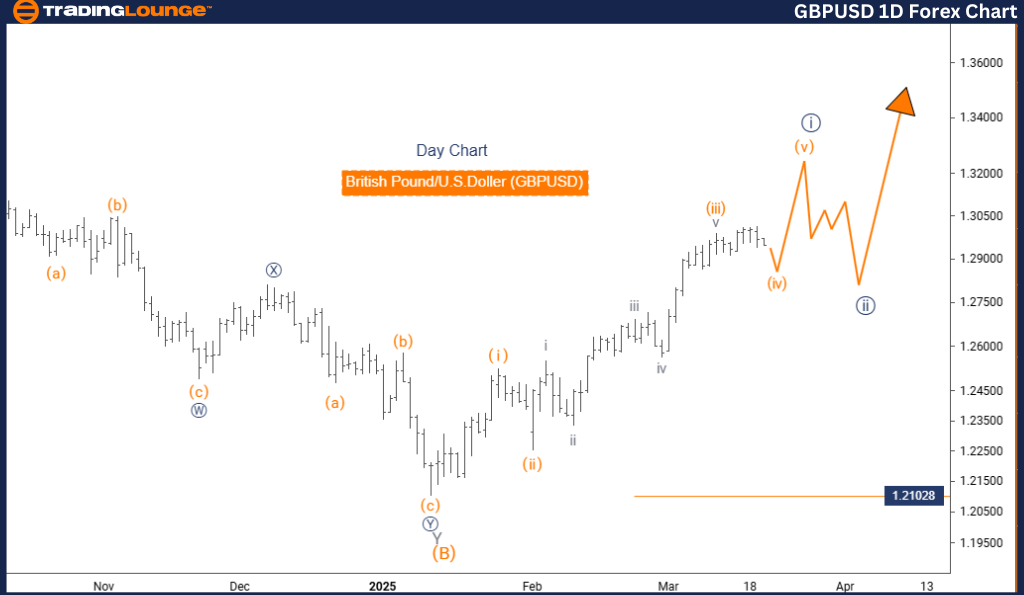

British Pound / U.S. Dollar (GBPUSD) Elliott Wave Analysis – TradingLounge Day Chart

GBPUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 1

Next Lower Degree Direction: Navy Blue Wave 2

Wave Invalidation Level: 1.21028

Analysis Overview:

The daily Elliott Wave analysis for GBPUSD highlights a bullish market structure with strong upward momentum. The current impulsive movement forms part of Navy Blue Wave 1, nested within the broader Gray Wave 1, confirming the ongoing bullish sentiment for GBPUSD.

Traders should recognize that Navy Blue Wave 1 is currently active and gaining strength. This phase is likely to continue until a transition into Navy Blue Wave 2 begins. A vital support level to monitor is 1.21028—any drop below this level would invalidate the existing wave count and may suggest a shift in the prevailing trend.

Trading Outlook:

- Monitor the development of Navy Blue Wave 1 for trend continuation.

- Watch for early signs of transition to Navy Blue Wave 2.

- A move below 1.21028 signals a possible wave count reassessment.

Identifying wave positions and invalidation points is crucial for staying aligned with the GBPUSD price direction. By observing Elliott Wave structures on the daily chart, forex traders can gain insights into long-term bullish trends and potential correction zones. These technical levels provide strategic guidance for GBPUSD price forecasting and risk management.

British Pound / U.S. Dollar (GBPUSD) Elliott Wave Analysis – TradingLounge 4-Hour

GBPUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 4

Position: Navy Blue Wave 1

Next Lower Degree Direction: Orange Wave 5

Wave Invalidation Level: 1.25221

Analysis Overview:

This 4-hour GBPUSD Elliott Wave chart highlights a corrective market phase. Currently, Orange Wave 4 is in progress within the larger Navy Blue Wave 1, signaling a temporary pullback rather than sustained bullish movement.

Orange Wave 3 has concluded, and the development of Orange Wave 4 of 3 is underway. As a corrective wave, this phase is expected to show sideways or consolidating behavior. Following its completion, Orange Wave 5 will likely resume the broader impulsive move upward.

The key resistance level to watch is 1.25221. If GBPUSD breaks above this point, it will invalidate the current wave count, requiring a revised outlook.

Trading Outlook:

- Focus on price action during Orange Wave 4 to identify potential entries.

- Prepare for the next leg of the trend with Orange Wave 5.

- Maintain caution if price approaches or exceeds 1.25221.

Using the 4-hour chart for short-term GBPUSD wave analysis helps traders adapt to immediate price fluctuations and refine their strategy. Recognizing the end of corrective waves and preparing for impulsive continuations enables better execution and risk control in dynamic forex markets.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support