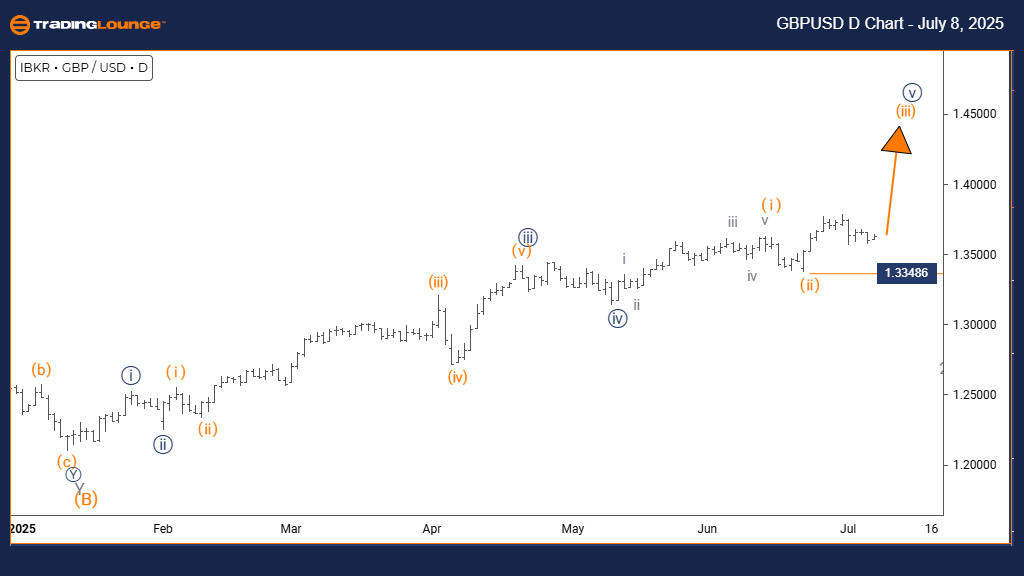

British Pound / U.S. Dollar (GBPUSD) Elliott Wave Analysis | Trading Lounge Day Chart

GBPUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Momentum

MODE: Impulsive Pattern

STRUCTURE: Developing Orange Wave 3

POSITION: Advancing within Navy Blue Wave 5

DIRECTION (Next Lower Degree): Orange Wave 4 Potential

DETAILS:

Orange wave 2 appears completed, with orange wave 3 now underway in the GBPUSD daily chart.

Invalidation Level: 1.33486

According to Elliott Wave analysis, GBPUSD continues to move in a bullish direction on the daily timeframe. The impulsive structure indicates orange wave 3 is forming within the larger navy blue wave 5, pointing to further upward movement. However, a short-term correction in orange wave 4 is likely to follow.

Now that orange wave 2 has finalized, GBPUSD progresses through orange wave 3, backed by strong bullish momentum. The impulsive nature suggests a sustained upward path. A move below the invalidation level at 1.33486 would negate the current wave scenario and suggest a possible trend reversal.

The pair's position within navy blue wave 5 indicates the broader uptrend is still in effect, though approaching a potential high. Traders may continue to favor long setups, keeping an eye out for signs that wave 3 is nearing completion — which would signal an incoming correction phase via orange wave 4.

This structured Elliott Wave overview highlights key support and resistance zones for GBPUSD traders and provides insight into possible market shifts.

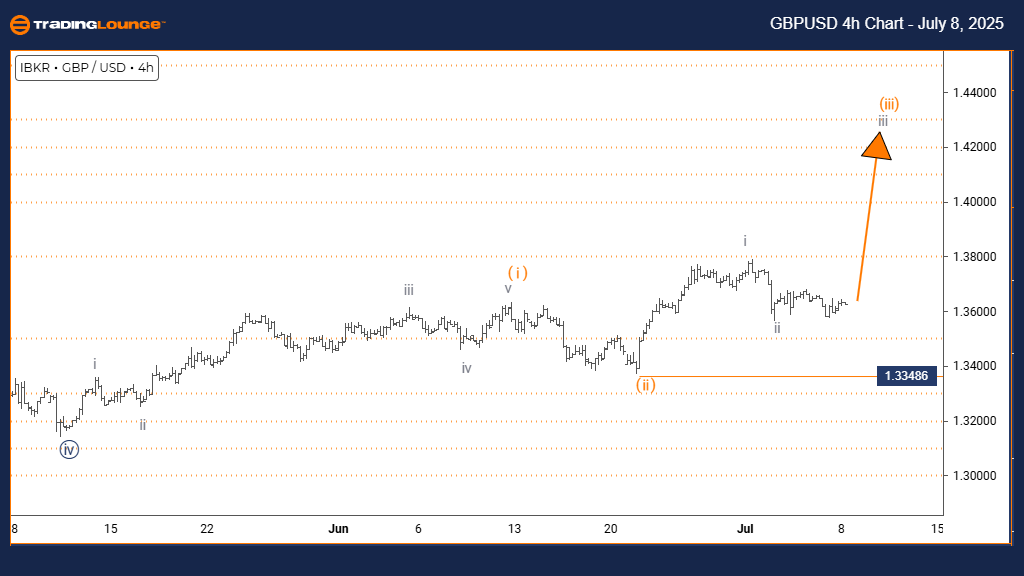

British Pound / U.S. Dollar (GBPUSD) Elliott Wave Analysis | Trading Lounge 4-Hour Chart

GBPUSD Elliott Wave Technical Analysis

FUNCTION: Sustained Bullish Trend

MODE: Impulsive Formation

STRUCTURE: Gray Wave 3 In Progress

POSITION: Advancing Within Orange Wave 3

DIRECTION (Next Higher Degree): Gray Wave 3 Continuation

DETAILS:

Gray wave 2 seems complete, with gray wave 3 unfolding.

Invalidation Level: 1.33486

The 4-hour GBPUSD chart reveals a continuation of the bullish trend under Elliott Wave guidelines. The current structure features gray wave 3 forming within the broader orange wave 3, reflecting strong upward momentum and a favorable near-term outlook.

Following the end of gray wave 2, the pair is showing a clear progression into gray wave 3. The impulsive pattern confirms persistent buying strength. The key invalidation level remains at 1.33486 — a price move beneath this would warrant a review of the bullish scenario.

This outlook favors bullish entries as long as GBPUSD stays above the invalidation point. A correction via gray wave 4 is anticipated once the present impulsive wave concludes.

Overall, GBPUSD demonstrates strong upside potential in the short term. This analysis supports continued long positions with focus on wave development and critical support levels.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AUDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support