Welcome to our comprehensive Elliott Wave analysis for MicroStrategy Inc. (MSTR) as of June 4, 2024. This detailed examination uses Elliott Wave Theory to analyze MSTR's price movements, helping traders identify potential trading opportunities based on current trends and market structures. We provide insights from both the daily and 4-hour charts to give a thorough understanding of MSTR's market behaviour.

MSTR Elliott Wave Analysis - Trading Lounge Daily Chart

MicroStrategy Inc. (MSTR) Daily Chart Analysis

MSTR Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 1

Direction: Top in Minor wave 1

Details: We are looking for a top in either Minor wave 1 or Intermediate wave (5).

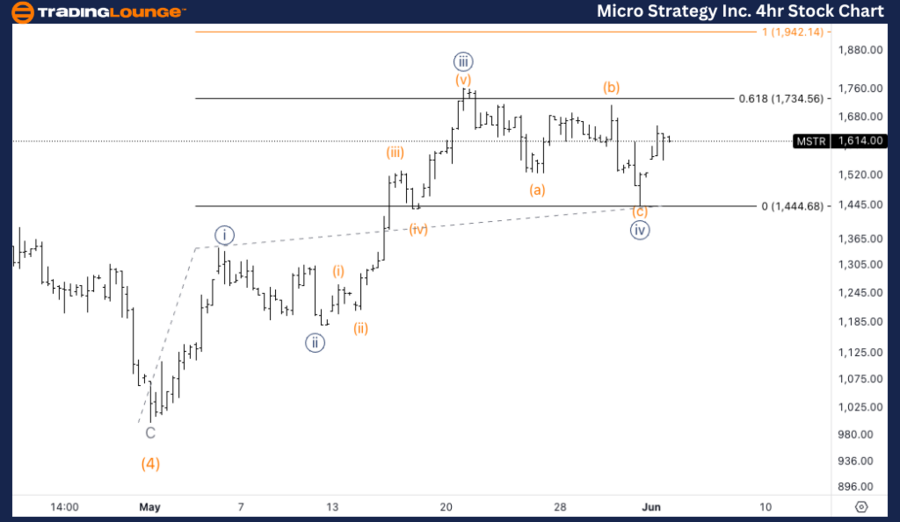

MSTR Elliott Wave Analysis - Trading Lounge 4-Hour Chart

MicroStrategy Inc. (MSTR) 4-Hour Chart Analysis

MSTR Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {v} of 5

Direction: Upside in wave {v}

Details: We anticipate an upside move into wave {v}, with confirmation at the break of the previous Minuette wave (b). The equality of wave {v} versus wave {i} is projected at $1940.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Exxon Mobil Inc. (XOM) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion:

Our Elliott Wave analysis for MicroStrategy Inc. (MSTR) as of June 4, 2024, provides traders with a thorough examination of MSTR's price movements and potential trading opportunities. By analyzing both the daily and 4-hour charts, we offer valuable insights into the current trends and market structures, helping traders make informed decisions. Keep an eye on the projected tops in Minor wave 1 and Intermediate wave (5), as well as the anticipated upside move in wave {v}, with key confirmation levels to watch. This comprehensive analysis aims to support your trading strategy and enhance your understanding of MSTR's market behavior.