Silver (XAGUSD) Elliott Wave Analysis: A Comprehensive Forecast

Silver Elliott Wave Technical Analysis

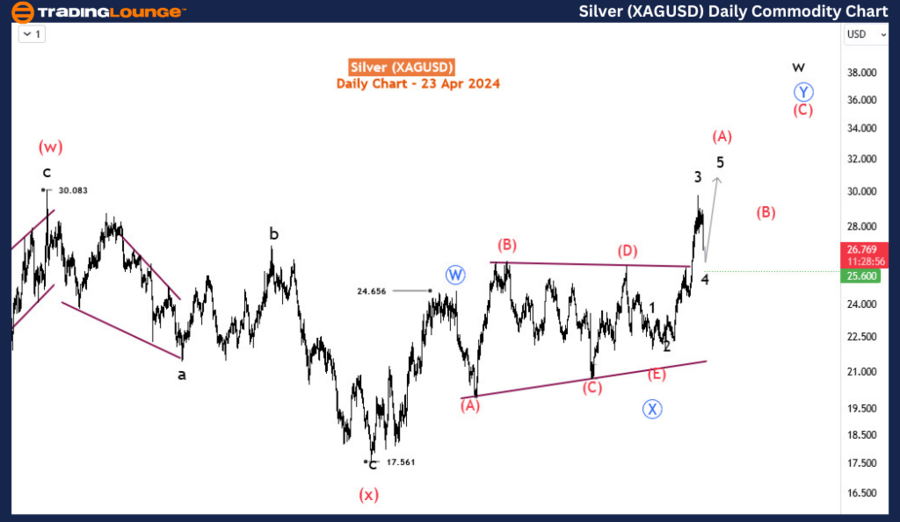

Function: Trend

Mode: Trend

Structure: Impulse for (A)

Position: Wave 3 of (A)

Direction: Wave 4 of (A)

Details: Presently experiencing a wave 4 dip before further escalation into wave 5 of (A). Expect another leg lower for wave 4. Recent trends remain consistent.

Since April 12th, 2024, Silver has extended its pullback phase and currently sits within a critical Fibonacci reversal zone. This situation suggests a bullish continuation is on the horizon as the market prepares for an upward shift. During this period, investors are closely monitoring this area for signs of a bullish resurgence, emphasizing the importance for traders to focus on this key reversal zone.

Expert Predictions and Trading Insights with Daily Chart Analysis

On the daily chart, Silver showcases a notable breakout from a long-term triangular pattern, part of a complex double zigzag structure originating from a low of $17.56 in September 2022. The price movement is currently progressing through the intermediate wave (A) of the primary wave Y, outlined in blue. Initiated in late January 2024, wave (A) is characteristically impulsive, indicating strong market movements. Within this impulsive sequence, the ongoing decline marks wave 4. As wave 4 nears its end, the market is setting the stage for a significant rise in wave 5, which could thrust the prices toward or beyond the $30 level. A critical aspect for traders is pinpointing the exact finish of wave 4.

Elliott Wave Technical Forecast for Silver 4-hour Chart Analysis

Turning our attention to the H4 chart, wave 4 appears as a zigzag pattern, pinpointing potential support at the 100-138% Fibonacci extension levels, between $26.86 and $26.07. If the price stretches to the 161.8% Fibonacci level at $25.6, it might challenge the zigzag formation’s stability, potentially leading to a sharper decline. Nevertheless, a rebound within this zone is anticipated, setting a crucial phase for the next bullish wave. Currently, prices are navigating this essential area, with the potential for further exploration of lower levels. However, a strong and decisive recovery from this point is essential for pushing into wave 5.

This analysis serves as a guide for traders and investors interested in Silver, providing insights into its near-term trajectories and long-term prospects within the framework of Elliott Wave theory. Understanding these patterns will help in making informed decisions in the commodities market, particularly for those trading in Silver.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Natural Gas Elliottwave Analysis

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE