Meta Platforms Inc. (META) Elliott Wave Analysis – Bullish Momentum in Focus

Meta Platforms Inc. (META) is showing strong bullish momentum, as demonstrated by Elliott Wave analysis. With the stock rebounding from recent lows and signaling further upward potential, traders are closely watching key targets for the next major rally. In this analysis, we break down META’s wave structure on both the daily and 1-hour charts, focusing on key support and resistance levels, along with actionable insights for traders.

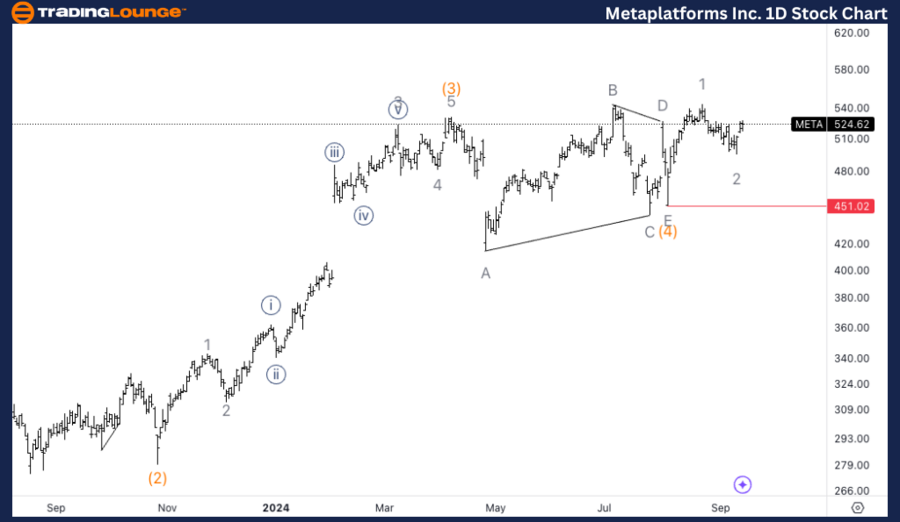

META Elliott Wave Analysis – TradingLounge Daily Chart

Meta Platforms Inc. (META) Daily Chart Overview

META Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Intermediate wave (5)

Direction: Upside in wave 3

Details: After bouncing off the $500 support level, we are looking for the bottom of wave 2 to be in place, with upside targets around the $650 Medium Level.

META Stock Daily Chart Analysis

On the daily chart, META is progressing in Intermediate wave (5), having just completed a wave 2 correction. The stock has rebounded from the $500 support level and is now preparing for a further upward move. The next target on this bullish trajectory is the $650 Medium Level, which serves as a significant resistance point within wave 3. Establishing support at $500 strengthens the case for an ongoing uptrend, signaling that bullish momentum remains intact.

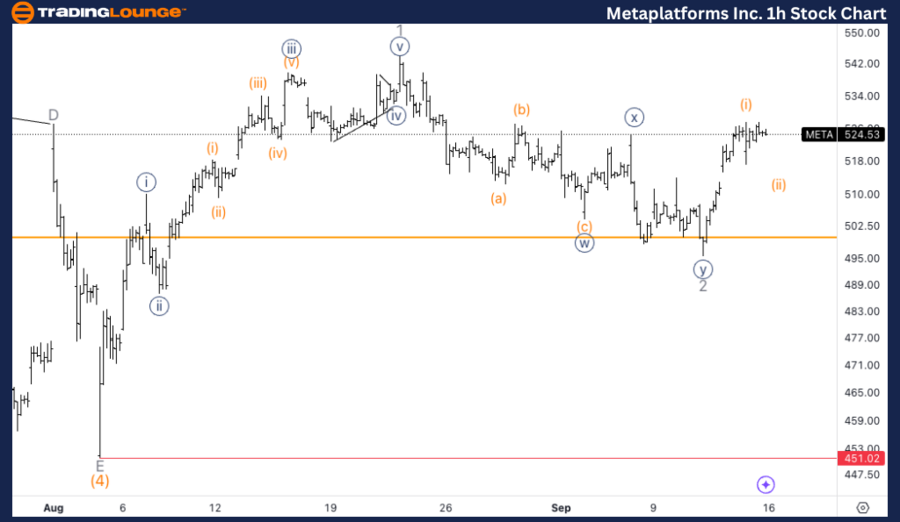

META Elliott Wave Analysis – TradingLounge 1-Hour Chart

Meta Platforms Inc. (META) 1H Chart Overview

META Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minute wave {i}

Direction: Upside in wave {i}

Details: A potential top in wave (i) of {i} may be forming after breaking the previous wave {b}, with a three-wave pullback expected.

Meta 1-Hour Chart Analysis

The 1-hour chart shows that META is currently in Minute wave {i} within a larger wave structure. After surpassing the previous wave {b} high, the stock appears to be nearing the top of wave (i) of {i}. Traders should anticipate a three-wave pullback in wave (ii), which would act as a correction before the next upward phase. This pullback may present a buying opportunity for those looking to position for further gains in the upcoming wave.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous:McDonald's Corp. (MCD) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support