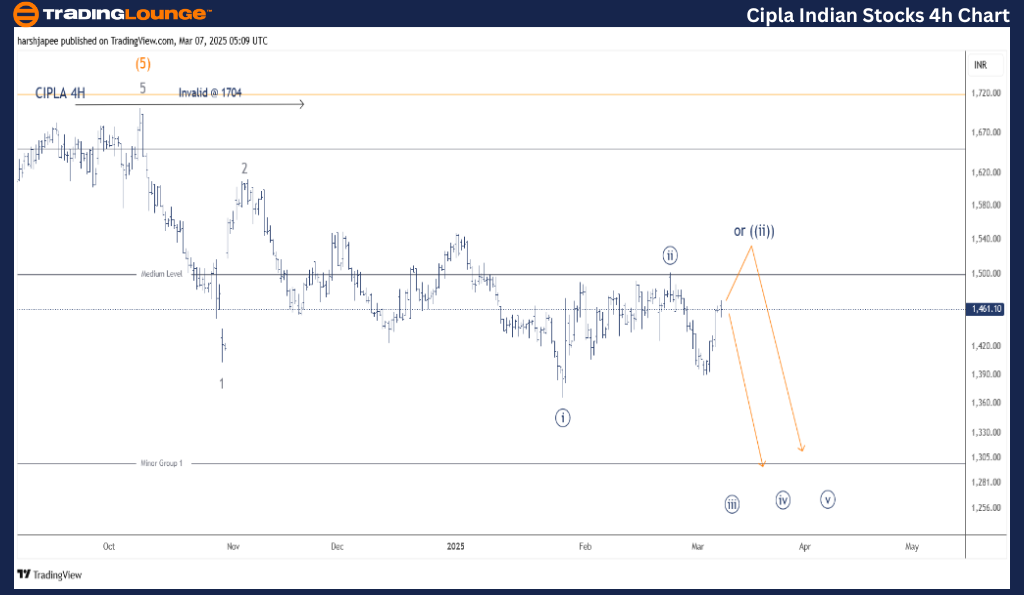

CIPLA – Elliott Wave Technical Analysis (4H Chart)

Function: Counter-Trend (Minor Degree - Grey)

Mode: Corrective

Structure: Impulse within a larger-degree corrective structure

Position: Minor Wave 3 (Grey)

Market Dynamics & Wave Progression

A broader correction remains in play, with Minor Wave 1 completing near 1400 and Minor Wave 2 finalizing around 1620-1630. At present, Wave 3 appears active against the 1705 level, with price action expected to remain below the 1600 resistance.

Additionally, Wave 3 is subdividing into smaller impulsive structures:

- Minute Wave ((i)) terminated near 1365

- Minute Wave ((ii)) retraced to 1500

- Minute Wave ((iii)) is currently unfolding downward

Invalidation Point: 1705

CIPLA 4H Chart – Elliott Wave Forecast & Price Levels

The 4H chart tracks the wave structure following the 1705 high on October 9, 2024. The stock is likely forming an impulsive decline at Minor Degree, with Waves 1 and 2 already completed while Wave 3 extends downward against 1616.

Breakdown of Minor Wave 3 Subdivision:

- Minute Wave (i): Completed around 1375

- Minute Wave ((ii)): Completed around 1500 (with an alternative scenario near 1540)

- Minute Wave ((iii)) is in progress, targeting levels below 1616

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous:BRITANNIA INDUSTRIES Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion & Market Outlook

CIPLA is currently in a downtrend within Minute Wave ((iii)) of Minor Wave 3, with key resistance at 1616. Traders should monitor wave developments and price action for further confirmations, identifying potential entry or exit opportunities based on this Elliott Wave structure.