ASX: WESTPAC BANKING CORPORATION – WBC Elliott Wave Technical Analysis TradingLounge (1D Chart)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with WESTPAC BANKING CORPORATION - WBC. Our recently updated forecast for NST in the Top 50 ASX Stocks service is still active. We have identified a long-term trading opportunity with WBC and are watching closely to provide the best Entry points.

ASX: WESTPAC BANKING CORPORATION – WBC Elliott Wave Technical Analysis

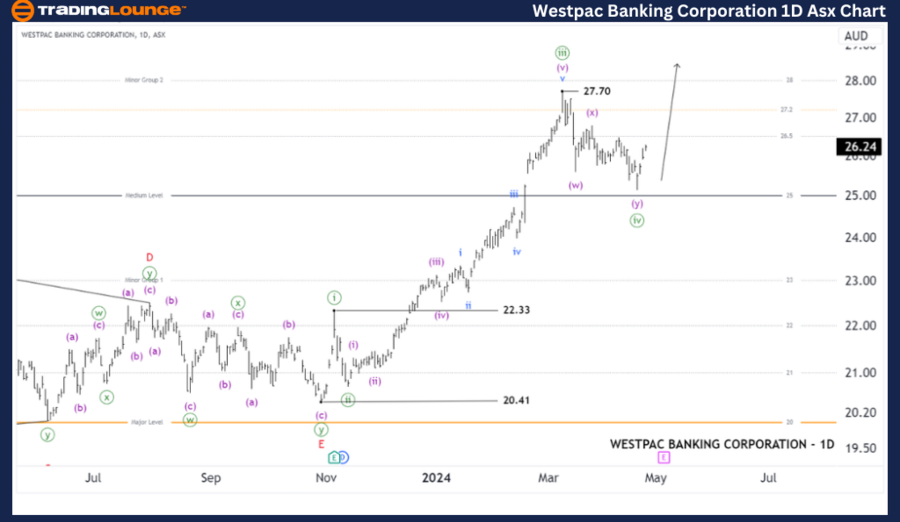

ASX: WESTPAC BANKING CORPORATION – WBC 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minute degree, green)

Mode: Motive

Structure: Impulse

Position: Wave ((v))-green

Details: The short-term outlook suggests that the ((iv))-green wave has concluded, and the ((v))-green wave is unfolding to push prices even higher. A price increase above the 26.5 - 27.2 range would be an initial step to enhance the likelihood of this perspective.

Invalidation point: 22.33

ASX: WESTPAC BANKING CORPORATION – TradingLounge (4-Hour Chart)

ASX: WESTPAC BANKING CORPORATION – WBC Elliott Wave Technical Analysis

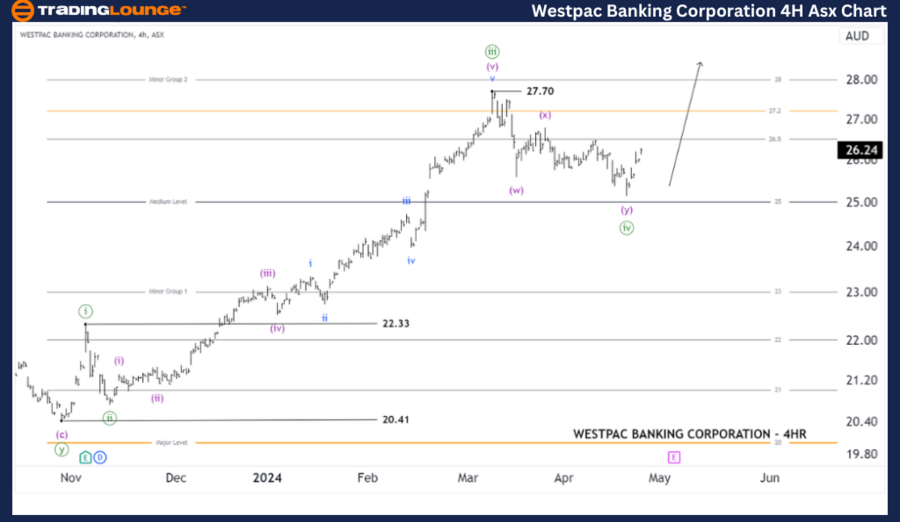

ASX: WESTPAC BANKING CORPORATION – WBC 4-Hour Chart Analysis

Function: Major trend (Minute degree, green)

Mode: Motive

Structure: Impulse

Position: Wave ((v))-green

Details: The shorter-term outlook suggests that the ((iii))-green wave has recently peaked, and the ((iv))-green wave has unfolded in the form of a Flat correction, with the ((iv))-wave likely completed. The ((v))-green wave is now unfolding to push prices higher. Breaking above the 26.5 level would be an initial step to strongly reinforce this perspective. We are closely monitoring WBC, and there will soon be a long-term trading opportunity with it.

Invalidation point: 22.33

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: COLES GROUP LIMITED. – COL Elliott Wave Technical Analysis

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: WESTPAC BANKING CORPORATION – WBC aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.