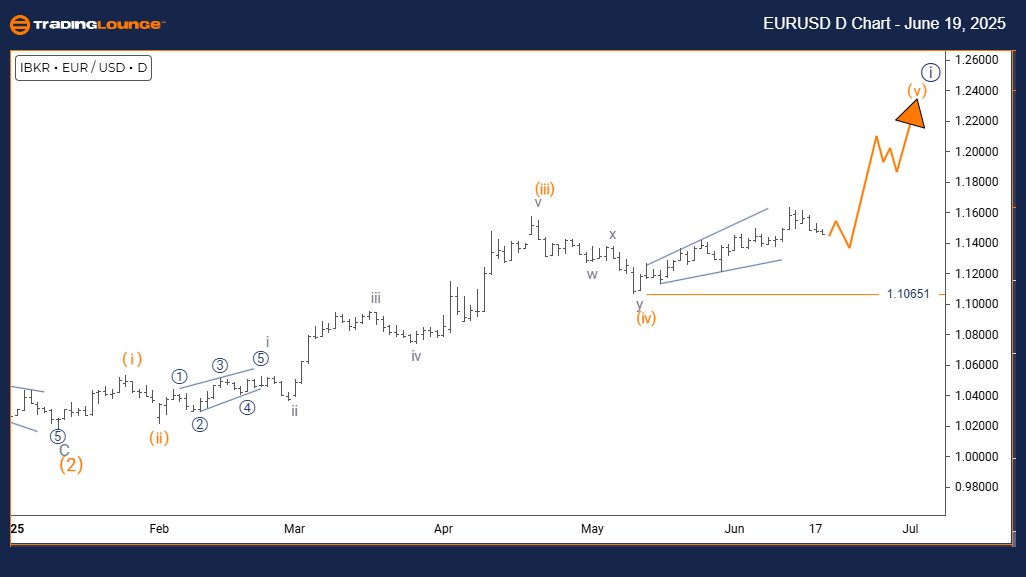

Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis – Trading Lounge Day Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 5 (active)

DETAILS: Completion of Orange Wave 4 is likely; Orange Wave 5 is underway.

Wave Cancel Invalidation Level: 1.10651

The EURUSD daily Elliott Wave forecast signals a strong bullish trend. Current market momentum supports the formation of Orange Wave 5, part of a larger impulsive movement within Navy Blue Wave 1. This development is consistent with a continuation of the overall uptrend.

With Orange Wave 4 likely finished, Orange Wave 5 marks the final leg of this impulse sequence, typically characterized by accelerating price action. Traders should monitor this wave for confirmation of sustained upward movement within the larger bullish Elliott Wave structure.

The critical invalidation level to watch remains at 1.10651. A drop below this threshold would nullify the current wave count, requiring a revised Elliott Wave analysis. Until then, the bullish structure remains valid, indicating a potential upward extension.

This chart setup points toward a final upward thrust for EURUSD, driven by Orange Wave 5. While the structure supports further gains, traders should stay alert for reversal signals, as this move may conclude the short-term trend cycle.

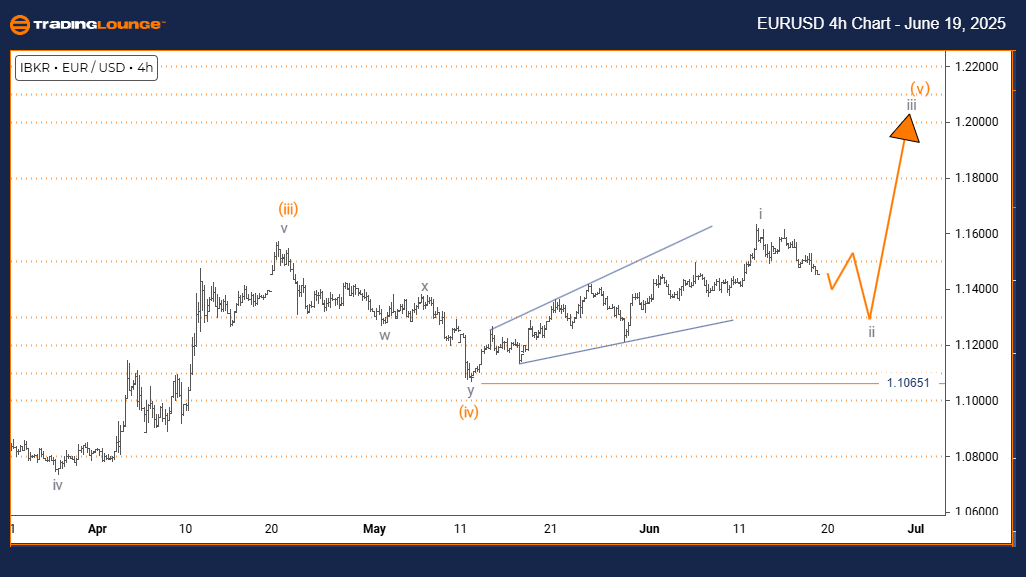

Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis – Trading Lounge 4-Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Gray Wave 2

POSITION: Orange Wave 3

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3

DETAILS: Gray Wave 1 appears complete; Gray Wave 2 is developing.

Wave Cancel Invalidation Level: 1.10651

The 4-hour EURUSD Elliott Wave analysis indicates a corrective counter-trend phase. The currency pair is forming Gray Wave 2, which occurs within a larger Orange Wave 3 bullish context. This pullback is a typical feature before the continuation of the broader trend.

With Gray Wave 1 completed, the market is now in the retracement phase of Gray Wave 2, often characterized by sideways or mildly declining price action. Once this corrective wave concludes, Gray Wave 3 is expected to resume the primary trend with increased momentum.

Traders should observe the corrective behavior within this zone. Until Gray Wave 2 completes, the price may remain range-bound. The key invalidation point at 1.10651 is essential; if breached, it would invalidate the current wave count and demand reevaluation.

The current wave scenario supports a short-term consolidation period before EURUSD resumes its upward trajectory through Gray Wave 3. Monitoring for the completion of Gray Wave 2 will help identify the next bullish opportunity.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AUDJPY Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support