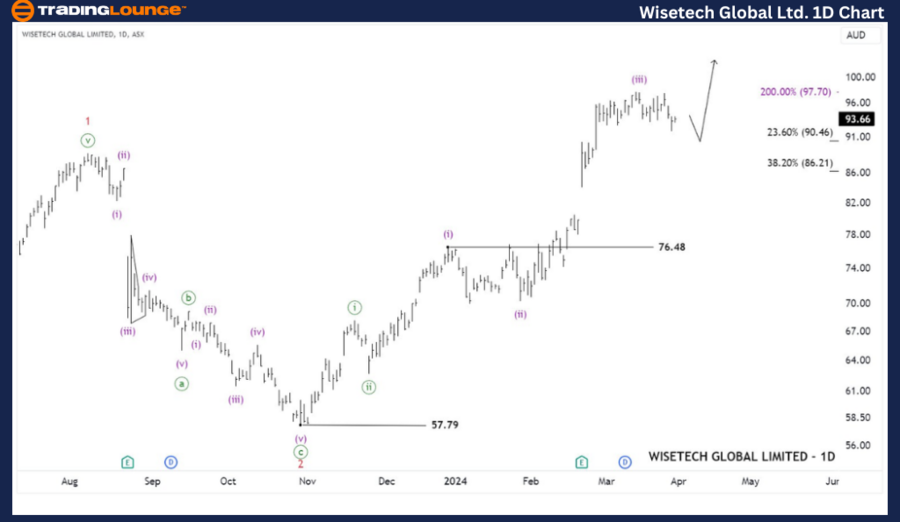

ASX: WISETECH GLOBAL LIMITED – WTC Elliott Elliott Wave Technical Analysis TradingLounge (1D Chart)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with WISETECH GLOBAL LIMITED – WTC. We have identified a potential opportunity with wave (v)-purple, but first, we are observing and waiting to see how wave (iv)-purple will conclude.

ASX: WISETECH GLOBAL LIMITED – WTC Elliott Wave Technical Analysis

ASX: WISETECH GLOBAL LIMITED – WTC 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minute degree, green)

Mode: Motive

Structure: Impulse

Position: Wave (iv)-purple of Wave ((iii))-green

Details: The short-term outlook from the low at 57.79 indicates that wave 3-red is unfolding, subdividing into waves ((i)) and ((ii))-green. Once again, it subdivides into waves (i), (ii), and (iii)-purple, with some indications suggesting that wave (iii)-purple may have concluded, notably reaching the 200% Fibonacci extension level (Wave 3 = 200% of Wave 1). Therefore, wave (iv)-purple is unfolding to continue declining lower, seeking support around 90.46 - 86.21 (the 23.6% and 38.2% Fibonacci retracement levels). Wave (iv) may take some time to unfold before concluding, after which wave (v)-purple will follow to continue pushing higher.

Invalidation point: 76.48

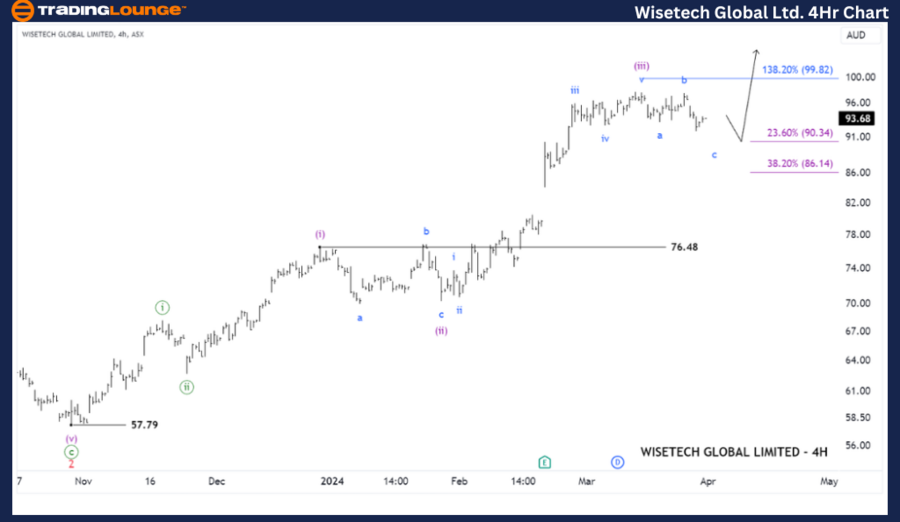

ASX: WISETECH GLOBAL LIMITED – WTC TradingLounge 4-Hour Chart

ASX: WISETECH GLOBAL LIMITED – WTC Elliott Wave Technical Analysis

ASX: WISETECH GLOBAL LIMITED – WTC 4-Hour Chart Analysis

Function: Major trend (Minute degree, green)

Mode: Motive

Structure: Impulse

Position: Wave (iv)-purple of Wave ((iii))-green

Details: The short-term outlook indicates that wave (iv)-purple is currently unfolding to push lower, followed by wave (v)-purple returning to continue pushing higher. At this point, I'm not sure if wave (iv) has concluded yet, as potential support for wave (iv) typically lies around 23.6% - 38.2%, and the price has not reached this target yet... Conversely, if it rises above the initial level of 99.82, it may renew the view that wave (v)-purple has resumed and will continue to push higher.

Invalidation point: 76.48

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: WISETECH GLOBAL LIMITED – WTC aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: WOODSIDE ENERGY GROUP LTD

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.