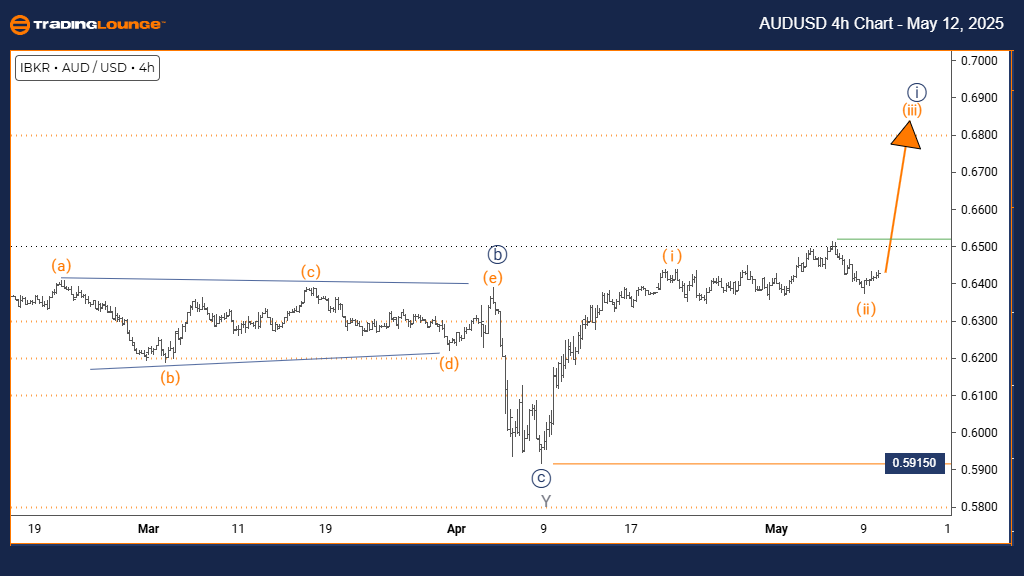

Australian Dollar/U.S. Dollar (AUDUSD) Elliott Wave Analysis – Trading Lounge Day Chart

AUDUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Orange Wave 4

DETAILS: Orange Wave 2 appears complete; Orange Wave 3 is currently in progress.

Wave Cancel/Invalidation Level: 0.59150

The daily Elliott Wave analysis of the AUDUSD pair signals a strong bullish trend, supported by impulsive market behavior. Based on the current wave pattern, Orange Wave 3 is actively forming within the framework of a broader upward movement, labeled as Navy Blue Wave 1. The prior corrective Orange Wave 2 has likely concluded, setting the stage for the start of Wave 3 – typically the most powerful phase in Elliott Wave theory.

The next anticipated move is Orange Wave 4, expected to be a corrective wave after Orange Wave 3 completes. The end of Orange Wave 2 supports a renewed bullish phase. Traders should monitor the invalidation level at 0.59150, as a break below this threshold would disrupt the bullish structure and may signal a trend reversal or more extensive correction.

The impulsive characteristics observed indicate sustained buying interest in the Australian Dollar. Investors and traders should closely watch the development of Orange Wave 3 to anticipate the transition into Wave 4. This daily technical overview confirms AUDUSD remains in a bullish cycle, with potential upside remaining before the next corrective phase begins.

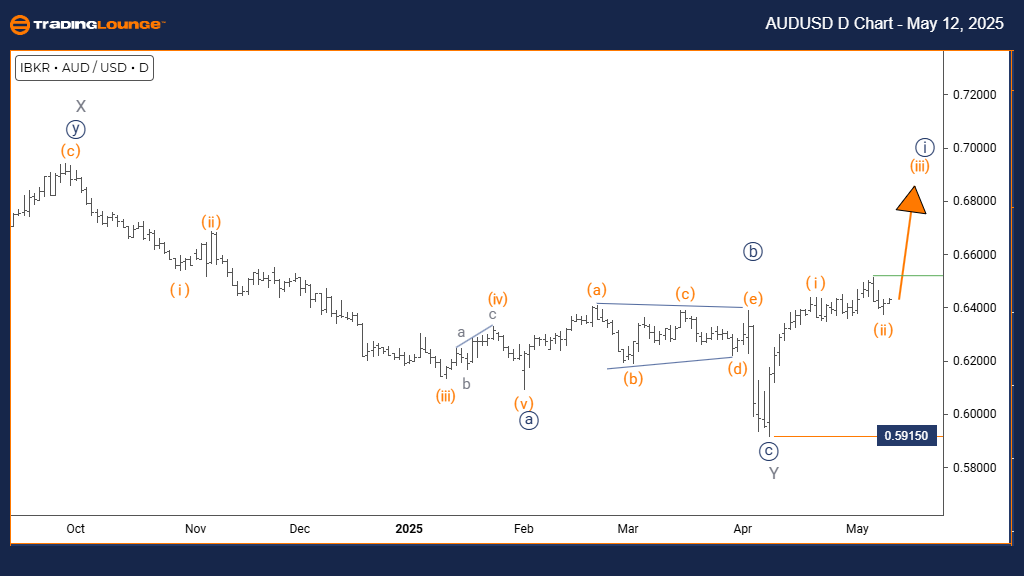

Australian Dollar/U.S. Dollar (AUDUSD) Elliott Wave Analysis – Trading Lounge 4 Hour Chart

AUDUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3 (in progress)

DETAILS: Orange Wave 2 is likely complete; Orange Wave 3 is underway.

Wave Cancel/Invalidation Level: 0.59150

The 4-hour Elliott Wave outlook for AUDUSD also maintains a bullish bias, with clear impulsive momentum seen in the structure of Orange Wave 3. This wave formation unfolds inside a larger uptrend, represented by Navy Blue Wave 1. Following the completion of Orange Wave 2, the market has entered Orange Wave 3, typically known for its strong price movement and acceleration.

The forecast suggests continued upward movement within Orange Wave 3, reinforcing the bullish sentiment for the Australian Dollar against the US Dollar. The termination of Orange Wave 2 confirms a completed correction, indicating potential for further gains. A crucial support level stands at 0.59150; any breach below this point would invalidate the current Elliott Wave count and potentially suggest a complex correction or trend reversal.

The impulsive formation of Orange Wave 3 demonstrates robust buying pressure. Traders should monitor this wave's progression to gauge the trend's strength and prepare for the next potential reversal at the end of Wave 3. This short-term technical analysis complements the daily view and supports the perspective that AUDUSD continues to trade within a larger bullish Elliott Wave cycle.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: USDCHF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support