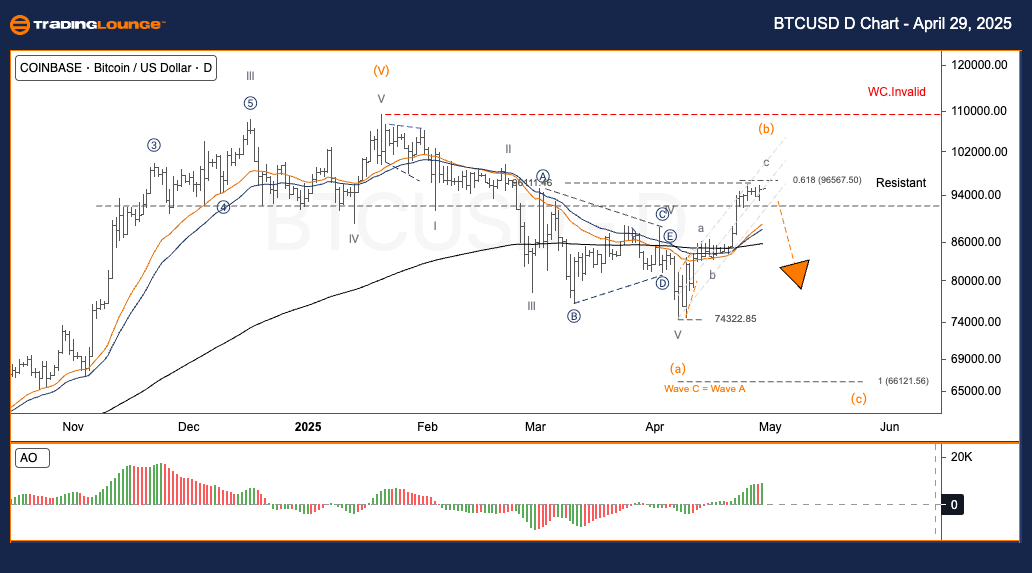

BTCUSD Elliott Wave Analysis – TradingLounge Daily Chart

Bitcoin / U.S. Dollar (BTCUSD) Daily Chart Analysis

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave C

Next Direction (Higher Degree): Wave (b)

Invalidation Level: (not specified)

Bitcoin / U.S. Dollar (BTCUSD) Daily Trading Strategy

BTCUSD has rebounded within a classic Elliott Wave a-b-c corrective structure, reaching the 0.618 Fibonacci resistance. Current price behavior reveals signs of exhaustion, indicating that wave (b) may be nearing completion. This positions BTCUSD for a potential decline into wave (c), aligning with typical zigzag corrective patterns seen in crypto markets.

Trading Strategies

Strategy:

- For Short-Term Traders (Swing Trade): If BTCUSD breaks below 90,817, it would signal the onset of wave (c), with downside targets near 74,322 or lower. This sets up a strong short opportunity in line with Elliott Wave projections.

- Risk Management: A move above 96,143, and especially a breakout past 109,427, would invalidate the current wave structure, requiring a fresh technical review.

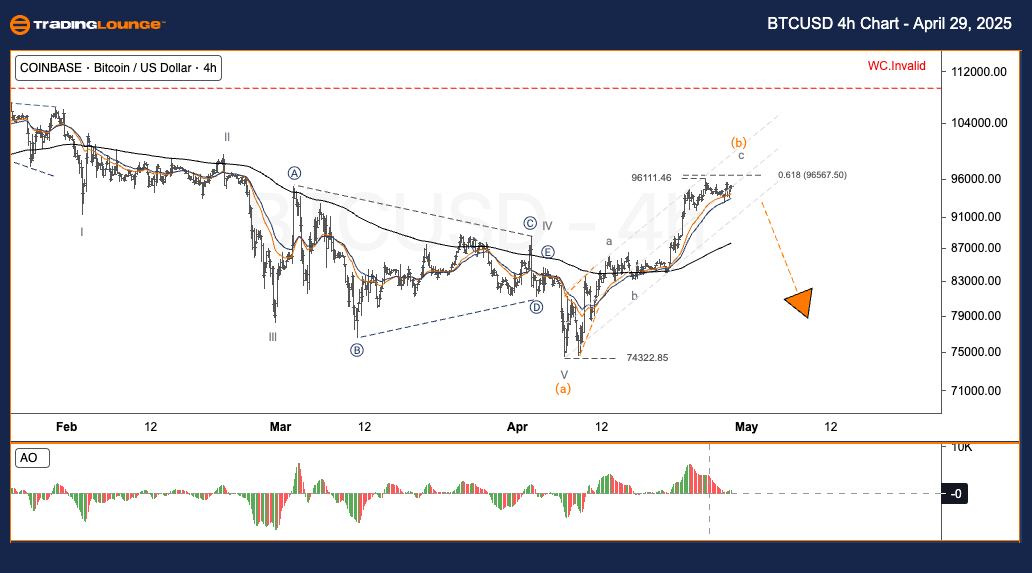

BTCUSD Elliott Wave Analysis – TradingLounge H4 Chart

Bitcoin / U.S. Dollar (BTCUSD) H4 Chart Analysis

BTCUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave C

Next Direction (Higher Degree): Wave (b)

Invalidation Level: (not specified)

Bitcoin / U.S. Dollar (BTCUSD) 4-Hour Trading Strategy

On the 4-hour timeframe, BTCUSD completed a sharp rebound inside a corrective a-b-c pattern and encountered resistance at the 0.618 Fibonacci level. Weakening momentum suggests that wave (b) is close to finalizing, increasing the probability of a wave (c) decline, a common development in crypto market corrections.

BTCUSD Trading Strategies

Strategy:

- For Short-Term Traders (Swing Trade): A decline below 90,817 would confirm the beginning of wave (c), targeting the 74,322 area or lower, offering a potential short trade setup.

- Risk Management: If BTCUSD rallies above 96,143 and continues through 109,427, the current Elliott Wave count is invalid, and new wave labeling must be considered.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: NEOUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support