MSTR Elliott Wave Analysis | MicroStrategy Inc. (MSTR) Stock Forecast

This analysis examines the current price action of MicroStrategy Inc. (MSTR) using Elliott Wave Theory across both the daily and 1-hour charts. Below is a detailed outlook on the stock's positioning and potential price movements.

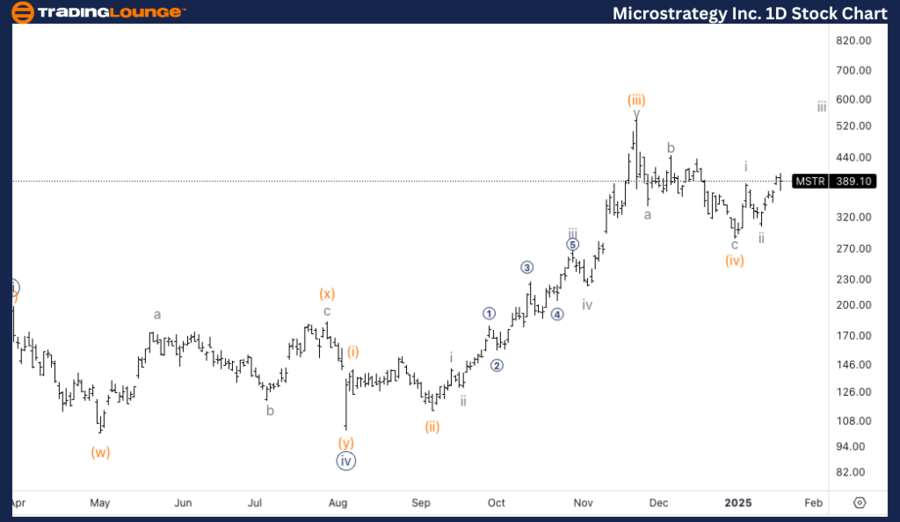

MSTR Elliott Wave Analysis | Trading Lounge Daily Chart

MicroStrategy Inc. (MSTR) Daily Chart Analysis

MSTR Elliott Wave Technical Analysis

- Function: Trend

- Mode: Impulsive

- Structure: Motive

- Position: Wave (v) of {v}

- Direction: Uptrend in wave (v)

- Details: Upside momentum is expected as the stock advances into wave iii of (v), approaching the key Trading Level 5 at $500.

MSTR Elliott Wave Technical Analysis – Daily Chart Breakdown

MicroStrategy (MSTR) continues to exhibit strong bullish momentum, advancing within wave iii of (v). Upside price targets are set near the critical Trading Level 5 at $500, which serves as an important psychological and technical resistance level. The current impulsive Elliott Wave pattern suggests the potential for further gains, reinforcing a positive outlook for investors.

Key Takeaways:

- Watch for potential resistance around $500, a significant trading level.

- Sustained bullish movement could pave the way for higher targets beyond $500.

- Strong trading volume and price action confirmations are essential for further rally validation.

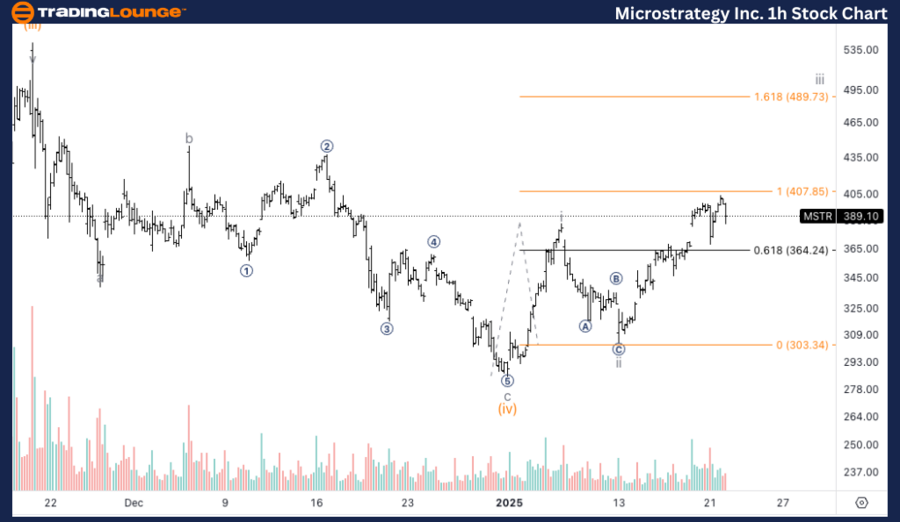

MicroStrategy Inc. (MSTR) 1-Hour Chart Analysis

MSTR Elliott Wave Technical Analysis

- Function: Trend

- Mode: Impulsive

- Structure: Motive

- Position: Wave iii of (v)

- Direction: Uptrend in wave iii

- Details: Further upside potential as wave iii nears equality with wave i, a possible resistance point that could trigger a corrective pullback.

MSTR Elliott Wave Technical Analysis – 1H Chart Breakdown

MicroStrategy (MSTR) is expected to maintain its upward trajectory, progressing within wave iii of (v). The next critical resistance level aligns with the equality of wave iii vs. wave i, which could act as a hurdle for further growth. A failure to break this level could result in a double correction, leading to temporary consolidation before resuming the uptrend.

Key Takeaways:

- Monitor resistance at wave iii vs. wave i equality for potential price reactions.

- Failure to break through resistance may trigger a corrective pullback, offering buying opportunities.

- Investors should observe volume trends to confirm the stock’s strength in continuation patterns.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Netflix Inc. (NFLX) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

The Elliott Wave Analysis of MicroStrategy (MSTR) indicates a prevailing bullish trend across both daily and intraday charts. As the stock approaches critical resistance levels, traders should remain vigilant for potential breakouts or corrective moves. The key focus remains on the $500 level in the daily chart and the wave equality resistance in the 1-hour chart.

SEO Keywords:

MicroStrategy stock forecast, MSTR Elliott Wave analysis, MSTR stock price prediction, MicroStrategy technical analysis, Elliott Wave trading strategy, stock market trends, MSTR price target.