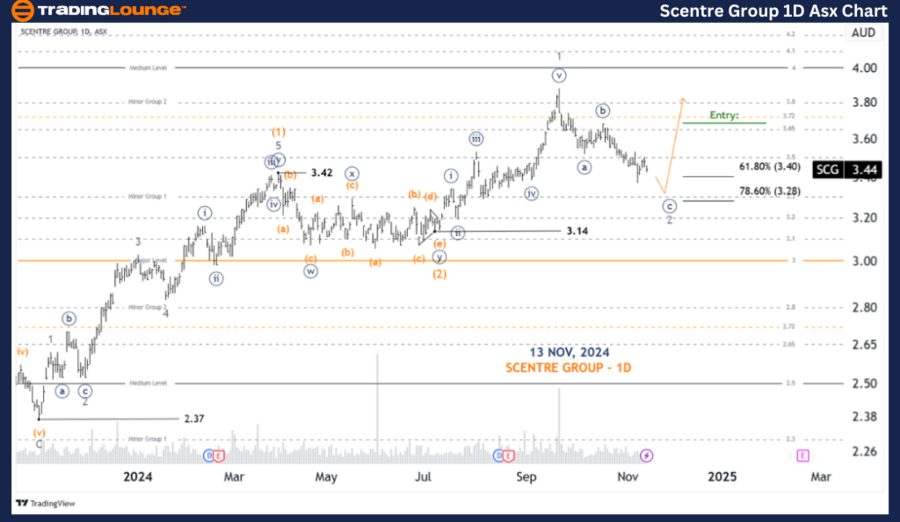

ASX: SCENTRE GROUP – SCG Elliott Wave Analysis TradingLounge Day Chart

Greetings! In today’s Elliott Wave analysis, we focus on SCENTRE GROUP (SCG) listed on the Australian Stock Exchange (ASX). Our study suggests a potential bullish market scenario developing in Wave 3-grey for SCG.ASX. However, further confirmation is required before the pattern unfolds completely.

ASX: SCENTRE GROUP – SCG 1D Chart (Semilog Scale) Analysis

SCG Elliott Wave Technical Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave 2-grey of Wave (3)-orange

Details: Wave 1-grey has completed, and Wave 2-grey is in progress, expected to push lower. A possible target range is between 3.40 and 3.28. If the price falls below 3.14, it will necessitate a reevaluation of the wave structure. On the other hand, if the price moves above the end of Wave ((b))-navy, it indicates the beginning of Wave 3-grey.

Invalidation Point: 3.14

ASX: SCENTRE GROUP – SCG 4-Hour Chart Analysis

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave ((c))-navy of Wave 2-grey

Details:

Wave 2-grey is unfolding as a Zigzag labeled ((a))((b))((c))-navy. Currently, Wave ((c))-navy is extending lower. A break below 3.28 would confirm increased bearish pressure and demand reassessment. Conversely, a move above Wave ((b))-navy suggests that Wave 3-grey is ready to take shape.

Invalidation Point: 3.14

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: QBE INSURANCE GROUP LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: SCENTRE GROUP – SCG provides actionable insights into ongoing trends and key price levels. The identified validation and invalidation points serve as crucial indicators for confirming our wave counts and their implications for market movements. These details offer traders and investors a professional framework to navigate market opportunities effectively.