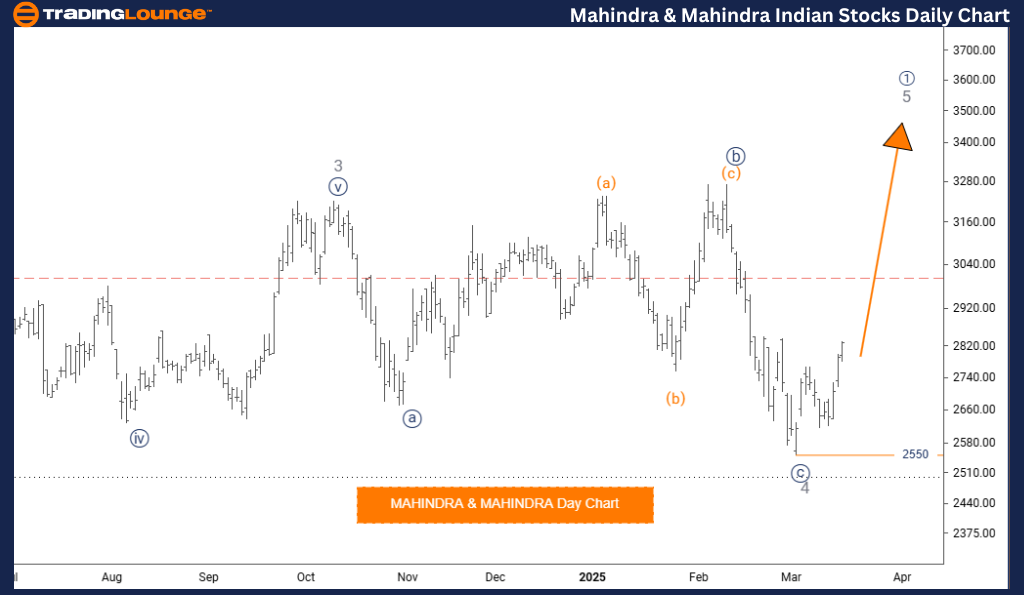

Mahindra & Mahindra Elliott Wave Analysis – Trading Lounge Day Chart

Mahindra & Mahindra Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 5

Direction Next Lower Degree: Navy Blue Wave 2

Wave Cancel Invalidation Level: 2550

Analysis Overview

The Mahindra & Mahindra Elliott Wave Analysis on the daily chart provides a detailed outlook on the stock's price trend and potential future movements.

- The stock is in a bullish trend, characterized by impulsive rather than corrective price action.

- The primary wave under observation is Navy Blue Wave 1, forming part of a larger wave within Gray Wave 5.

- It is likely that Gray Wave 4 has concluded, and the market is transitioning into Navy Blue Wave 1 of 5.

- This wave is anticipated to be strong and directional, leading the market higher before the next significant correction.

- The next critical phase to monitor is Navy Blue Wave 2, expected to develop once Navy Blue Wave 1 completes.

Key Levels & Trading Considerations

If the stock price falls below this level, the current Elliott Wave count would be invalid, indicating a potential shift in trend.

Monitor Navy Blue Wave 1 as it progresses.

Be prepared for the potential start of Navy Blue Wave 2 once the current wave structure completes.

Trading Insights

This daily chart analysis offers a short-term perspective on Mahindra & Mahindra stock price action, helping traders make well-informed decisions.

- Recognizing wave formations and key price levels is essential for effective trading strategies.

- Identifying wave completions and new trend formations enables traders to anticipate market movements with better accuracy.

- A structured approach to market trends allows traders to align their strategies with short-term price fluctuations.

Conclusion

This Elliott Wave Analysis of Mahindra & Mahindra provides a comprehensive framework for traders seeking to interpret price action in a bullish market. By focusing on wave structures, trend transitions, and key price levels, traders can navigate market conditions with more confidence.

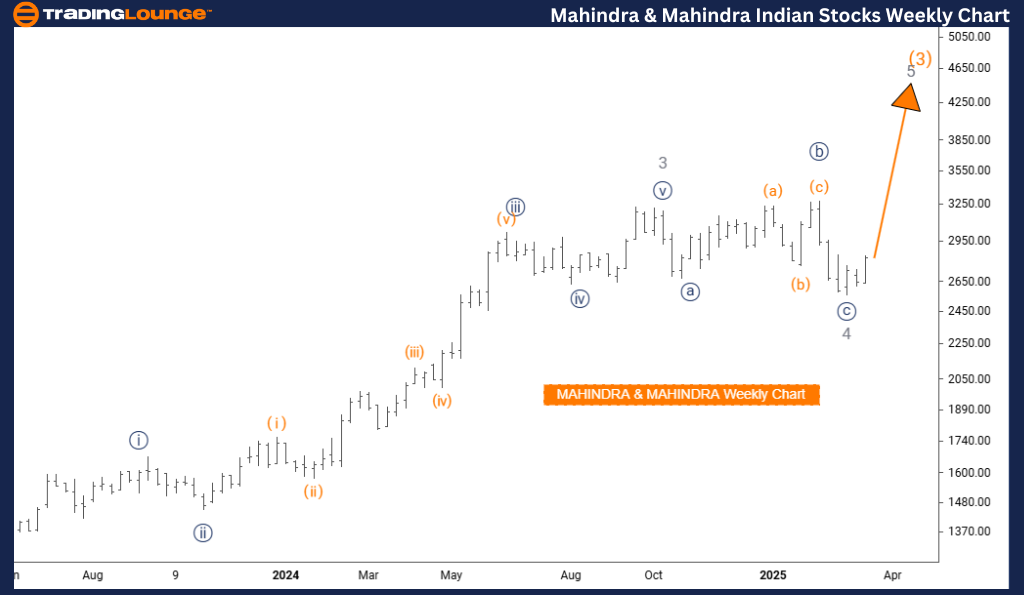

Mahindra & Mahindra Elliott Wave Analysis – Trading Lounge Weekly Chart

Mahindra & Mahindra Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Gray Wave 5

Position: Orange Wave 3

Direction Next Lower Degree: Gray Wave 5 (Started)

Analysis Overview

The Mahindra & Mahindra Elliott Wave Analysis for the weekly chart provides a long-term perspective on stock price movements and potential future trends.

- The market remains in a bullish phase, dominated by impulsive price movements instead of corrective actions.

- The primary wave in focus is Gray Wave 5, part of a larger wave structure within Orange Wave 3.

- Gray Wave 4 appears to have completed, with the market transitioning into Gray Wave 5.

- Gray Wave 5 is expected to continue its impulsive upward movement, possibly leading to new highs before a major trend shift.

- The next lower-degree wave to watch is Gray Wave 5, which has already commenced and is expected to extend higher.

Key Trading Considerations

- Monitor Gray Wave 5 as it progresses, as it will dictate the stock's long-term trend continuation.

- Prepare for further bullish momentum, ensuring alignment with the ongoing uptrend.

- Traders should focus on Elliott Wave structure analysis to make informed trading decisions.

Trading Insights

This weekly chart analysis offers traders a macro-level perspective on Mahindra & Mahindra stock movements.

- Understanding wave structures and trend formations is crucial for strategic decision-making.

- Recognizing wave completions and emerging trend shifts allows traders to anticipate market movements effectively.

- A long-term perspective helps traders align their investment strategies with broader market cycles.

Conclusion

This Elliott Wave Analysis of Mahindra & Mahindra presents a structured methodology for interpreting market trends and price movements. By leveraging wave structures, key price levels, and trend shifts, traders can make data-driven trading decisions with greater confidence.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous:HCL TECHNOLOGY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support