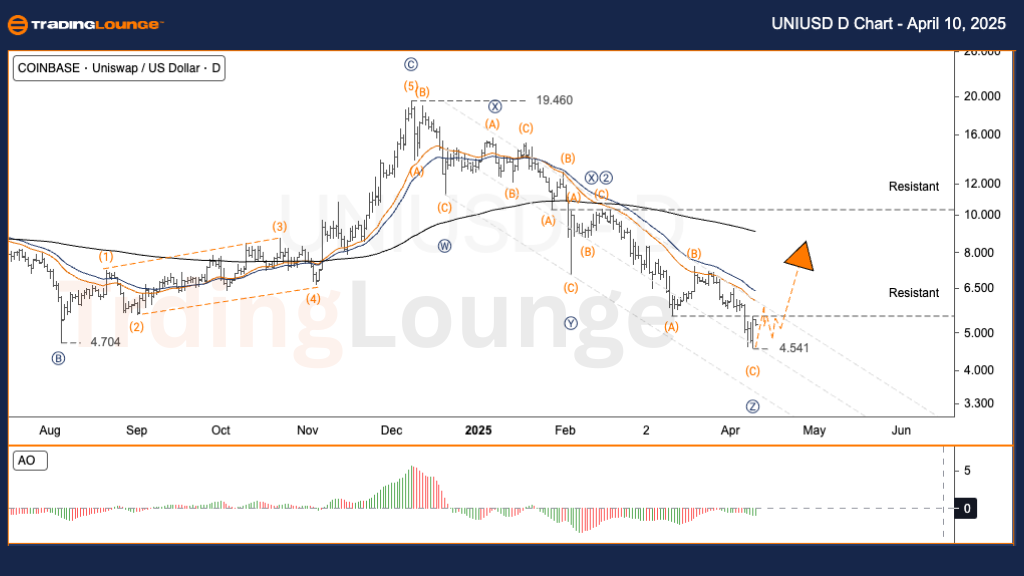

UNIUSD Elliott Wave Analysis – TradingLounge Daily Chart

Uniswap / U.S. Dollar (UNIUSD) – Crypto Market Forecast

UNIUSD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Next Direction (Higher Degree): Wave Z

Invalidation Level: Not specified

UNIUSD Trading Strategy – Daily Time Frame

Uniswap (UNIUSD) appears to have completed a complex W–X–Y–X–Z Elliott Wave correction, suggesting a potential bullish reversal. The final wave "Z" alongside the prior triangle “e” wave structure signals the possibility of a low forming between $4 and $5. This zone may now act as a key support base after the sharp decline from $19.46.

Trading Strategies

✅ Swing Trade Opportunity (Short-Term)

Watch for a breakout confirmation above the $6.50 to $7.00 resistance area with supporting volume.

Risk Management

Apply a stop-loss just below $4.70 to limit downside exposure and protect capital.

UNIUSD Elliott Wave Analysis – TradingLounge H4 Chart

Uniswap / U.S. Dollar (UNIUSD) – Crypto Trading Setup

UNIUSD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Next Direction (Higher Degree): Wave Z

Invalidation Level: Not specified

UNIUSD Trading Strategy – 4-Hour Time Frame

The H4 Elliott Wave count reinforces the view that the W–X–Y–X–Z corrective structure has likely ended. Price action suggests a bullish setup developing from the termination of wave "Z" and the triangle “e” pattern. Support remains firm around $4 to $5, after the drop from $19.46.

Trading Strategies

✅ Swing Trade Opportunity (Short-Term)

Monitor price action near $6.50–$7.00 for bullish confirmation or volume surge.

Risk Management

Use a tight stop-loss beneath $4.70 to manage risk effectively.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ETHUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support