AUDUSD Elliott Wave Analysis | Trading Lounge Day Chart

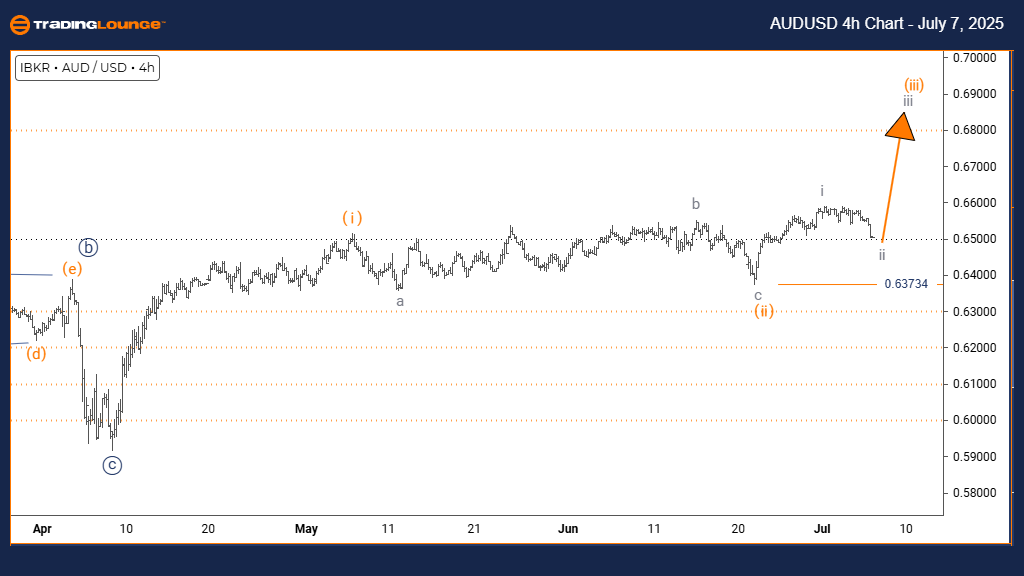

Australian Dollar/U.S. Dollar (AUDUSD) Day Chart Analysis

AUDUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 1

Direction Next Higher Degrees: Orange Wave 3 (Initiated)

Details: Orange Wave 2 has likely ended; Orange Wave 3 is currently unfolding.

Wave Cancel Invalid Level: 0.559155

The AUDUSD daily Elliott Wave forecast indicates a continuation of the bullish trend, supported by impulsive price action with strong upward momentum. The market is currently developing within Orange Wave 3, a segment of the broader Navy Blue Wave 1, signaling the start of a new bullish phase within the higher-degree wave structure.

With Orange Wave 2 likely completed, Orange Wave 3 has initiated. Historically, this wave is often the most dynamic and typically brings the strongest price acceleration in the Elliott Wave sequence. This ongoing upward development suggests increased bullish potential and trading opportunities as market momentum intensifies.

The critical invalidation level is defined at 0.559155. Any downward movement below this point would invalidate the existing Elliott Wave count and require a reevaluation of the current trend analysis. This level is key for traders to manage risk and validate trade setups.

Overall, this setup supports a bullish AUDUSD outlook. As Orange Wave 3 progresses, traders should watch for bullish confirmation signals while closely tracking the invalidation threshold to adapt strategies accordingly.

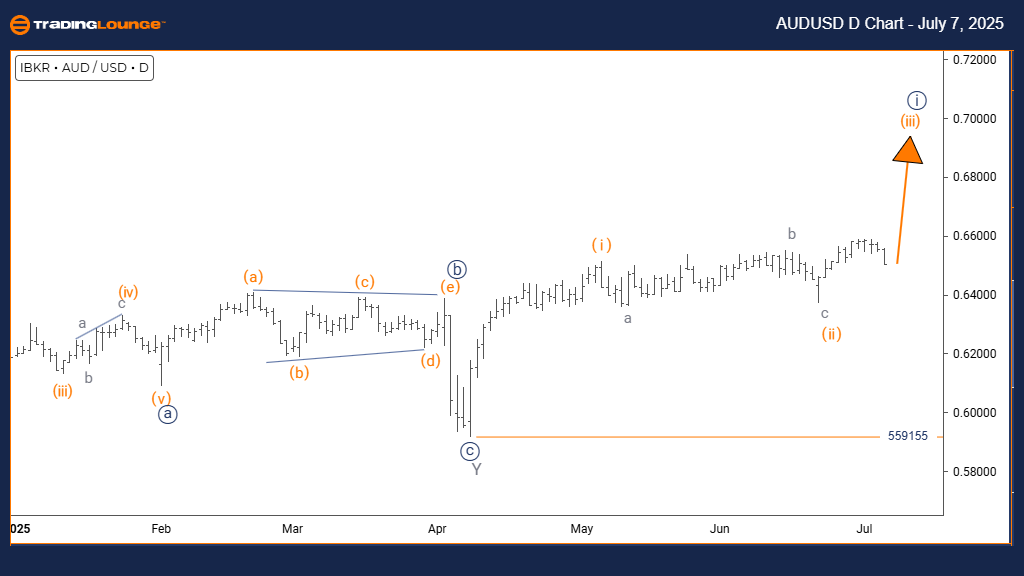

Australian Dollar/U.S. Dollar (AUDUSD) 4-Hour Chart Analysis

AUDUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Gray Wave 2

Position: Orange Wave 3

Direction Next Higher Degrees: Gray Wave 3

Details: Gray Wave 1 has likely ended; Gray Wave 2 is active.

Wave Cancel Invalid Level: 0.63734

The AUDUSD 4-hour Elliott Wave analysis points to a corrective phase within a counter-trend move. Price is consolidating in Gray Wave 2, which forms a sub-structure within the active Orange Wave 3 of the broader trend.

The completion of Gray Wave 1 suggests the current retracement is temporary. Gray Wave 2 represents a short-term correction, likely preceding the emergence of Gray Wave 3, which should continue the upward trajectory in line with the larger impulsive pattern.

The defined invalidation level for this wave count is 0.63734. A break below this price would negate the current wave structure, requiring an updated market interpretation. Traders can use this level to guide risk controls and refine entry points.

This Elliott Wave analysis offers a disciplined approach to trading the AUDUSD pair, highlighting structural patterns and key price levels that enable traders to anticipate movements and refine their strategies.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: NZDUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support