Microsoft Corp., Elliott Wave Technical Analysis

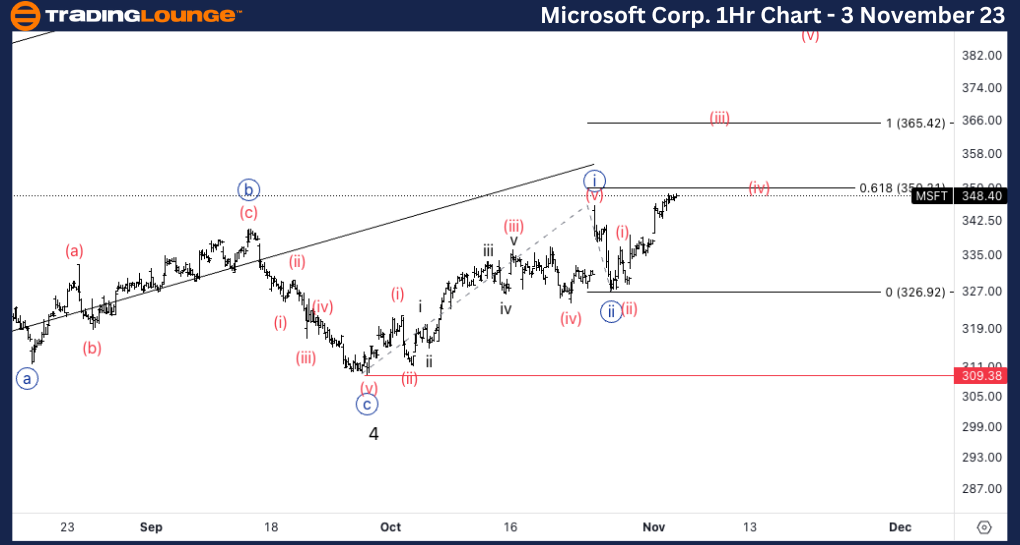

Microsoft Corp., (MSFT:NASDAQ): 4h Chart 3 November 23

MSFT Stock Market Analysis: We have been looking for upside resumption for a few days now. Looking for continuation higher into {iii} as we seemed to have found a bottom. If not we could still be in a sideways wave 4, nonetheless remaining in a corrective environment.

MSFT Elliott Wave Count: Wave {iii} of 5.

MSFT Technical Indicators: Above all averages.

MSFT Trading Strategy: Looking for upside into wave {iii} with invalidation at 309$.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

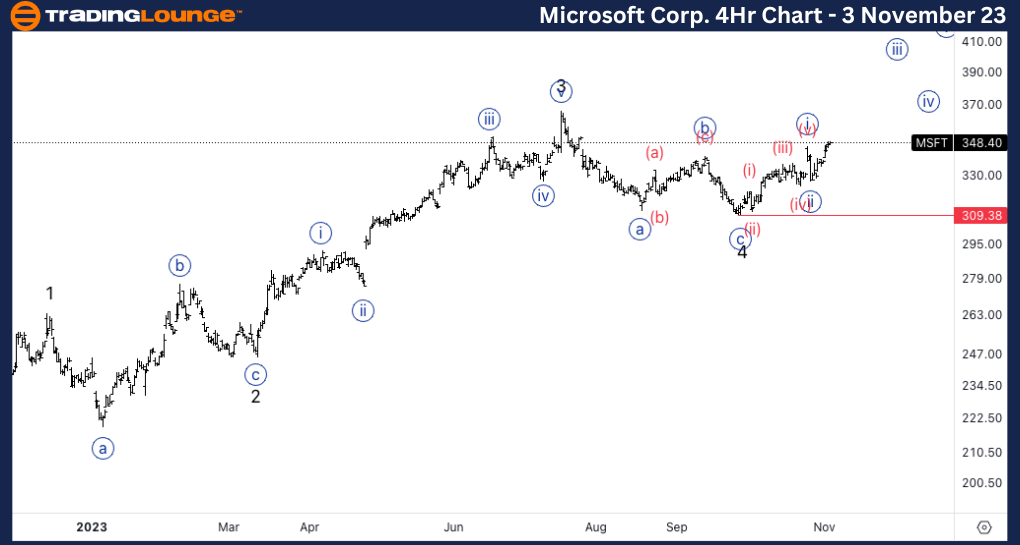

Microsoft Corp., MSFT: 1-hour Chart, 3 November 23

Microsoft Corp., Elliott Wave Technical Analysis

MSFT Stock Market Analysis: Looking for continuation higher to at least equality of {iii} vs. {i} at 365$. We could look for short term trades on the way up into wave {iii} as it unfolds.

MSFT Elliott Wave count: Wave (iii) of {iii}.

MSFT Technical Indicators: Above all averages.

MSFT Trading Strategy: Looking for longs on the way up into wave {iii}.