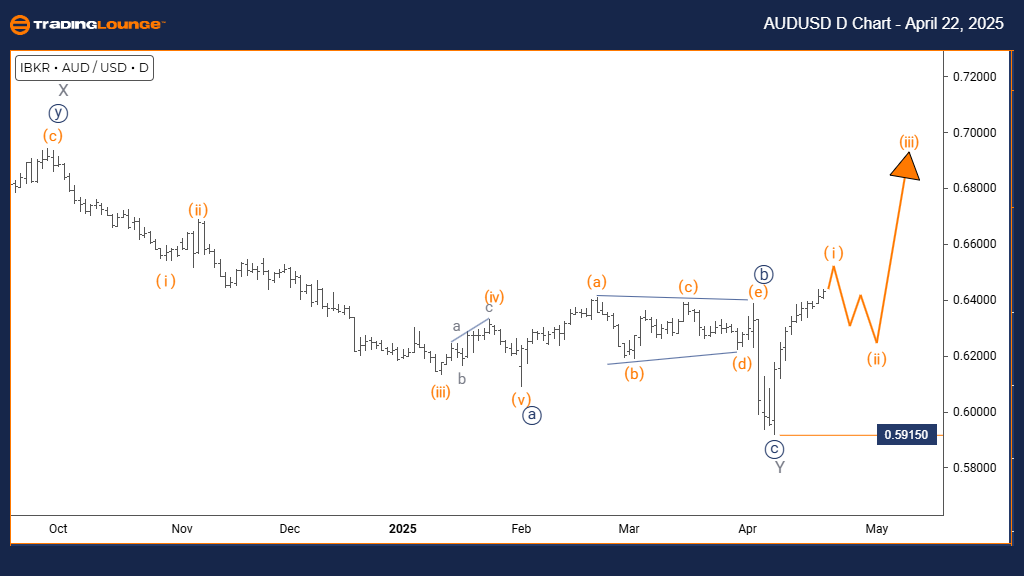

AUDUSD Elliott Wave Analysis – Trading Lounge Daily Chart

Australian Dollar/U.S. Dollar (AUDUSD) – Daily Chart

AUDUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 1

Direction Next Lower Degree: Orange Wave 2

Details: Orange wave 1 of navy blue wave 1 is developing as part of a broader trend

Wave Cancel Invalid Level: 0.59150

The AUDUSD daily Elliott Wave analysis signals the early formation of a bullish trend, unfolding through an impulsive wave structure. Currently, the Australian Dollar is advancing in orange wave 1, which belongs to a larger navy blue wave 1, hinting at the emergence of a new upward cycle across higher timeframes.

This initial orange wave 1 typically marks the first push in a new bullish trend, often accompanied by a shift in momentum and sentiment. While wave 1 may appear moderate compared to wave 3, its formation is essential in establishing the foundation of a potential five-wave structure, as defined by Elliott Wave Theory.

Traders should anticipate an upcoming correction in orange wave 2, likely retracing a portion of wave 1 before a more robust wave 3 advance. This makes wave 2 a potential setup zone for traders seeking low-risk long entries. The 0.59150 level remains critical; a drop below this invalidation point will nullify the current bullish count and suggest reevaluation.

The daily chart offers a strategic view of this developing trend, where price action, volume, and momentum indicators will play a crucial role in confirming wave 1’s progress. This scenario favors a trend-trading approach as the bullish pattern evolves, with attention on technical setups aligned with impulsive wave development.

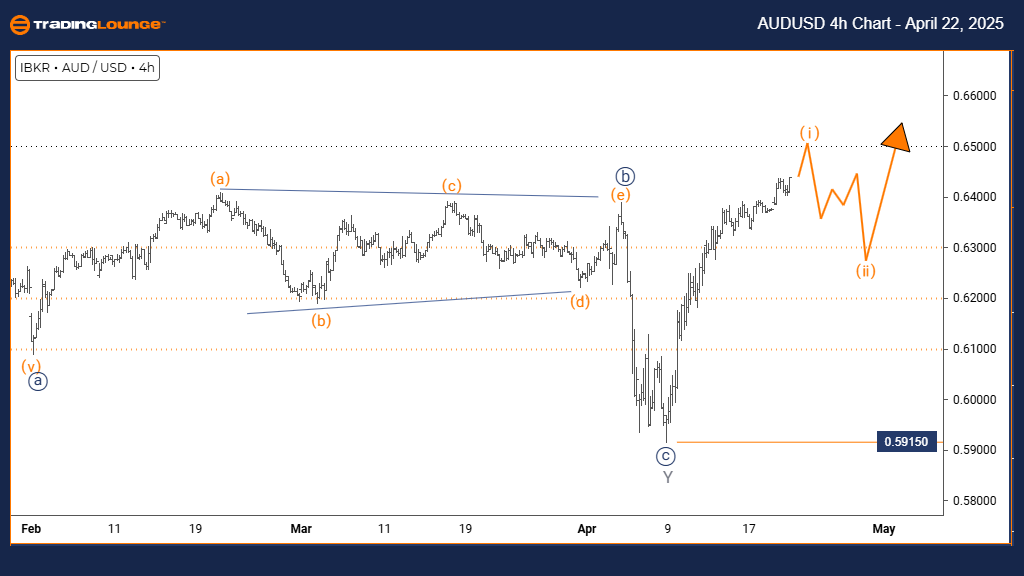

Australian Dollar/U.S. Dollar (AUDUSD) – TradingLounge 4-Hour Chart

AUDUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 1

Direction Next Lower Degree: Orange Wave 2

Details: Orange wave 1 of navy blue wave 1 is advancing within a trend formation

Wave Cancel Invalid Level: 0.59150

The AUDUSD 4-hour chart reinforces a bullish outlook, showcasing the development of orange wave 1 inside the broader navy blue wave 1. This impulsive move indicates the initiation of a trend sequence, positioning the pair for a potential multi-wave rally.

Wave 1 serves as the trend initiator, often marked by increasing bullish pressure and supportive technical indicators. While not typically the strongest wave in terms of magnitude, its structure is crucial in confirming a directional shift. The progression of this wave points to a maturing impulse that sets the groundwork for upcoming corrections and expansions.

Following wave 1, traders can expect a pullback in orange wave 2—a natural retracement phase before the market resumes higher in wave 3. This anticipated dip may offer a prime entry zone for trend traders preparing for the next leg up.

Traders must monitor the 0.59150 invalidation level closely. Any breach below this key support would invalidate the current Elliott Wave count, necessitating an alternative structure review. Until then, bullish conditions prevail within the current impulsive layout.

With the wave structure suggesting the start of navy blue wave 1 on a higher degree, there’s potential for a sustained upward movement. Traders should focus on validating this outlook through price action, breakout signals, and confirming momentum tools, while preparing for strategic entries during corrective phases.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: GBPUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support