JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis TradingLounge

Introduction

Our latest Elliott Wave analysis provides an updated outlook on the Australian Stock Exchange (ASX), with a specific focus on JAMES HARDIE INDUSTRIES PLC (JHX).

Current market conditions suggest that ASX:JHX shares may continue their downtrend in the medium term. Given the prevailing risks, traders should exercise caution when considering a long strategy. This analysis highlights critical price levels and market trends, offering a structured and data-driven approach to forecasting.

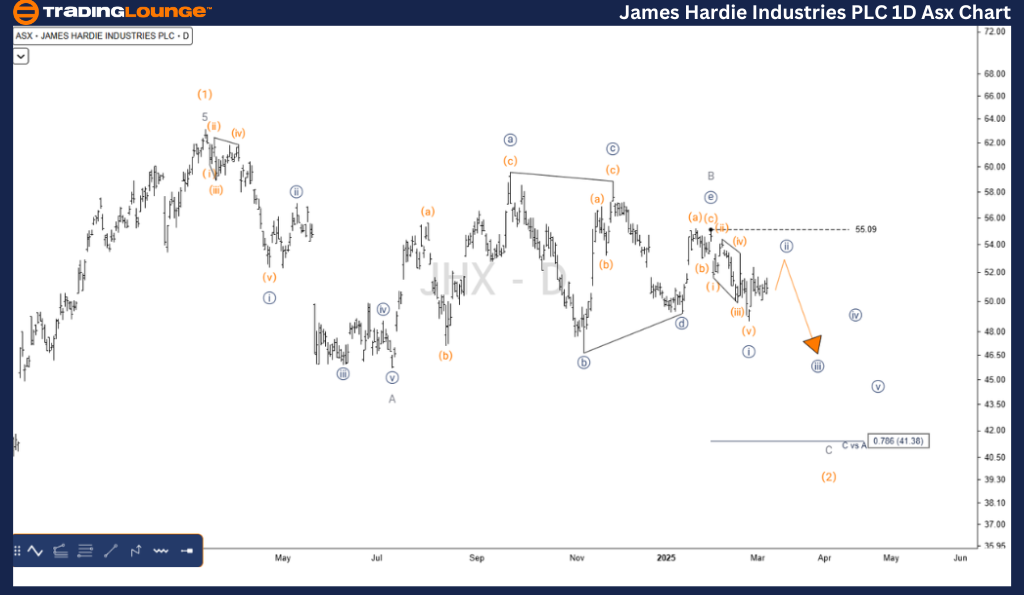

JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis - 1D Chart

JHX Elliott Wave Technical Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave C - Grey of Wave (2) - Orange

Key Insights:

- Wave (2) - Orange is still developing as a Zigzag and may not yet be complete.

- Recent price action suggests a sideways movement, forming a Triangle labeled Wave B - Grey.

- This Triangle pattern has recently concluded, opening the way for Wave C - Grey to move lower, potentially breaking the 49.16 USD level, confirming the bearish outlook.

Key Price Levels:

- Invalidation Point: 55.09 USD

- Key Support Level: 49.16 USD

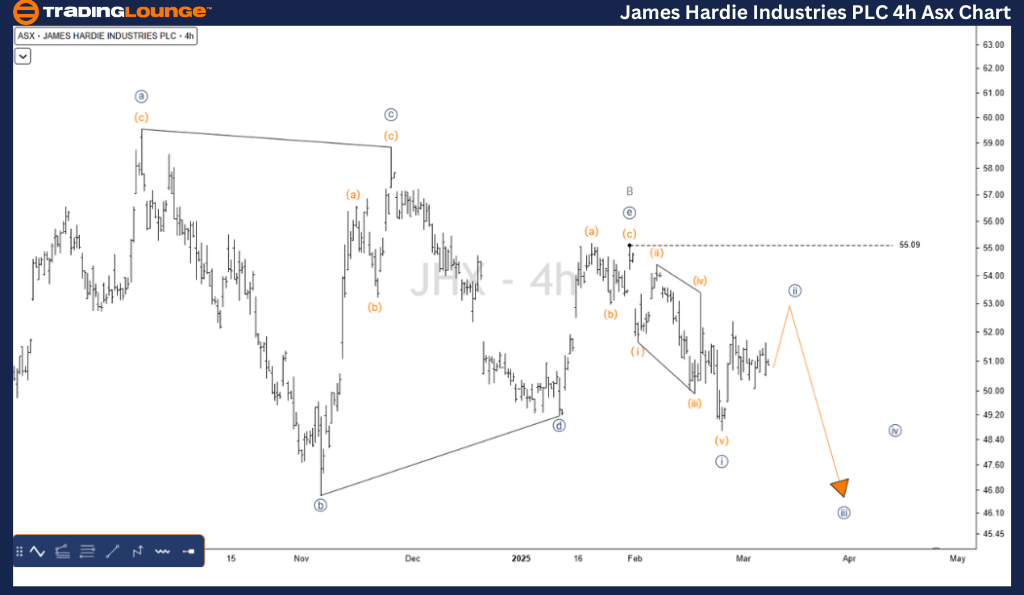

JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis - 4-Hour Chart

JHX Elliott Wave Technical Analysis

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((ii)) - Navy of Wave C - Grey of Wave (2) - Orange

Key Insights:

- A closer analysis shows that Wave ((e)) - Navy of Wave B - Grey has recently completed a three-wave Zigzag, peaking at 55.09 USD.

- Market behavior indicates a bearish sentiment, suggesting that further downward movement is highly likely.

Key Price Levels:

- Invalidation Point: 55.09 USD

- Key Support Level: 49.16 USD

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NEWMONT CORPORATION (NEM) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis of JAMES HARDIE INDUSTRIES PLC (JHX) provides valuable insights into market trends and potential trading opportunities. By identifying validation and invalidation price points, traders can confidently approach Elliott Wave projections. This structured methodology ensures an objective and professional perspective on market movements, enabling traders to make informed decisions.