Natural Gas Commodity Elliott Wave Analysis

Natural Gas Elliott Wave Technical Analysis

Natural gas is currently in a recovery phase after a significant bearish trend throughout 2024. However, this downtrend is expected to strengthen in the coming weeks. After a strong rebound from the February 2024 low, natural gas has retraced more than two-thirds of those gains, indicating a possible revisit to the 2020 lows. The broader trend has been bearish since August 2022, and despite a short-term recovery that started on August 5th, it is likely to be temporary. Sellers may regain control later this month or by early September.

TradingLounge Commodity Natural Gas Daily Chart Analysis

On the daily chart, the decline from the $10 high in August 2022 is forming a corrective pattern, labeled as waves a-b-c of the cycle degree. Wave a concluded near 4.77, followed by wave b, which ended around 7.61. Since November 2022, wave c has been unfolding as an ending diagonal pattern. Currently, the 5th leg (wave 5, circled) within this diagonal is ongoing, and it is expected to continue downward in a three-wave structure. This movement is likely to break below the 3rd wave low (wave 3, circled) at 1.524, signaling further downside before the pattern completes. The 5th wave (circled) of c of (y) is anticipated to develop into a three-wave structure, which is more evident on the H4 chart.

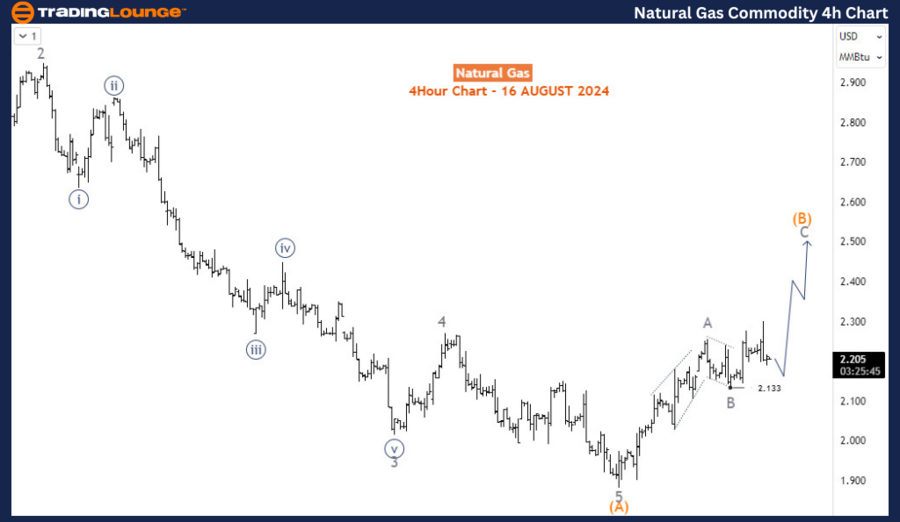

TradingLounge Commodity Natural Gas 4-Hour Chart Analysis

Natural Gas Commodity Market

On the H4 chart, the price has completed wave (A) of 5 (circled) and is currently correcting upward in wave (B). Once wave (B) is complete, the price is expected to resume its decline in wave (C). However, wave (B) has not yet finished, so in the near term, the commodity is favoring an upside move.

Conclusion

Natural gas is in a complex corrective phase, with potential short-term gains likely to give way to a continuation of the broader downtrend. The Elliott Wave analysis suggests that while brief rallies may occur, the overall outlook remains bearish, with further declines anticipated once the current corrective wave (B) is complete. Traders should be cautious of the temporary recovery and prepare for potential downside movement as the broader bearish trend reasserts itself.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SGX TSI Iron Ore Index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support