Corn Elliott Wave Analysis: Unveiling the Next Major Move

Function - Trend

Mode - Impulsive

Structure - Impulse Wave

Position - Wave 2 in progress

Direction - Upwards for wave 3

Details - A break below 434 means wave 2 is taking a lower leg for an expanding flat and could enter 423-415. Not much has changed since the last update.

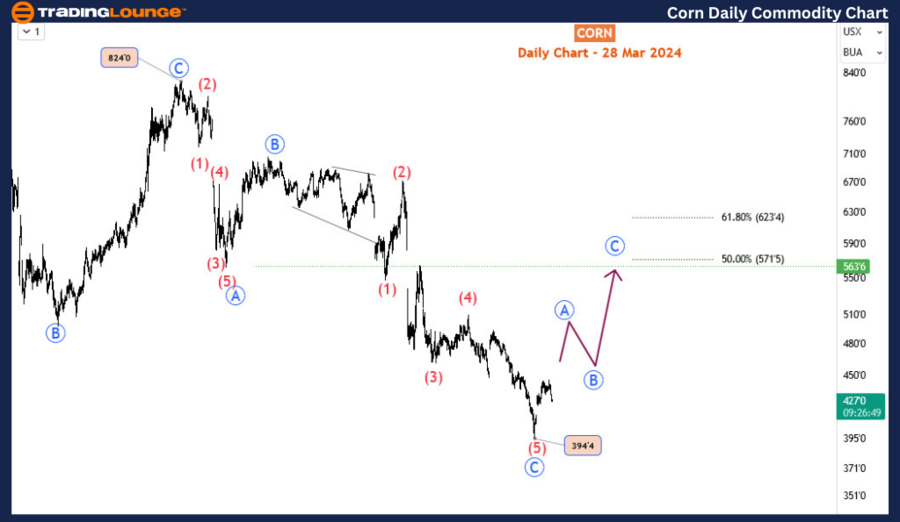

In the intricate world of commodities trading, particularly in the realm of corn prices, the Elliott wave theory offers a compelling lens through which we can analyze recent movements and anticipate future trends. As of the time of crafting this analysis, corn prices have embarked on a retracement journey following a notable surge of over 12% witnessed between the dates of 26 February 2024 and 12 March 2024. Presently hovering below the $430 mark, indications suggest a continuation of this pullback trajectory, potentially dipping below the $420 threshold. However, amidst this temporary setback, glimmers of optimism emerge from the shadows, hinting at a forthcoming resurgence echoing the momentum initiated on 26 February, when prices bottomed out at $394.

To fully grasp the potential trajectory of corn prices, let's delve into the historical context provided by the Elliott wave theory. In April 2022, corn traded at a robust $814, albeit falling slightly shy of its peak in 2012 at $846. From this pinnacle, the price embarked on a tumultuous descent, plummeting to $394—a staggering 52% decline within approximately 22 months. Within this tumultuous period, the market completed three distinct swings, painting a picture of either an impulse or a simple A-B-C pattern.

Should the former scenario hold, the completion of the third wave suggest a forthcoming minor bullish correction, potentially manifesting as the fourth wave? Conversely, in the latter scenario, a bullish correction remains probable, if not an outright impulse upside. In either case, the prevailing sentiment leans towards a bullish reaction, with the path of least resistance indicating at least a three-wave bounce. This sentiment gains traction with the inception of sub-waves within the broader blue wave A, emanating from the $394 low.

Corn Elliott Wave Analysis Trading Lounge 4-Hour Chart

Corn 4-Hour Chart Analysis:

Zooming into the H4 timeframe, we discern the intricate dance of waves unfolding before our eyes. The completion of wave 1 within the blue A wave sets the stage for the ongoing progression of wave 2, poised to carve its path within the 424-413 zone before pivoting upwards for wave 3. Uncertainties loom, as we await confirmation of wave 3's commencement, signalled by the breach of the $445 pinnacle.

In this tapestry of market dynamics, opportunities abound for astute traders poised to capitalize on the unfolding patterns. With the potential for blue wave A to ascend to lofty heights of $500, buying the dips will be the way to go. As we navigate the ebbs and flows of corn prices through the lens of Elliott wave analysis, we stand primed to seize the opportunities that lie ahead, armed with insights gleaned from a meticulous examination of market dynamics.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WTI Crudeoil

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.