KOTAK BANK Elliott Wave Analysis – Trading Lounge Day Chart

Kotak Bank Day Chart Analysis

KOTAK BANK Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 2

POSITION: Navy Blue Wave 3

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Orange Wave 1 has completed, and Orange Wave 2 is currently forming.

Wave Invalidation Level: 1681

The daily Elliott Wave chart for Kotak Bank shows the stock in a corrective counter-trend pattern, part of a broader bearish sequence under Navy Blue Wave 3. The ongoing development of Orange Wave 2 follows the completion of the downward Orange Wave 1, indicating a temporary pause in the primary downtrend.

This corrective phase suggests a limited upside as the market adjusts within Orange Wave 2. Should the price exceed 1681, the current Elliott Wave structure would be invalidated, signaling a potential trend reversal or a more complex correction.

Key Takeaways:

- Kotak Bank is undergoing a corrective phase.

- Wave 2 upside potential appears restricted.

- Monitoring 1681 as the invalidation level is crucial.

- Completion of Wave 2 may resume the broader bearish move (Wave 3).

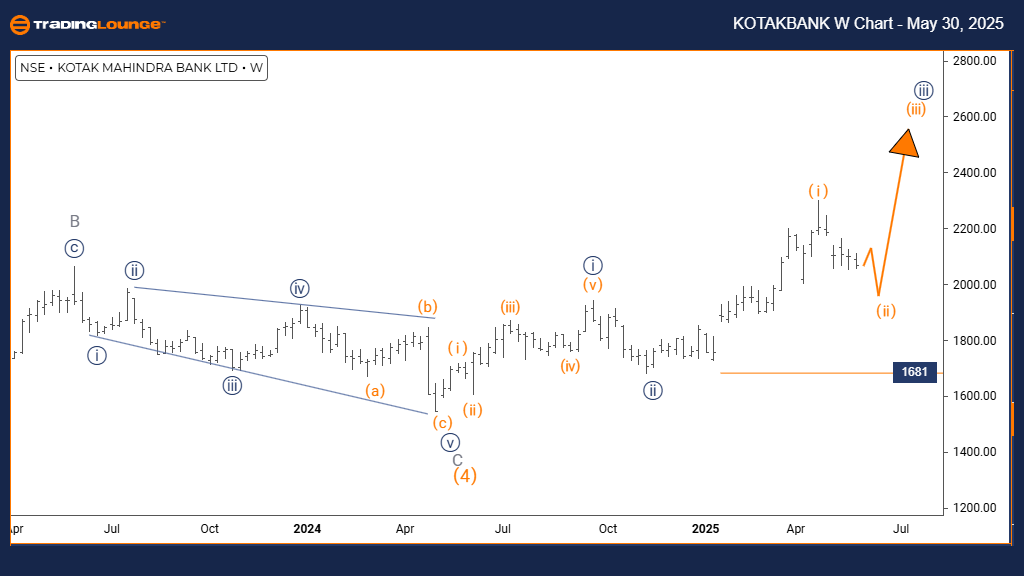

KOTAK BANK Elliott Wave Analysis – Trading Lounge Weekly Chart

KOTAK BANK Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 2

POSITION: Navy Blue Wave 3

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Orange Wave 1 has completed, and Orange Wave 2 is progressing.

Wave Invalidation Level: 1681

On the weekly timeframe, Kotak Bank is engaged in a counter-trend correction within a larger bearish wave structure. The progression of Orange Wave 2 suggests a short-term retracement rather than a new bullish phase.

The upward movement should be interpreted as a limited corrective bounce. A price move beyond 1681 would challenge the current wave count, hinting at a more extended correction or a potential trend reversal.

Key Takeaways:

- Weekly structure aligns with corrective movement.

- Price action is part of a larger bearish pattern.

- Invalidation level at 1681 must be monitored.

- Risk management is essential during this corrective phase.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: STATE BANK OF INDIA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support