ASX: BHP GROUP LIMITED - BHP Elliott Wave Technical Analysis – TradingLounge

Greetings,

This Elliott Wave market analysis focuses on BHP GROUP LIMITED (ASX: BHP), listed on the Australian Securities Exchange.

A bullish opportunity has emerged as wave 2) orange completed its Zigzag correction. Now, wave 3) orange may be developing, indicating a possible upward price movement. This outlook outlines key resistance targets and the crucial invalidation point that maintains the current bullish bias.

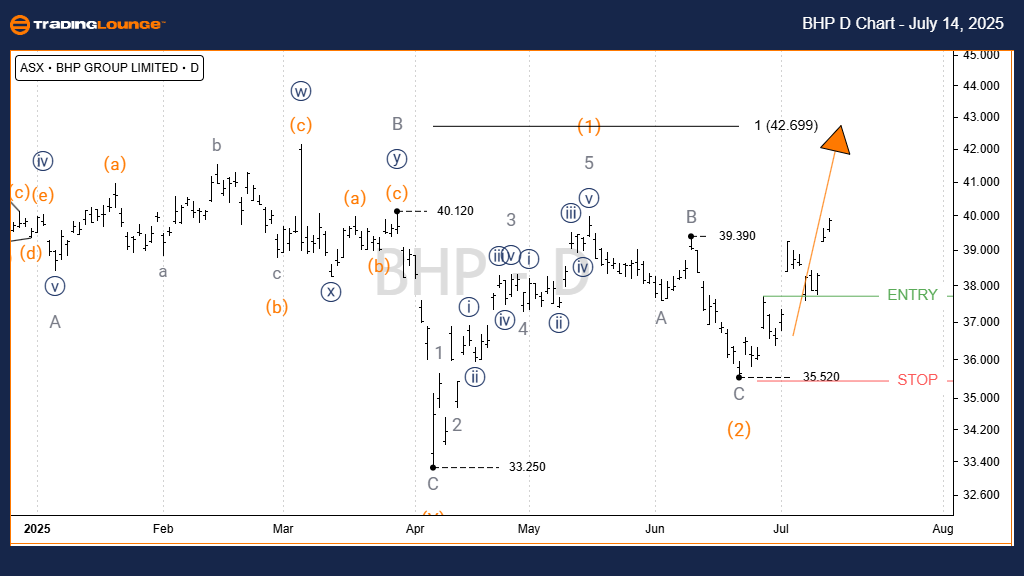

ASX: BHP GROUP LIMITED - BHP Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

Function: Intermediate trend (Orange degree)

Wave Mode: Motive

Wave Structure: Impulse

Wave Position: Wave 3) orange

Technical Breakdown:

Wave 1) orange initiated from the low at 33.25 and unfolded into a complete five-wave impulsive move. Wave 2) orange then corrected in a clear A-B-C Zigzag formation. This corrective phase appears to have ended, allowing wave 3) orange to commence. The projected upside target lies between 42.70 and 47.84, provided the price holds above the critical support at 35.52.

Invalidation Level: 35.52

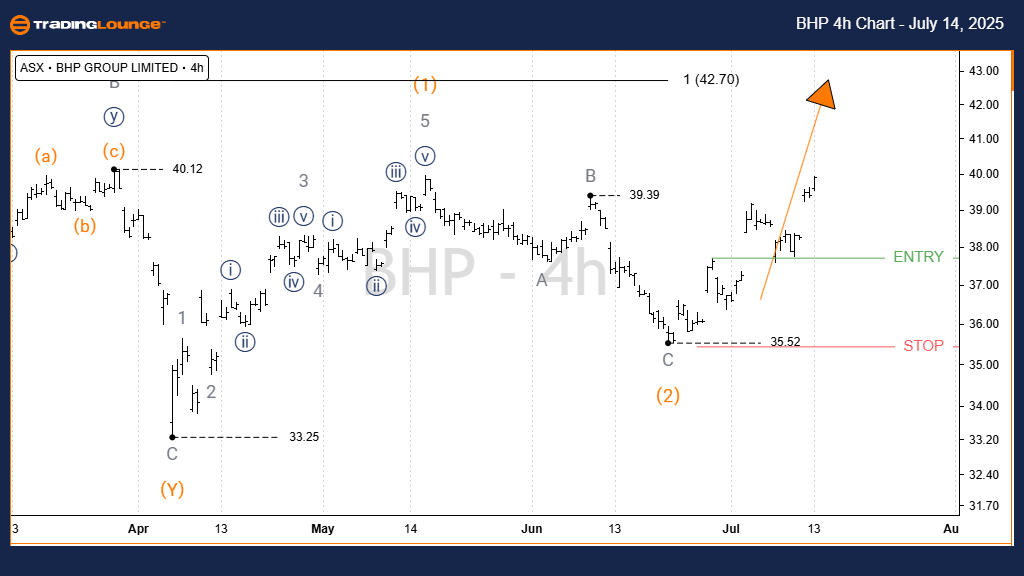

ASX: BHP GROUP LIMITED - BHP Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

Function: Intermediate trend (Orange degree)

Wave Mode: Motive

Wave Structure: Impulse

Wave Position: Wave 3) orange

Technical Breakdown:

The 4-hour chart confirms the same bullish structure seen in the daily chart. A long trade setup may activate once the price breaks above a clearly defined resistance level. For this bullish scenario to remain valid, the price must stay above the 35.52 invalidation mark.

Technical Analyst: Hua (Shane) Cuong, CEWA‑M (Certified Elliott Wave Analyst – Master Level)

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This updated Elliott Wave forecast for ASX: BHP GROUP LIMITED (BHP) provides actionable market insights and technical clarity. By defining bullish targets and the invalidation level, this analysis supports traders in making informed decisions. Our mission remains to deliver precise and strategic guidance based on advanced wave theory.