ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis TradingLounge

Greetings, traders!

Today’s Elliott Wave analysis for the Australian Stock Exchange (ASX) spotlights Newmont Corporation (ASX:NEM).

We are tracking ASX:NEM advancing within a powerful third wave, offering key target zones and invalidation levels to guide traders on when the current bullish trend may complete or extend further.

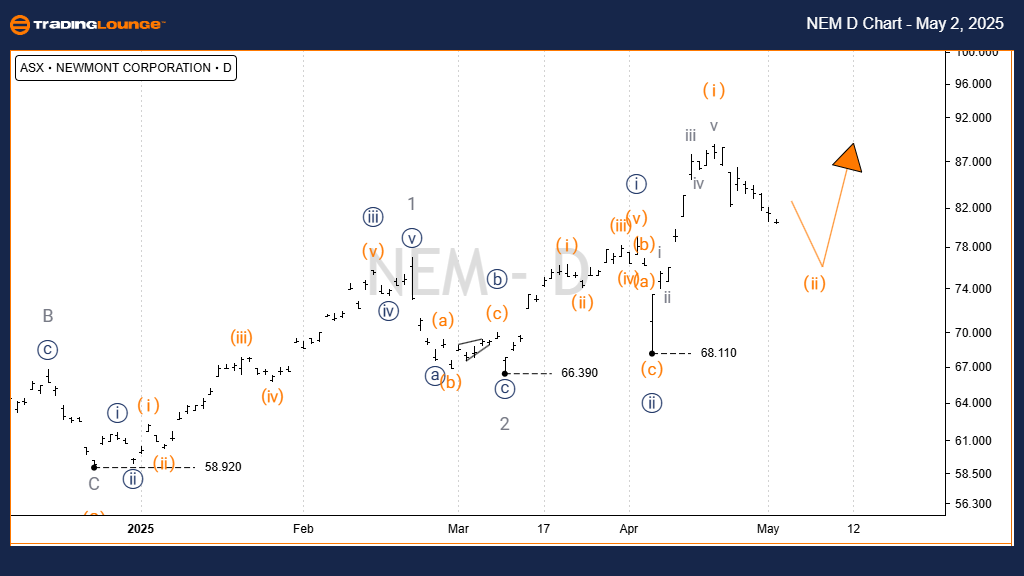

ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis 1D Chart (Semilog Scale)

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3 - grey of Wave (3) - orange

Details:

- Wave 2 - orange concluded near $58.92.

- Wave 3 - orange has commenced a new bullish leg, subdividing into wave 1 - grey, wave 2 - grey, and now an ongoing wave 3 - grey.

- The projected target zone for wave 3 - grey is between $100.00 and $102.37.

Key Invalidation Level: $68.11

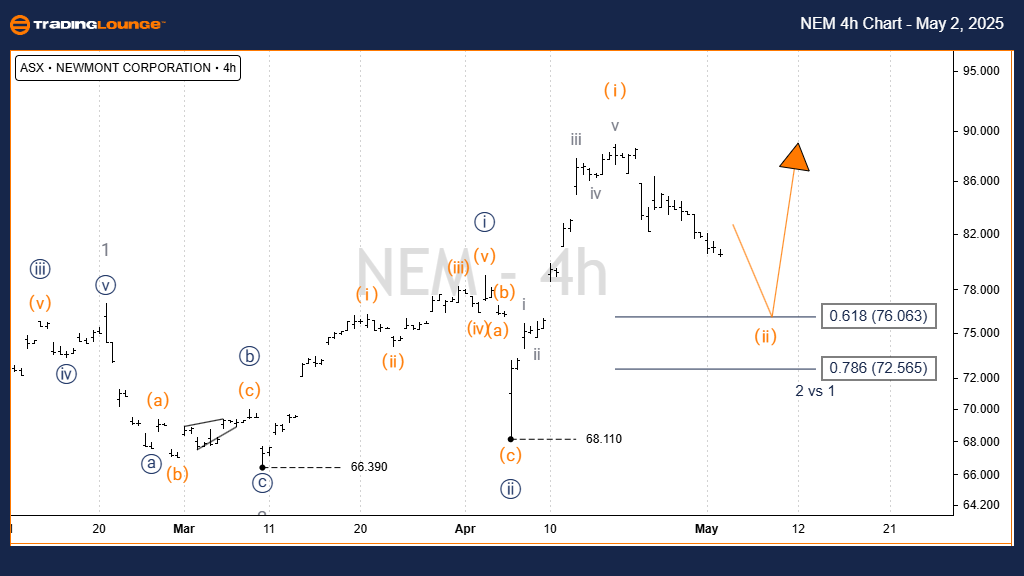

ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis 4-Hour Chart

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy of Wave 3 - grey

Details:

- From the $58.92 low, wave 3 - orange has developed to the upside.

- The current formation is identified as wave ((iii)) - navy, advancing toward the $102.37 target zone.

- Price must stay above $68.11 to sustain the bullish Elliott Wave structure.

- The $79.00 level is crucial: overlapping this point would force a reassessment of the current wave structure.

- Specifically, wave i) - orange must not be overlapped by wave iv)) - navy to maintain the motive pattern.

Key Invalidation Points: $68.11 and $79.00

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: COCHLEAR LIMITED - COH Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This ASX:NEM technical analysis, trend forecast, and trading outlook aim to equip traders with precise and actionable information.

We highlight clear validation and invalidation levels to enhance trading decisions.

By combining detailed Elliott Wave analysis with objective technical strategies, we empower traders to navigate Newmont Corporation’s (ASX:NEM) market movements with professional confidence.