ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG Elliott Wave Technical Analysis

Greetings,

Today’s Elliott Wave update focuses on the Australian Stock Exchange (ASX) stock, INSURANCE AUSTRALIA GROUP LIMITED (ASX:IAG).

Our latest technical analysis suggests that ASX:IAG is completing a B-grey corrective wave and preparing for another downward move. Currently, there are no confirmed bullish signals, making long trade setups high-risk at this stage.

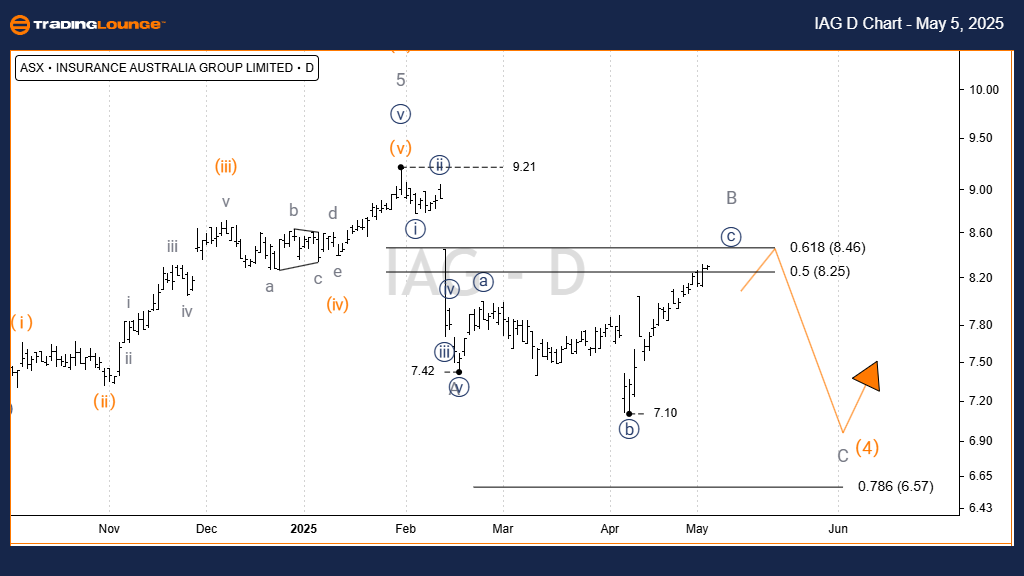

ASX: IAG Elliott Wave Analysis (1D Chart – Semilog Scale)

ASX: INSURANCE AUSTRALIA GROUP LIMITED Day Chart analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave c)) - navy of Wave B - grey

Details: Wave 3) - orange has completed its five-wave impulsive structure.

- Wave 4) - orange is unfolding lower as a Zigzag correction, labeled A, B, and C - grey.

- Wave A - grey has finished, and Wave B - grey is advancing higher in an Expanded Flat structure.

- Wave c)) - navy of Wave B - grey is expected to target the 8.25–8.46 price zone.

Invalidation Point: End of Wave b)) - navy

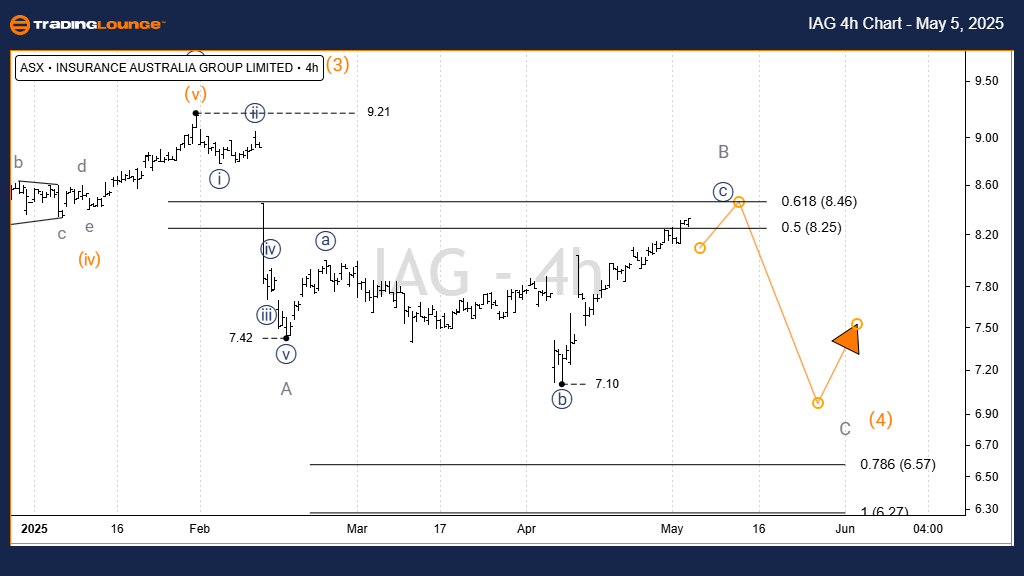

ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG 4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave c)) - navy of Wave B - grey

Details:

- From the 7.420 price level, Wave B - grey is forming as an Expanded Flat, reflecting sideways movement with low momentum.

- Wave b)) - navy shows greater complexity compared to wave a)) - navy, while wave c)) - navy is displaying stronger bullish momentum, characteristic of Flat pattern formations.

- Price action is anticipated to climb toward the 8.25–8.46 range before the completion of Wave B - grey and the initiation of a Wave C - grey decline.

Invalidation Point: 7.100

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis on ASX: INSURANCE AUSTRALIA GROUP LIMITED (ASX:IAG) highlights critical price zones and key invalidation points, providing a structured outlook for traders and investors. Monitoring these levels enhances confidence in assessing the next market moves.

We are committed to offering a professional, objective, and strategic perspective in our technical analysis.