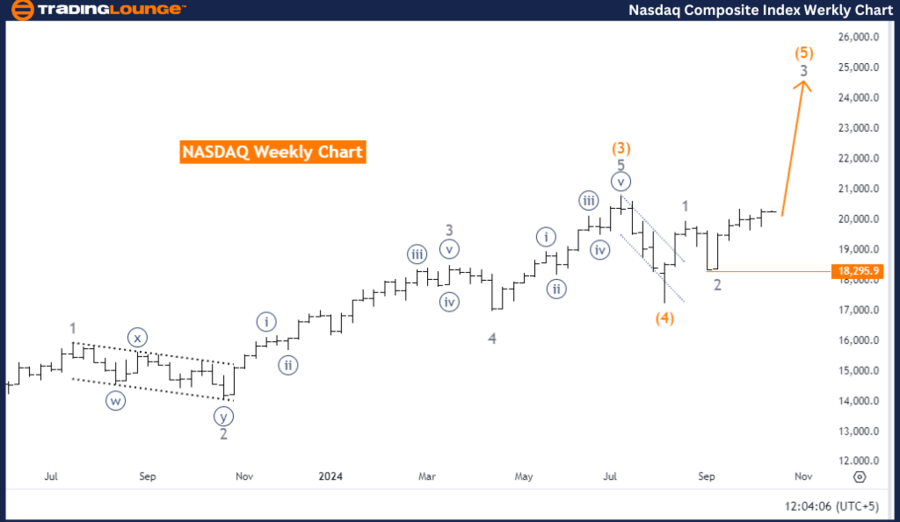

NASDAQ Elliott Wave Analysis – Trading Lounge Day Chart

NASDAQ Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Navy Blue Wave 3

Position: Gray Wave 3

Next Lower Degree: Navy Blue Wave 4

Wave Invalidation Level: 18,295.9

NASDAQ Analysis Overview

The NASDAQ Elliott Wave analysis on the daily chart indicates the market is in a bullish trend. The current structure follows an impulsive pattern, unfolding as Navy Blue Wave 3. This advanced stage within Gray Wave 3 suggests increasing momentum, aligning with the theory that wave three trends exhibit robust and extended upward movement.

NASDAQ Wave Structure & Position

NASDAQ Key Details

Summary

The NASDAQ remains in a strong bullish phase, supported by Navy Blue Wave 3. Analysts can expect further gains as long as the market trades above 18,295.9. Potential corrections may arise during the shift into Navy Blue Wave 4, but the overall uptrend remains intact.

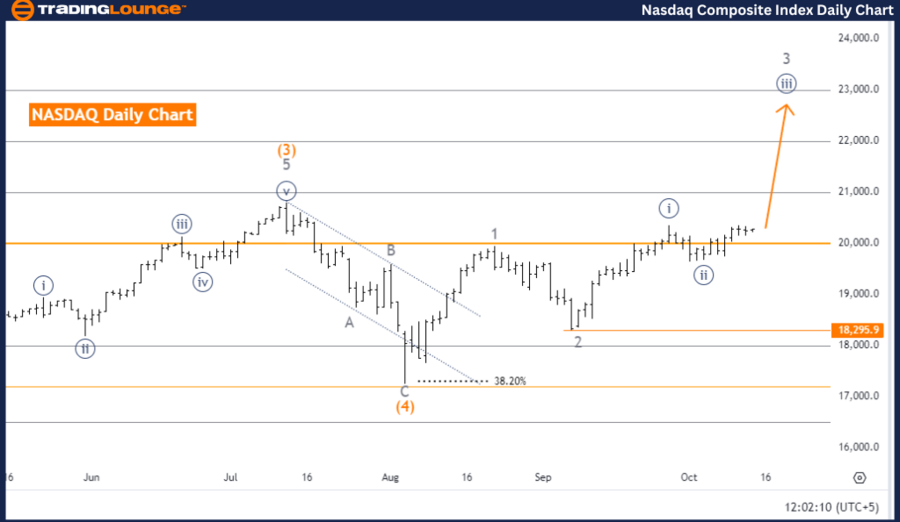

NASDAQ Elliott Wave Analysis – Trading Lounge Weekly Chart

NASDAQ Index Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 5

Next Lower Degree: Gray Wave 4

Wave Invalidation Level: 18,295.9

NASDAQ Index Analysis Overview

The weekly Elliott Wave analysis shows the NASDAQ is in a strong upward trend with an impulsive structure. This movement within Gray Wave 3 has progressed to Orange Wave 5, indicating the impulse sequence is entering later stages.

NASDAQ Index Wave Structure & Position

NASDAQ Index Key Details

Summary

The NASDAQ's bullish trend remains intact, with Gray Wave 3 leading the market higher. Traders should anticipate further gains while preparing for a corrective phase during Gray Wave 4. As long as the market remains above 18,295.9, the uptrend outlook stays valid.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Bovespa Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support