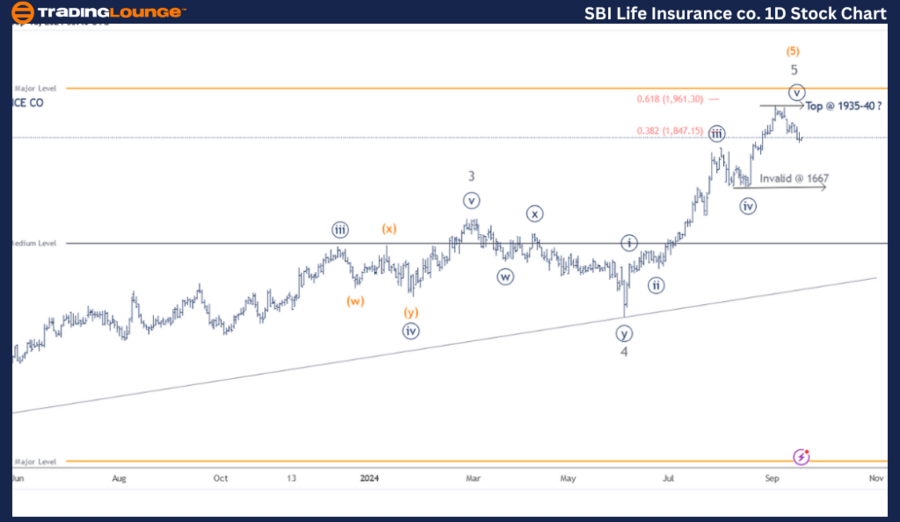

SBI Life Insurance Co – SBILIFE (1D Chart) Elliott Wave Technical Analysis

SBILIFE Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Navy

Details: Minute Wave ((v)) appears to have completed near 1940 or could terminate soon within Minor Wave 5 Grey of Intermediate Wave (5) Orange. Traders are advised to book profits as prices have begun to move lower.

Invalidation Point: 1667

SBI Life Insurance Co Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart for SBI Life Insurance Co shows an upward impulse wave formation from March 2023 to present, reaching highs between 1935-1940. There is a strong probability that the fifth wave has completed across multiple degrees. If this is correct, a larger degree corrective wave may soon begin, potentially moving against the 1940 resistance level.

The stock completed Intermediate Wave (4) Orange near the 1060-1065 range in March 2023. Since then, prices have rallied, reaching the 1935-1940 highs, and subdividing into five distinct waves. Notably, Minute Wave ((v)) of Minor Wave 5 Grey could either be complete or nearing completion around the 1960-1965 level.

The Fibonacci 0.618 extension from Wave 1 through Wave 3 was narrowly missed, meaning bulls may attempt another push higher. Alternatively, a break below 1667 would signal the top is in place and that bears are back in control.

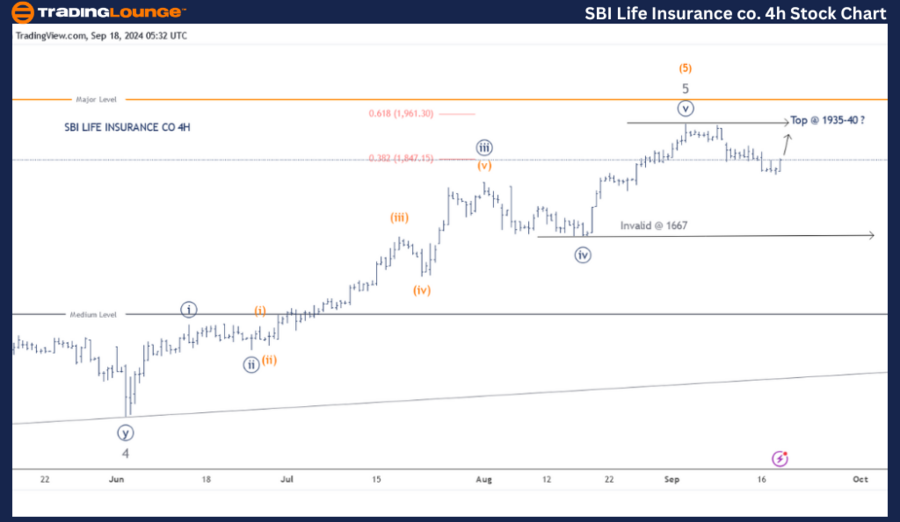

SBI Life Insurance Co – SBILIFE (4H Chart) Elliott Wave Technical Analysis

SBILIFE Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Navy

Details: Minute Wave ((v)) seems to have completed near 1940 or could be terminating soon within Minor Wave 5 Grey of Intermediate Wave (5) Orange. Subwaves within Wave ((v)) are not fully clear yet, and prices may still create a shallow high around 1960 before reversing.

Invalidation Point: 1667

SBI Life Insurance Co 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4-hour chart for SBI Life Insurance Co highlights the subwaves following Minor Wave 4 Grey, which completed around 1311 on June 4, 2024, similar to other stocks. Minute Wave ((iii)) was extended, and Wave ((iv)) was a flat correction. The subwaves within Minute Wave ((v)) remain unclear, leaving the possibility open for a retest of the 1940 level. However, 1667 remains a critical level to watch.

Conclusion

SBI Life Insurance Co may have completed its Intermediate Wave (5) Orange near the 1935-1940 range, or it could be approaching completion soon. A break below 1667 will confirm the completion.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: HINDALCO Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support