Exxon Mobil Inc., Elliott Wave Technical Analysis

Exxon Mobil Inc., (XOM:NYSE): 4h Chart 9 January 24

XOM Stock Market Analysis: As we are trading around a Major level-100$- we need to be mindful, there is a possibility we have five waves off the bottom in a leading diagonal and we could now be correcting in wave {ii}.

XOM Elliott Wave Count: Wave {ii} of 1.

XOM Technical Indicators: Below all averages.

XOM Trading Strategy: Looking for longs after a Trading Level Pattern on 100$ and a break of (b).

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

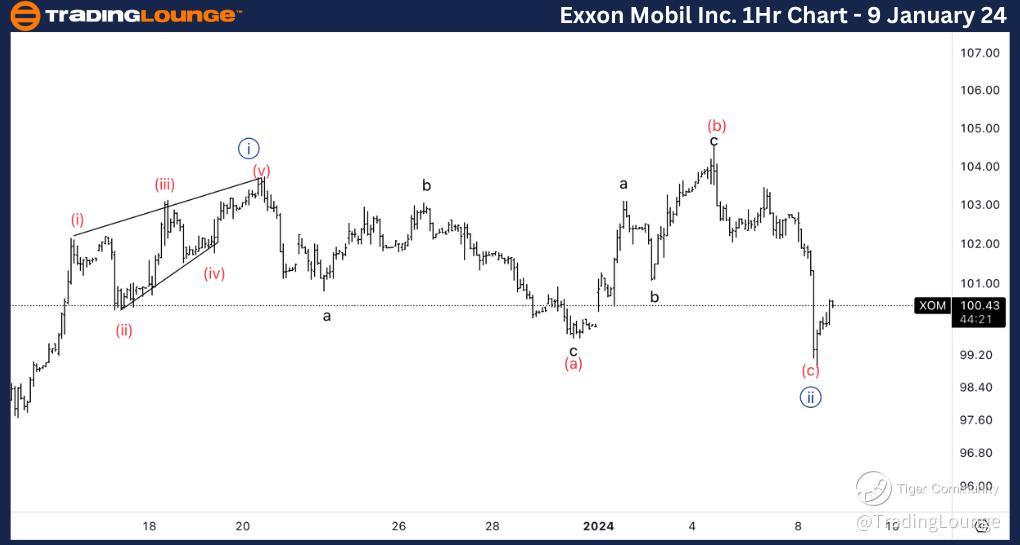

Exxon Mobil Inc., XOM: 1-hour Chart 9 January 24

Exxon Mobil Inc., Elliott Wave Technical Analysis

XOM Stock Market Analysis: Looking for a potential bottom in place in wave (c) knowing we could still continue lower as we seem to be missing a fifth wave. Looking for a break of (b) before considering longs.

XOM Elliott Wave count: Wave (i) of {i}.

XOM Technical Indicators: Below all averages.

XOM Trading Strategy: Looking for longs after a Trading Level Pattern on 100$ and a break of (b).