MSFT Elliott Wave Analysis Trading Lounge Daily Chart

Microsoft Inc., (MSFT) Daily Chart

MSFT Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Zigzag

POSITION: Intermediate (2)

DIRECTION: Bottom in wave A of (2).

DETAILS: We are considering a significant top in place with wave (1), and we are now looking for a three wave move correction into wave (2). We seem to be finding buyers on Medium Levell 400$, looking for 400$ to turn into resistance.

MSFT Elliott Wave Technical Analysis – Daily Chart

The daily chart of MSFT shows the stock in a corrective phase with a zigzag structure, identified as Intermediate wave (2). Currently, the stock is witnessing a bottom formation in wave A of (2). After observing a significant top in wave (1), MSFT appears to be undergoing a corrective three-wave movement. The price level around $400, which has been attracting buyers, is anticipated to evolve into a resistance level. Traders should monitor this zone closely for potential reversal signals.

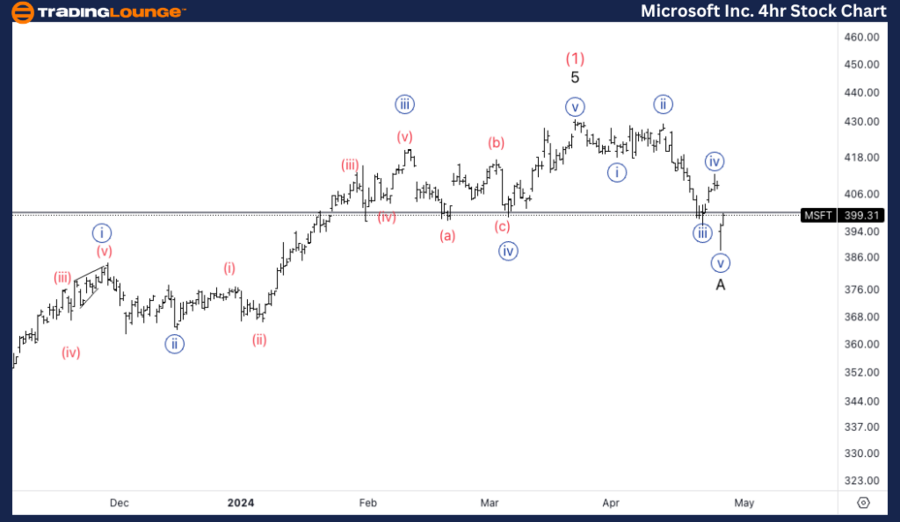

MSFT Elliott Wave Analysis Trading Lounge 4Hr Chart

Microsoft Inc., (MSFT) 4Hr Chart

MSFT Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Zigzag

POSITION: Wave A.

DIRECTION: Bottom in wave {v}.

DETAILS: I can count a clear five wave move into wave A, with alternation between {ii} and {iv}. Looking for a pullback in wave B to then fall back lower.

In this comprehensive Elliott Wave analysis for Microsoft Corporation (MSFT), we provide an in-depth review of the stock’s potential movements based on its current wave patterns, as observed in both the daily and 4-hour charts on April 26, 2024. This analysis aims to assist traders and investors in understanding the underlying market dynamics and planning their strategies accordingly.

MSFT Elliott Wave Technical Analysis – 4Hr Chart

Moving into the 4-hour chart, the analysis continues to reflect a counter-trend with a zigzag corrective structure, highlighting the end of Wave A. Here, a clear five-wave movement has been identified, with distinct alternations between waves {ii} and {iv}. The current position, at the bottom of wave {v}, suggests that the stock might experience a short-term pullback in wave B before potentially declining further. This provides a strategic point for traders to look for entry and exit points during the unfolding of wave B.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Texas Instruments Inc., (TXN)

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 6 Analysts covering over 150 Markets. Chat Room With Support