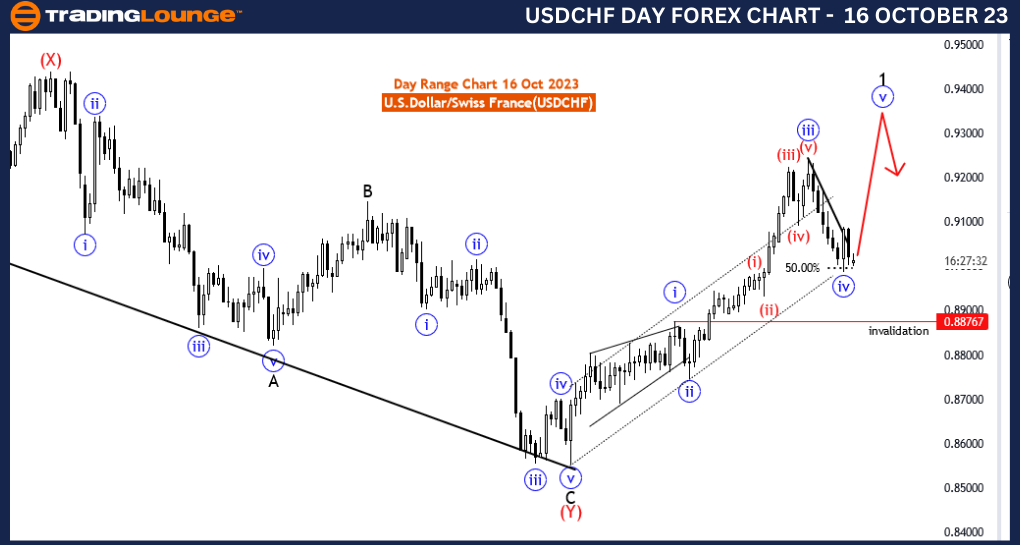

USDCHF Elliott Wave Analysis Trading Lounge 4-Hour Chart

U.S.Dollar/Swiss Franc(USDCHF) 4 Hour Chart

USDCHF Elliott Wave Technical Analysis

Function: Trend

Mode: impulsive

Structure: 5 of 1

Position: New Black Wave 1

Direction Next Higher Degrees: wave 5 of 1(started)

Details: blue corrective wave 4 of 1 completed at fib level 50.00 Now wave 5 of 1 started. Wave Cancel invalid level: 0.88767

The USD/CHF Elliott Wave Analysis for the 4-hour chart dated 16 October 23, delves into the dynamics of the U.S. Dollar/Swiss Franc (USD/CHF) currency pair. Utilizing Elliott Wave theory, a renowned tool for interpreting market trends and price action, this analysis aims to provide a deeper understanding of the current market situation.

The primary objective of this analysis is to identify and leverage the existing trend in the USD/CHF market. The market function is described as trending, specifically characterized as impulsive. In Elliott Wave theory, impulsive waves signify robust, sustained price movements that can present significant trading opportunities.

The analysis emphasizes the fifth wave within the overarching wave structure, denoted as "5 of 1." In Elliott Wave theory, the fifth wave is typically associated with the final and most powerful leg of a trending sequence, making it an area of keen interest for traders and investors.

The focal wave in this analysis is "blue corrective wave 4 of 1," which is acknowledged to have concluded at the 50.00 Fibonacci level. Fibonacci levels are pivotal points for traders, often acting as areas of support and resistance.

One of the standout observations is the declaration that "wave 5 of 1 started." This implies that a potentially vigorous and extended trend is now in progress. Wave 5s in Elliott Wave theory are often seen as offering substantial trading opportunities.

The analysis provides a critical reference point: the "Wave Cancel invalid level" positioned at 0.88767. This level functions as a crucial reference for traders to monitor, especially in terms of adjusting their trading strategies and risk management.

In summary, the USD/CHF Elliott Wave Analysis for 16 October 23, functions as a valuable guide for traders and investors involved in the USD/CHF market. It confirms the existence of a powerful impulsive wave, "5 of 1," and indicates the completion of a corrective wave, "blue corrective wave 4 of 1," emphasizing the initiation of a potentially forceful impulsive wave, "wave 5 of 1." Traders and investors should consider this analysis as they make their trading decisions within the USD/CHF currency pair.

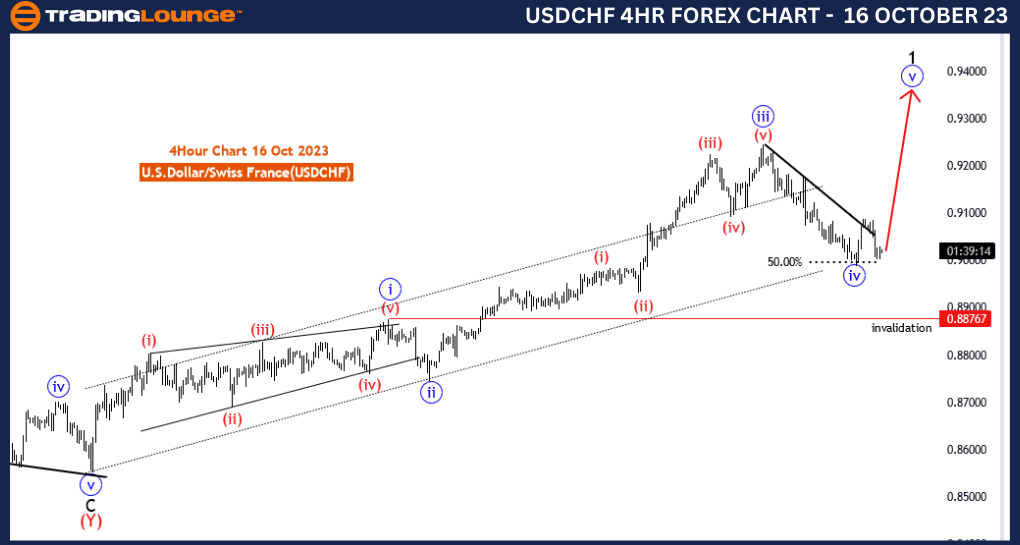

USDCHF Elliott Wave Analysis Trading Lounge Day Chart

U.S.Dollar/Swiss Franc(USDCHF) Day Chart

USDCHF Elliott Wave Technical Analysis

Function: Trend

Mode: impulsive

Structure: 5 of 1

Position: New Black Wave 1

Direction Next Higher Degrees: wave 5 of 1(started)

Details: blue corrective wave 4 of 1 completed at fib level 50.00 Now wave 5 of 1 started. Wave Cancel invalid level: 0.88767

The USD/CHF Elliott Wave Analysis for the daily chart on 16 October 23, provides valuable insights into the market dynamics of the U.S. Dollar/Swiss Franc (USD/CHF) currency pair. It employs the Elliott Wave theory, a renowned tool for interpreting market trends and price movements, to offer a comprehensive understanding of the current market conditions.

The primary objective of this analysis is to identify and capitalize on the existing trend in the USD/CHF market. The market function is identified as trending, with an impulsive mode. In Elliott Wave theory, an impulsive wave characterizes strong and sustained price movements, often presenting significant trading opportunities.

The analysis focuses on the fifth wave within the larger wave structure, referred to as "5 of 1." In Elliott Wave theory, the fifth wave is often associated with the final and most powerful leg of a trending sequence, making it a key area of interest for traders and investors.

The central wave in this analysis is "blue corrective wave 4 of 1," which is noted as having completed at the 50.00 Fibonacci level. Fibonacci levels are important reference points for traders, serving as potential levels of support and resistance.

One of the key takeaways from this analysis is the statement that "wave 5 of 1 has commenced." This suggests the initiation of a potentially strong and extended trend. In Elliott Wave theory, fifth waves are often considered to offer substantial trading opportunities.

The analysis introduces a critical reference point: the "Wave Cancel invalid level" situated at 0.88767. This level serves as an essential guide for traders to monitor, particularly when making trading decisions and managing risk.

In summary, the USD/CHF Elliott Wave Analysis for 16 October 23, offers a valuable resource for traders and investors operating in the USD/CHF market. It confirms the presence of a robust impulsive wave, "5 of 1," and signals the conclusion of a corrective wave, "blue corrective wave 4 of 1," while highlighting the initiation of a potentially potent impulsive wave, "wave 5 of 1." Traders and investors should take this analysis into account when formulating their trading strategies within the USD/CHF currency pair.