GX Uranium ETF Commodity Elliott Wave Analysis

The GX URA ETF (Global X Uranium ETF) tracks the performance of companies within the uranium industry. This ETF provides investors with a diversified portfolio that includes firms engaged in uranium mining, exploration, and production across the globe. As nuclear energy increasingly gains recognition as a cleaner power alternative, the demand for uranium is expected to grow, making the GX URA ETF an appealing option for investors seeking exposure to the sector's potential growth.

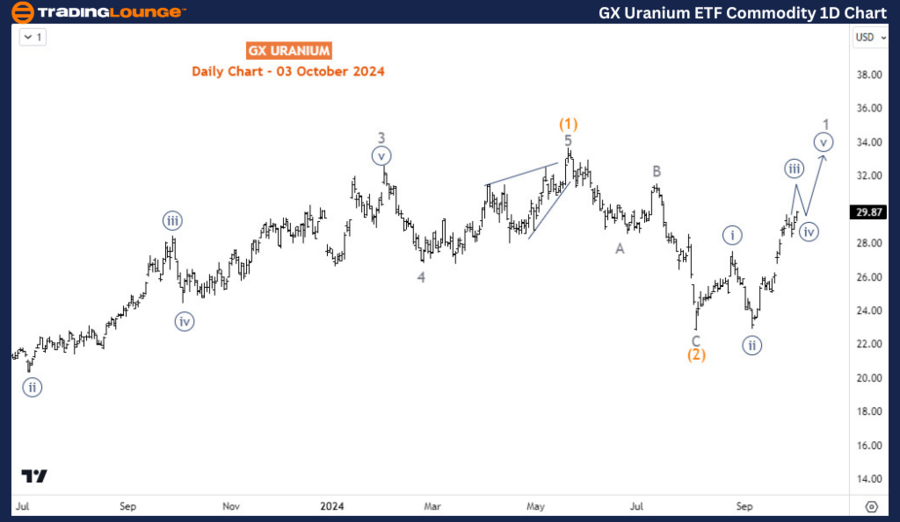

The price completed its bearish corrective cycle in August 2024, following a decline that started in May of the same year. After completing this cycle, the commodity rallied sharply, confirming a shift into a bullish phase. The current expectation is for the commodity to break above the May 2024 high, potentially reaching its highest price level in over a decade.

GX Uranium ETF Commodity Long-Term Analysis

From a long-term perspective, the GX URA ETF appears to be in a bullish corrective cycle. Between February 2011 and March 2020, the ETF consistently declined, creating lower lows and lower highs, resembling an impulse wave structure. Since the March 2020 low, the price has been correcting the long-term bearish trend.

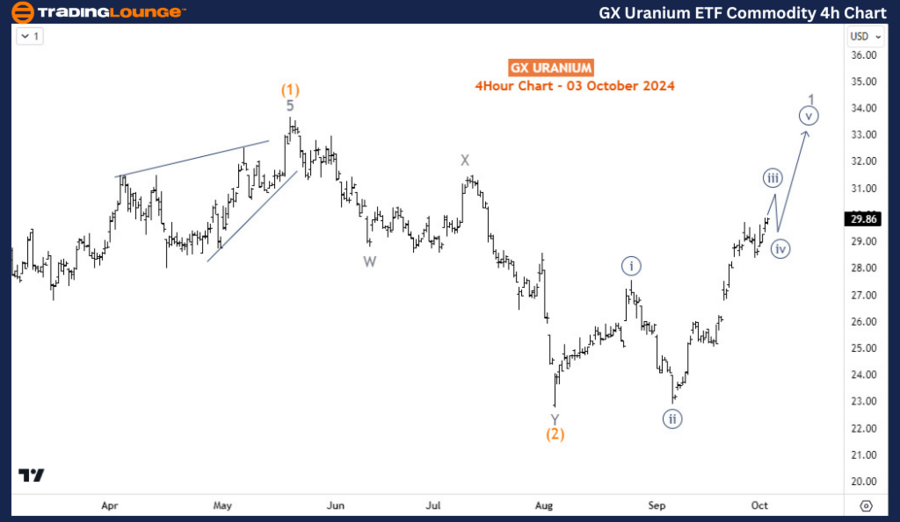

GX Uranium ETF Commodity H4 Chart Analysis

On the H4 chart, the price is currently within wave ((iii)) of 1 and may extend higher before experiencing a pullback for wave ((iv)), at which point buyers are expected to re-enter the market. Traders can look for buying opportunities during the dip, once wave ((iv)) or wave 2 completes in the near term.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Natural Gas Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support