Elliott Wave Analysis for Costco Wholesale Corp. (COST) - July 30, 2024

Welcome to our comprehensive Elliott Wave analysis for Costco Wholesale Corp. (COST) as of July 30, 2024. This analysis explores COST's price movements using Elliott Wave Theory, highlighting potential trading opportunities based on current trends and market structure. We examine both daily and 4-hour charts to provide a detailed view of COST's market dynamics.

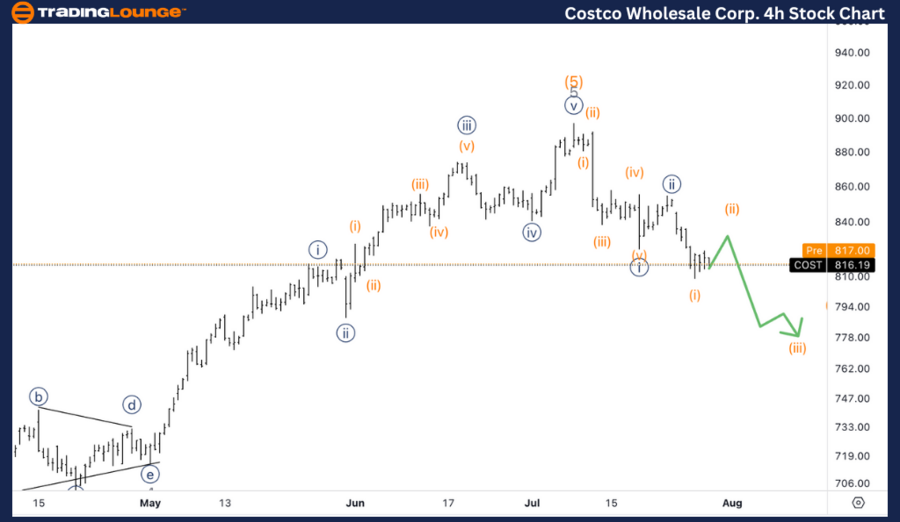

COST Elliott Wave Analysis - Daily Chart

Costco Wholesale Corp. (COST) Daily Chart Analysis

COST Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: ZigZag

Position: Wave A

Direction: Downside into Wave A

We are observing the end of a significant bull run in COST. The analysis indicates a potential retracement towards the area of the previous Minor Wave 4. This suggests more downside movement is expected in the coming weeks, aligning with a corrective pattern unfolding.

COST Technical Analysis - Daily Chart

The daily chart signals that COST might have concluded a major bullish phase. The anticipated movement is downward, likely reaching the previous Minor Wave 4 area. This ongoing correction implies further declines may occur before a potential market reversal.

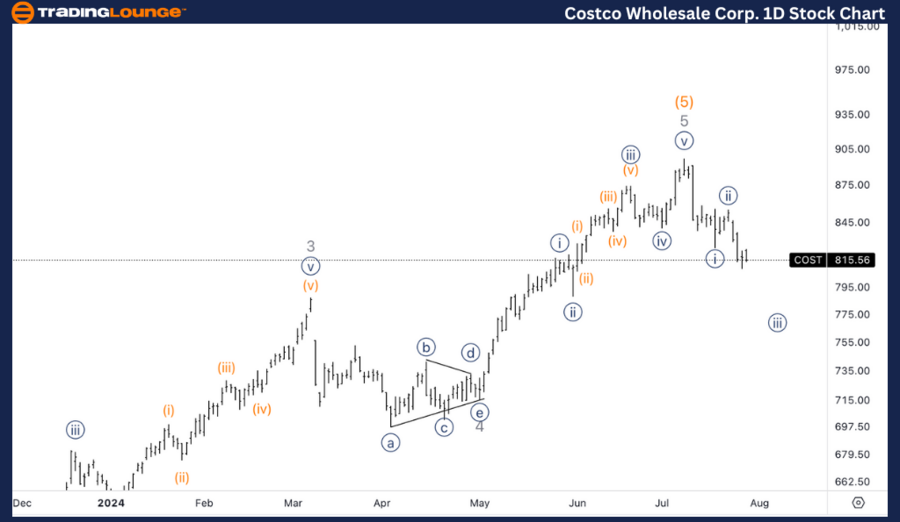

Tradinglounge COST Elliott Wave Analysis - 4H Chart

Costco Wholesale Corp. (COST) 4H Chart Analysis

COST Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: ZigZag

Position: Wave {iii} of A

Direction: Downside in Wave {iii}

The 4-hour chart presents a clear five-wave pattern leading into wave {i}, followed by a corrective phase and a continuation downward into wave {iii}. This pattern suggests the movement is part of a larger corrective phase. Even if a short-term three-wave correction occurs, the overall trend remains downward.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: JP Morgan & Chase Co. (JPM) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support