TradingLounge Coffee Commodity Elliott Wave Analysis

Coffee Elliott Wave Technical Analysis

Coffee prices are starting to shift lower after forming a key technical pattern. Since October 2023, coffee has been in a strong uptrend, but a corrective decline now seems likely before the next upward movement continues. This analysis discusses the potential for a pullback and identifies important levels where the next bullish leg could emerge.

Long-Term Chart Analysis

Coffee prices have historically traded within a broad range, with support between $40 and $55 and resistance from $276 to $337. The current bullish cycle for coffee began in May 2019, marking the start of a significant upward trend. The first phase of this cycle peaked in February 2022 when prices hit significant highs. A corrective second phase followed, which ended with a low in January 2023. After this bottom, the third and ongoing phase of the bullish cycle began, evolving within a larger corrective pattern, consistent with the broader Elliott Wave structure.

The current price action suggests that this third phase is developing as a corrective wave within a larger impulse that began in 2019. While further gains may occur, a substantial pullback is anticipated before the next upward leg continues.

Coffee Commodity Daily Chart Analysis

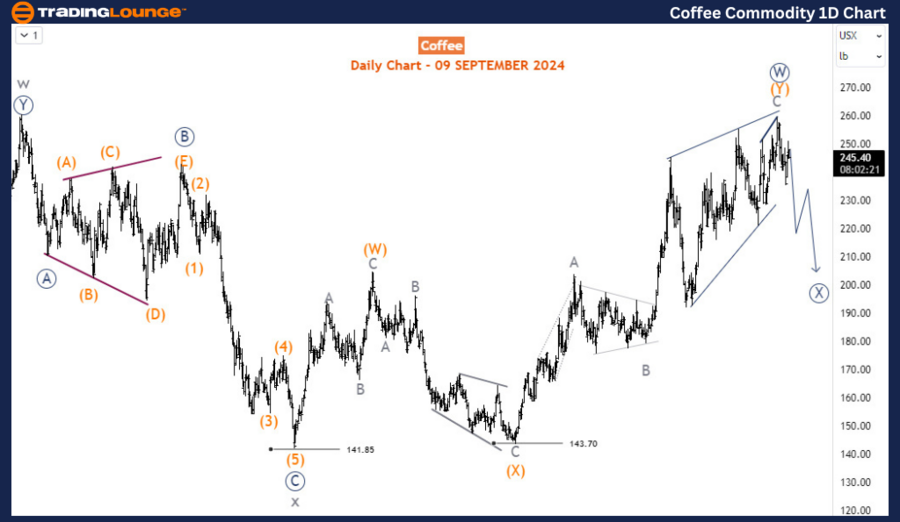

On the daily chart, the third phase of the recovery completed its first leg, wave (W), in April 2023. This was followed by a three-wave corrective structure, wave (X), which ended at 143.70 in October 2023, establishing support at that level. The next rally, representing wave (Y) of the primary degree wave W (circled), completed the bullish phase.

Wave (Y) of W (circled) appears to have formed an ending diagonal, signaling the exhaustion of the uptrend. With this structure likely completed, a corrective pullback in wave X (circled) is expected. This correction could unfold as a double zigzag, a complex pattern that typically suggests further downside before the uptrend resumes.

Coffee Commodity H4 Chart Analysis

On the H4 chart, wave (Y) of W (circled) has finished a diagonal pattern, indicating that the rally is losing momentum. The immediate decline can be identified as wave W of (W) of Y (circled), the first phase of the larger corrective structure. A bounce in wave X is expected but is likely to remain below the August 2024 high. Once this bounce completes, another decline in wave Y of (W) is likely, concluding the initial correction phase.

In summary, while the long-term trend for coffee remains bullish, the market is currently undergoing a bearish retracement that could continue in the coming weeks. This corrective phase will likely persist as long as the August 2024 high remains unbroken, offering traders a chance to reevaluate positions before the next major rally.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver (XAGUSD) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support