Soybeans Elliott Wave Analysis: Detailed Breakdown and Future Predictions

Soybeans Elliott Wave Technical Analysis

Function: Trend

Mode: Impulse

Structure: Impulse for (5)

Position: Wave 1 of (5)

Direction: Wave 2 of (5)

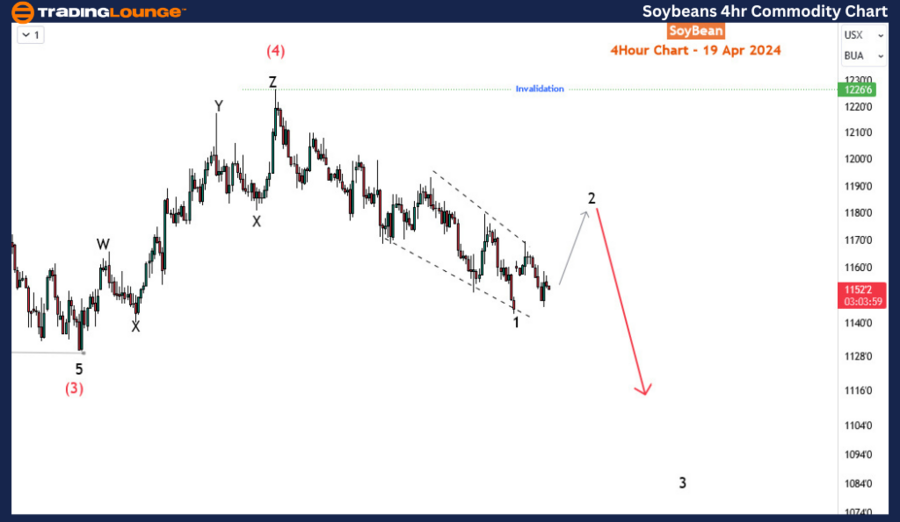

Details: Completion of Wave 1 of (5) with a diagonal pattern. Emergence of Wave 2 bounce expected before a downward turn in Wave 3 of (5). Current invalidation level at 1226’6. Stability in the analysis since the last update.

Soybean Price Analysis: Elliott Wave Perspective Signals Continued Downward Trend

In the realm of commodity trading, Soybean has recently undergone a significant downturn, marking a nearly 7% drop since March 21st. This decline appears to be part of a broader trend that commenced back in June 2022. However, before this recent descent, there was a brief period of respite characterized by a corrective bounce starting in late February.

Delving deeper into the price action, an Elliott Wave analysis sheds light on the intricacies of Soybean's movement. The daily chart's decline since June 2022 reveals a corrective pattern, delineated into waves A-B-C, as denoted by blue annotations.

The initial wave, labelled as Blue Wave 'A', terminated at 1249 in October 2023, exhibiting a distinct diagonal pattern. Subsequently, a modest rebound ensued, marked by Blue Wave 'B', which concluded at 1398 in November 2023. However, the ascendancy was short-lived as the bears regained control, manifesting in the ongoing development of Blue Wave 'C'. This wave, evolving into an impulse wave, has currently progressed to wave (5) following the completion of wave (4) in March 2024.

Focus Soyabin H4 Chart Analysis:

Zooming in on the H4 chart, a granular analysis reveals the sub-waves of wave (5). Wave 1 of (5) concluded with a diagonal structure, followed by a corrective phase as the price undergoes a temporary upside correction to complete wave 2. Despite uncertainties regarding whether wave 2 has fully concluded or will undergo another upward leg, the overarching trajectory remains clear – a downward break is anticipated to continue wave 3 of (5), leading to further downside movement.

In light of this analysis, the prevailing sentiment favours sellers, who continue to assert dominance over the commodity market. As long as the price remains below 1226’6, the outlook remains skewed towards further downside potential, with the possibility of reaching the lowest price point since November 2020.

In conclusion, the Elliott Wave perspective offers valuable insights into Soybean's price dynamics, signalling a continued bearish trajectory in the near term. While short-term fluctuations may occur, the broader trend suggests that sellers are likely to maintain control, shaping the commodity's price action in the foreseeable future.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WTI Crude Oil Commodity

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE