ASX: CAR GROUP LIMITED (CAR) Elliott Wave Analysis - TradingLounge 1D Chart

ASX: CAR GROUP LIMITED – CAR 1D Chart (Semilog Scale) Analysis

ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave iii)) - navy of Wave (5) - orange

Details:

Wave (4) - orange likely concluded at the 28.40 low, after starting from the 42.71 peak. This move appears as a Zigzag structure, labeled A-B-C in grey. The final wave C - grey subdivided into five clear waves, supporting the completion view. This setup strongly indicates that wave (5) - orange is now unfolding. Current market behavior reflects a slight downturn in wave iv)) - navy, with potential for wave v)) - navy to resume the upward trend.

Invalidation point: 34.150 (Price must remain above this level to uphold the current wave outlook.)

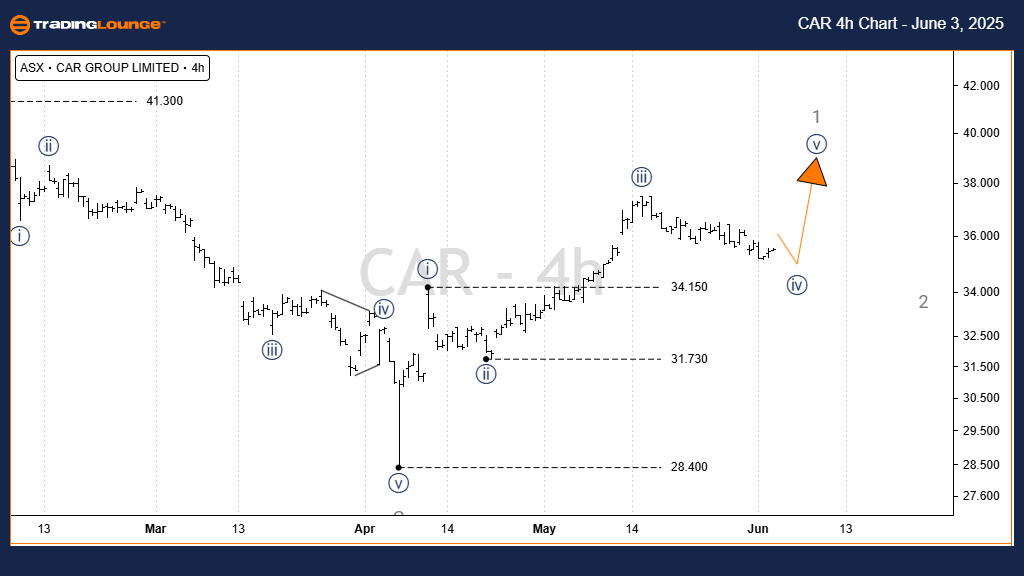

ASX: CAR GROUP LIMITED Elliott Wave Technical Analysis 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iv)) - navy of Wave 1 - grey

Details:

Wave iv)) - navy is currently correcting lower. However, if it dips below 34.150, the bullish Elliott Wave structure will be invalidated, as wave four should not overlap with wave one in an impulse sequence.

Invalidation point: 34.150 (Maintaining price above this level confirms the bullish outlook.)

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Insurance Australia Group Limited (IAG) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis of ASX: CAR GROUP LIMITED – CAR highlights both intermediate and minor trend perspectives. Our forecasts aim to guide traders with actionable price levels and reinforce confidence in potential bullish momentum. By aligning structure validation with key price thresholds, we deliver an analytical edge for navigating current market opportunities.