ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG Elliott Wave Technical Analysis

Hello,

Today's Elliott Wave forecast focuses on Insurance Australia Group Limited (ASX:IAG), analyzing the current corrective pattern and short-term price expectations within the Australian share market.

Our updated analysis identifies ASX:IAG as continuing within a corrective wave formation. We anticipate a modest decline before a potential recovery move, aligning with our broader technical perspective.

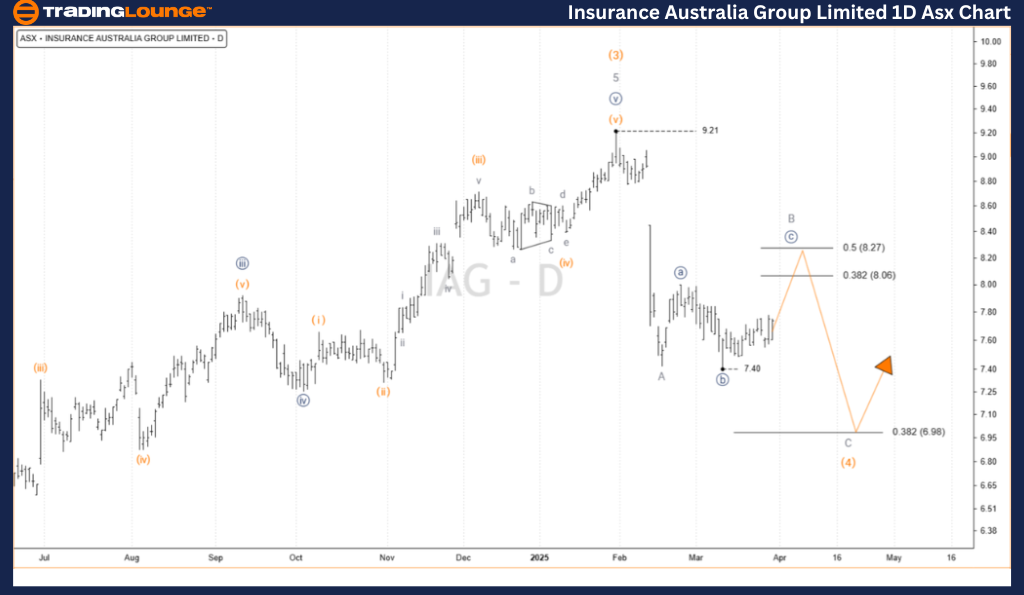

ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG Elliott Wave Technical Analysis 1D Chart (Semilog Scale)

Trend Function: Major trend (Primary degree, navy)

Mode: Motive

Wave Structure: Impulse

Current Position: Wave B-grey of Wave (4)-orange

Details:

Wave (4)-orange is still unfolding lower after completing Wave (3)-orange. The movement could extend toward the 38.2% Fibonacci retracement level. Wave A-grey has already finished, with Wave B-grey showing slight upward momentum.

Invalidation Point: 7.40

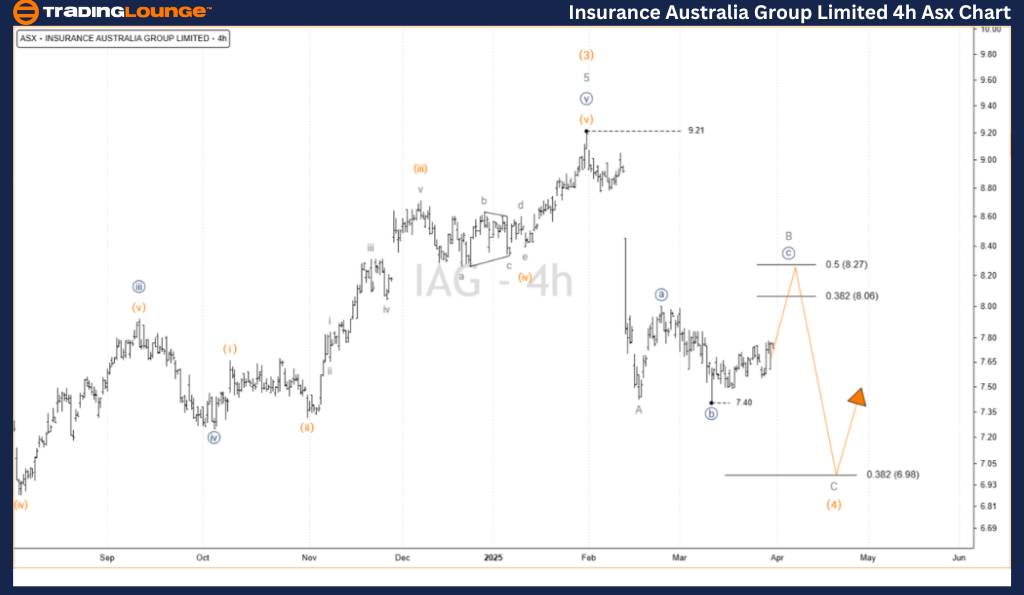

ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG Elliott Wave Technical Analysis | TradingLounge (4-Hour Chart)

Trend Function: Major trend (Intermediate degree, orange)

Mode: Motive

Wave Structure: Impulse

Current Position: Wave ((c))-navy of Wave B-grey

Details:

Wave B-grey appears to be developing as a Flat correction, labeled ((a))((b))((c))-navy. With ((B))-navy complete, Wave ((c))-navy is now advancing, targeting the price region between 8.063 and 8.271. A drop below 7.400 would invalidate this count and suggest the beginning of Wave C-grey.

Invalidation Point: 7.40

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEWS CORPORATION – NWS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This technical breakdown of ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG provides insights into the ongoing wave count and potential price movements. The analysis includes key validation and invalidation levels to support trading decisions. We aim to offer a concise, data-driven outlook aligned with Elliott Wave principles for ASX traders and investors.