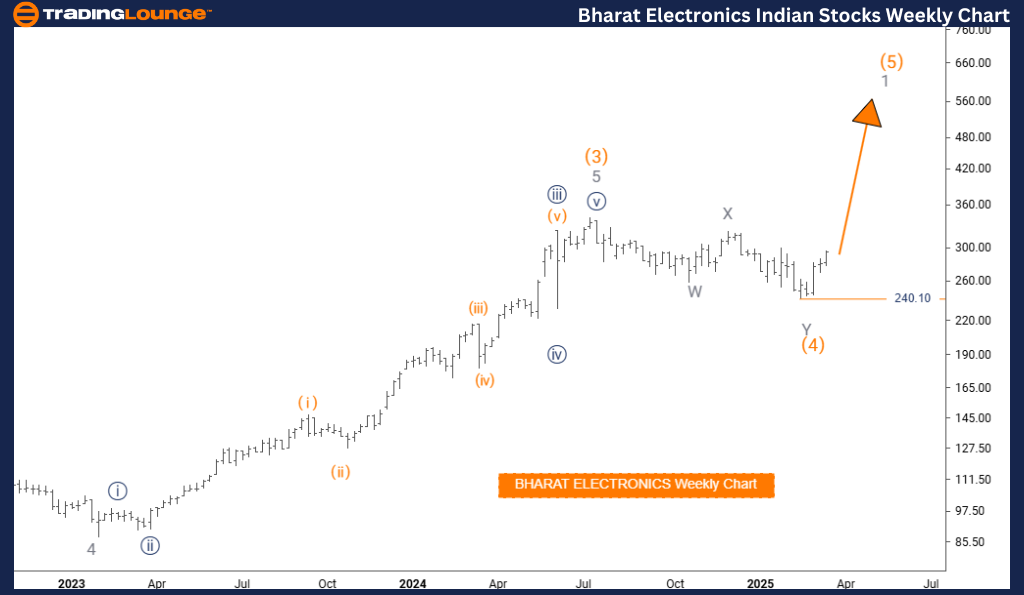

Bharat Electronics Elliott Wave Analysis – Trading Lounge Daily Chart

Bharat Electronics Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 1

Next Lower Degree Direction: Navy Blue Wave 2

Wave Cancellation Level: 240.10

Analysis Details

The Bharat Electronics Elliott Wave Analysis on the daily chart confirms a bullish trend, with the market currently in an impulsive phase, showcasing strong upward momentum.

- The primary wave structure under observation is Navy Blue Wave 1, forming part of a larger wave cycle.

- This Navy Blue Wave 1 is positioned within Gray Wave 1, validating its placement in the broader Elliott Wave framework.

- The previous corrective phase (Orange Wave 4) appears to be completed, enabling the market to transition into Navy Blue Wave 1 of Gray Wave 1.

- This phase marks the beginning of a new upward movement, signaling further gains before an anticipated corrective phase in Navy Blue Wave 2.

- A critical invalidation point is set at 240.10—if the price falls below this level, the current wave structure becomes invalid, necessitating a reassessment of trading strategies.

Trading Considerations

- Traders should monitor key price levels and prepare for potential corrections once Navy Blue Wave 1 completes.

- The bullish wave structure aligns with the broader Elliott Wave pattern, reinforcing expectations of continued market growth.

- Observing price movements and wave progressions will assist traders in making strategic, data-driven decisions based on prevailing market conditions.

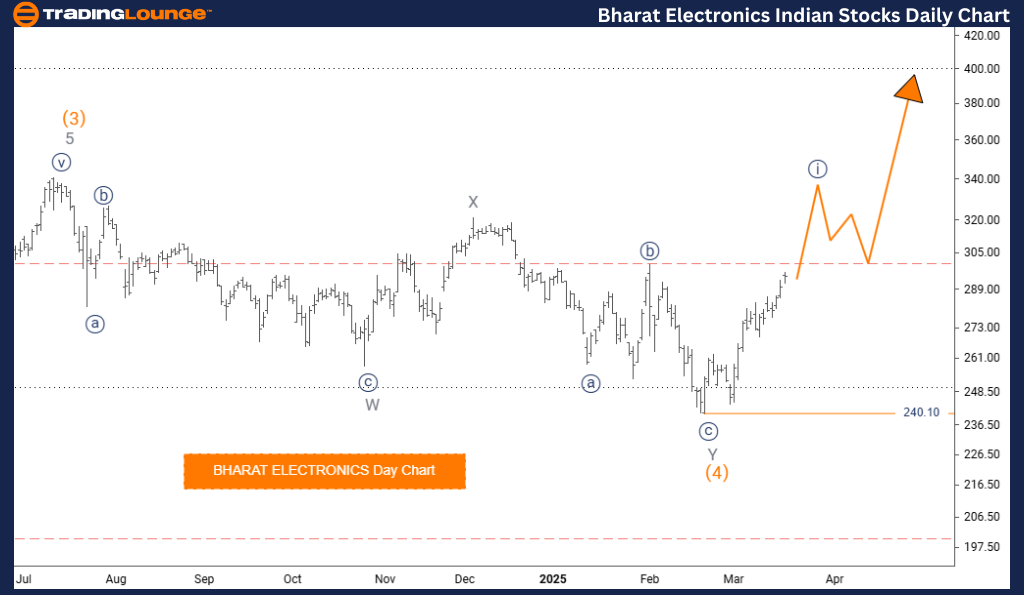

Bharat Electronics Elliott Wave Analysis – Trading Lounge Weekly Chart

Bharat Electronics Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Gray Wave 1

Position: Orange Wave 5

Next Higher Degree Direction: Gray Wave 1

Wave Cancellation Level: 240.10

Analysis Details

The Bharat Electronics Elliott Wave Analysis on the weekly chart reflects a bullish trend, with the market currently in an impulsive phase, exhibiting strong upward momentum.

- The primary wave structure in focus is Gray Wave 1, forming part of a larger wave cycle.

- This Gray Wave 1 is positioned within Orange Wave 5, confirming its placement in the broader Elliott Wave structure.

- The previous corrective phase (Orange Wave 4) appears completed, allowing the market to advance into Gray Wave 1 of Wave 5.

- This phase signifies the beginning of a new upward trend, suggesting potential gains before an expected corrective phase in lower-degree waves.

- A key invalidation level is set at 240.10—if the price drops below this threshold, the current wave structure will be invalidated, requiring traders to reassess their market approach.

Trading Considerations

- Traders should keep an eye on critical price levels and anticipate possible corrections upon the completion of Gray Wave 1.

- The bullish wave formation is consistent with the broader Elliott Wave pattern, supporting the expectation of sustained market growth.

- By closely tracking price fluctuations and wave progressions, traders can make well-informed trading decisions in line with current market conditions.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous:Mahindra & Mahindra Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support