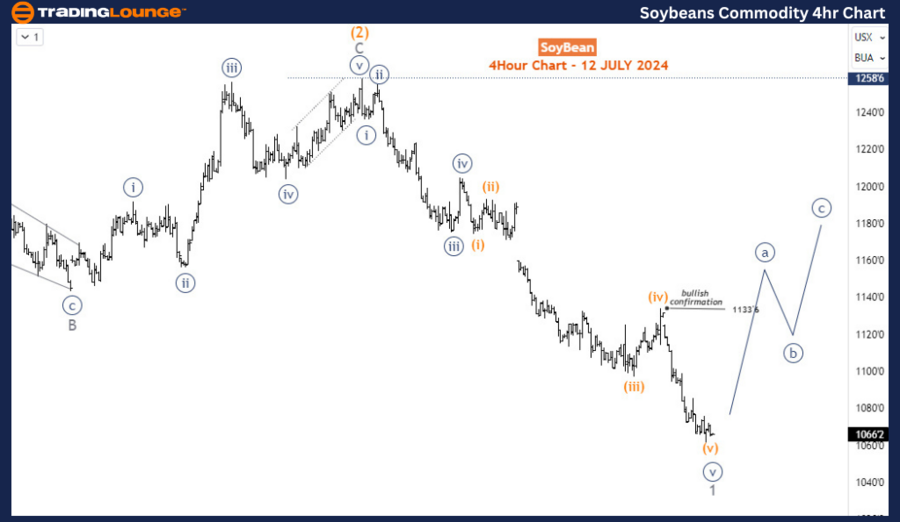

TradingLounge Commodity: Soybeans Elliott Wave Analysis

Function - Trend

Mode - Impulse

Structure - Impulse for wave (3)

Position - Wave 1 of (3)

Direction - Wave 1 of (3) is still in play

Details - Wave 1 is nearing completion, after which wave 2 bullish correction begins. The confirmation level remains above 1133’6.

Soybeans Elliott Wave Technical Analysis

Soybean prices have dropped to their lowest levels since October 2020, continuing the long-term bearish trend that began in June 2022. In the short term, the current decline started in May 2024, erasing the recovery from February to March 2024. While a corrective bounce may occur soon, traders should expect this commodity to maintain its gradual sell-off in the coming months.

Daily Chart Analysis

On the daily chart, a bullish impulse structure that began in May 2019 was completed at 1785 in June 2022. Since reaching that peak, the price has been correcting the bullish trend. The daily chart illustrates the structure emerging for this corrective bearish phase. The decline from 1785 is evolving into a zigzag A-B-C (circled) structure. Wave A and B (circled) ended at 1249 (October 2023 low) and 1398 (November 2023 high), respectively. From 1398, wave C (circled) is emerging downwards. Within wave C, the price has completed waves (1) and (2) of 5 (circled) and is now progressing into wave 1 of (3). Eventually, the commodity is expected to collapse below 1000 in wave 3. However, a corrective bounce for wave 2 should precede that.

H4 Chart Analysis

On the H4 chart, wave 1 appears to be nearing completion of an impulse wave structure, with an extended fifth sub-wave. A bullish confirmation for wave 2 is needed. The best trade idea here is to wait for the end of wave 2 and then find SHORT opportunities into wave 3 of (3), provided that the 1288 wave (2) high is not breached.

Conclusion

Both the daily and H4 charts indicate a continued bearish trend for Soybean, with the price nearing significant support levels. The evolving zigzag structure on the daily chart suggests that the long-term corrective phase is still in progress, while the H4 chart outlines the final stages of wave 1 and the anticipated corrective bounce in wave 2. By closely monitoring the completion of wave 1 on the H4 chart and the overall zigzag pattern on the daily chart, traders can identify strategic entry points to capitalize on the anticipated decline. The upcoming wave 2 corrective bounce provides a potential opportunity for traders to position themselves for the next leg down in wave 3, aiming for targets below 1000. This strategic approach ensures that traders can maximize their returns while navigating the ongoing bearish trend in the Soybean market.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Wheat Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support