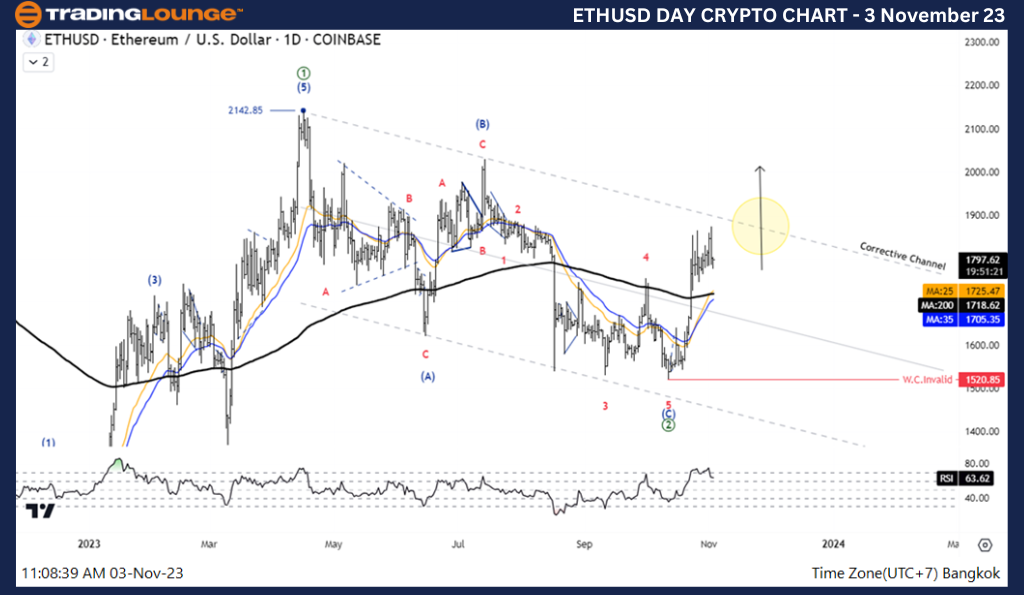

Elliott Wave Analysis TradingLounge Daily Chart, 3 November 23,

Ethereum / U.S. dollar(ETHUSD)

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave ((3))

Direction Next higher Degrees: wave 1 of Impulse

Wave Cancel invalid level:

Details: The correction is likely to end at the level of 1520. A five-wave increase supports this idea.

Ethereum / U.S. dollar(ETHUSD)Trading Strategy: The correction in wave ((2)) is likely to end at the level of 1520.85, and the five-wave increase will support this idea. Therefore, we are waiting for another correction to join the trend.

Ethereum / U.S. dollar(ETHUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, RSI is a Bullish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

Elliott Wave Analysis TradingLounge 4H Chart, 3 November 23,

Ethereum / U.S. dollar(ETHUSD)

ETHUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 1

Direction Next higher Degrees: wave 1 of Impulse

Wave Cancel invalid level:

Details: Wave 1 May End at 1875 and Moves to Corrective of wave 2.

Ethereum / U.S. dollar(ETHUSD)Trading Strategy: The correction in wave ((2)) is likely to end at the level of 1520.85, and the five-wave increase will support this idea. Therefore, we are waiting for another correction to join the trend.

Ethereum / U.S. dollar(ETHUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, RSI is a Bullish Momentum.